The US will not implement reciprocal tariffs on all countries, and the deadline for imposing duties on imports of cars, semiconductors, and pharmaceuticals is being postponed. A trade war would cause more pain for the US economy. Let’s discuss this topic and develop a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- The US is trying to postpone trade wars.

- The uncertainty is supporting the US dollar.

- The US will suffer more than the rest of the world due to tariffs.

- Short trades can be opened as long as the EURUSD pair is trading below 1.0855.

Weekly US Dollar Fundamental Forecast

As a rule, the US dollar appreciates when the US economy outperforms its counterparts, as it did in 2023–2024. Following the presidential election in November, investors anticipated an escalation in divergence due to tariffs and tax cuts, leading to a sell-off in the EURUSD pair. However, according to JP Morgan, trade wars are likely to bring more pain to the US than to the global economy. Meanwhile, some countries and regions will suffer even more. As a result, if this is the case, the downward trend of the USD index is a logical outcome.

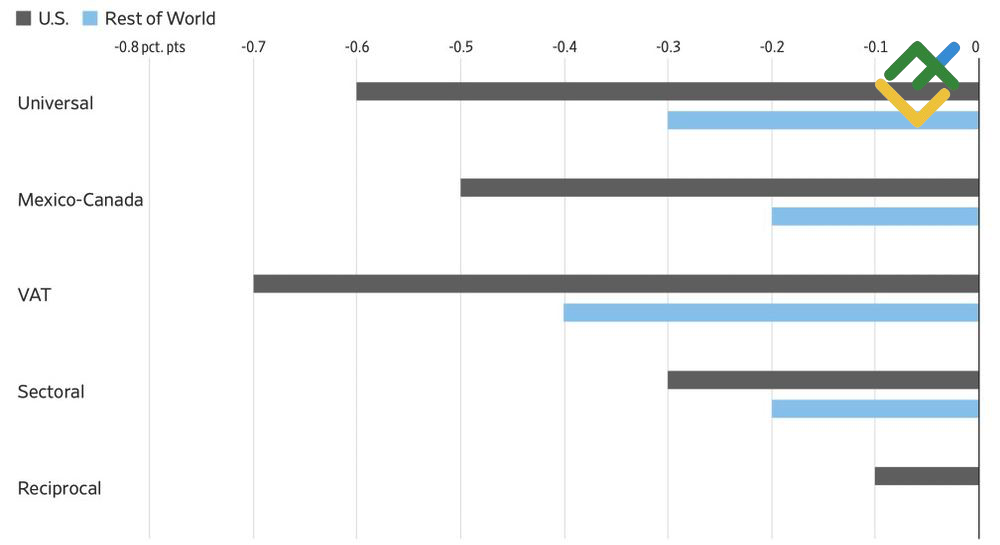

Effects of Different Tariff Scenarios on GDP

Source: Wall Street Journal.

The imposition of universal tariffs would deal a severe blow to the global economy. In contrast, reciprocal tariffs could potentially enable certain countries to outperform the US economy. The more exclusions there are, the greater the gap between global and US GDP. Notably, Donald Trump has demonstrated a willingness to make exceptions. He has expressed disdain for the practice of imposing the same tariffs as certain nations do.

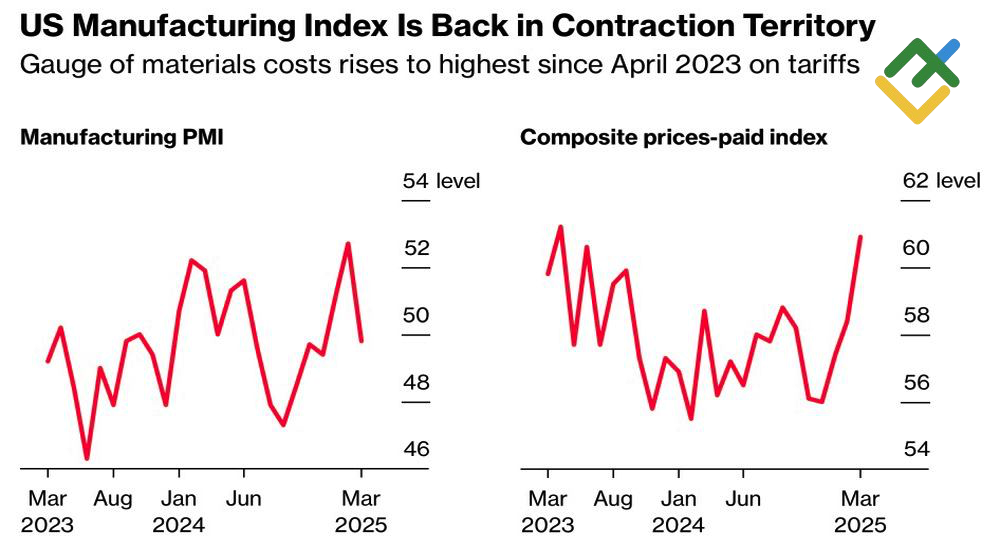

From a financial planning perspective, it would be better for the US to impose tariffs all at once. The current uncertainty surrounding the implementation date, exemptions, and operational details of tariffs on semiconductors and automobiles remains, and it is unclear how the tariffs will be enforced. Moreover, the impact of these tariffs on businesses is already being felt, as evidenced by the return of the US manufacturing PMI to below the critical 50 threshold, which separates expansion from contraction, in March.

US Purchasing Managers’ Index

Source: Bloomberg.

The markets are increasingly buzzing about a recession, and it could be a self-fulfilling prophecy. This phenomenon originates in psychological perceptions, and when discussions regarding a recession in the US reach a certain level, subsequent events tend to materialize over time. As a rule, this will likely occur in seven months. While market predictions are not always accurate, there is a historical precedent for this cycle. In 2022, for instance, the likelihood of a recession within the next year was a concerning 63%, attributed to the Fed’s aggressive tightening of monetary policy. However, this scenario did not materialize.

Presently, Donald Trump is urging the Fed to cut rates, citing falling energy prices that will eventually lead to slower inflation. The central bank is not in a rush to act. Atlanta Fed President Raphael Bostic has revised his outlook, anticipating a single act of monetary expansion in 2025 instead of two, as previously projected.

The US is beginning to recognize that there is a bumpy road ahead. This has led to a shift in stance, with the US now seeking to temper its tariff threats. The proposed reciprocal duties would not apply to all countries but rather to the “dirty 15,” later levies on semiconductors, automobiles, and pharmaceuticals. The US administration’s actions are contributing to a state of uncertainty in global markets, which is allowing even a weakened US dollar to soar.

Weekly EURUSD Trading Plan

The EURUSD pair will likely face a minor correction within the ongoing uptrend. Until the end of March, the major currency pair will continue to be under pressure. However, the principle of “sell the rumor, buy the news” will likely be in play at that point. As long as the euro remains below 1.0855, short trades can be considered.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.