Following the debates and the attempted assassination of Donald Trump, the markets demonstrated confidence in a new Republican presidency. Joe Biden appeared to lack the strength to lead effectively and dropped out of the presidential race. This factor will likely alter the strategic landscape. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- Betting on the Trump trade started to look excessive.

- Hawkish ECB rhetoric and strong PMIs will buoy the euro.

- A recovery in the S&P 500 may allow traders to buy the euro above 1.0905.

Weekly US dollar fundamental forecast

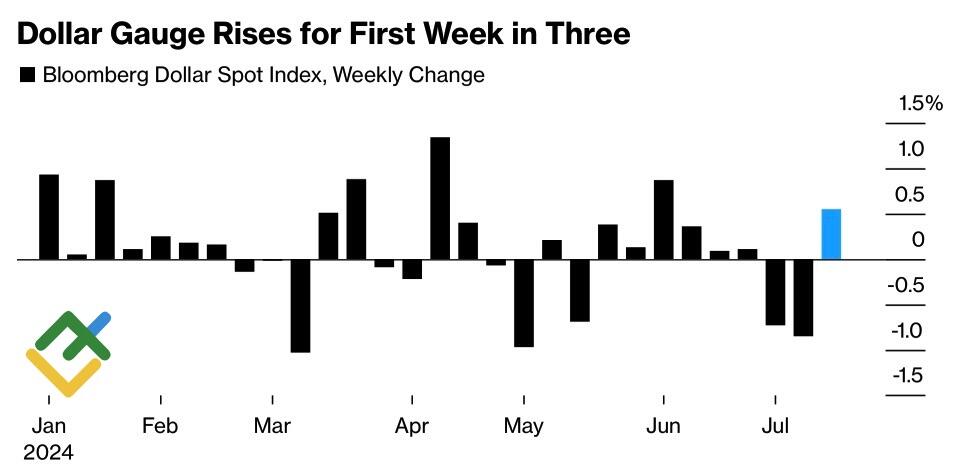

The US dollar index has performed exceptionally strongly over the past six weeks, benefiting from dovish ECB rhetoric, a deterioration in global risk appetite, and the impact of the Trump trade. Nonetheless, Joe Biden’s announcement that he will no longer pursue the presidency poses an unpredictable variable for the markets, likely contributing to heightened volatility. Conversely, the ECB officials’ hawkish rhetoric, the recovery of European business activity, and the US PCE’s deceleration could support the EURUSD pair.

USDX weekly change

Source: Bloomberg.

Recently, the markets have been experiencing a state of flux, with investors weighing the possibility of the Fed’s planned monetary expansion cycle in September against the potential impact of the so-called Trump trade. Investors have been divesting their tech stock holdings and reallocating those assets to securities that could benefit from lower Fed rates and deregulation. The reallocation resulted in a pullback in the S&P 500, which was further exacerbated by cyber outages worldwide that led to the delayed processing of 36,000 airline flights and bank payments. A decline in risk appetite led to a downward movement in the EURUSD pair.

The euro’s decline was influenced by the findings of an ECB survey of 57 major companies in the eurozone. The objective is to decelerate wage growth from 5.4% in 2023 to 4.3% in 2024 and to 3.5% in 2025. At a press conference following the July Governing Council meeting, Christine Lagarde presented the view that wage growth was falling. Bank of France Governor François Villeroy de Galhau stated that markets were correct in anticipating two acts of monetary expansion before the end of 2024. His Lithuanian counterpart, Gediminas Šimkus, highlighted progress in disinflation and suggested that a rate cut would likely occur soon.

The ECB hawks will not be prepared to endorse such rhetoric. They will undoubtedly focus on persistent wage growth rates and services inflation. In light of the gradual recovery of business activity in the eurozone following the news that the worst in France was avoided, EURUSD bulls may have an opportunity to counterattack.

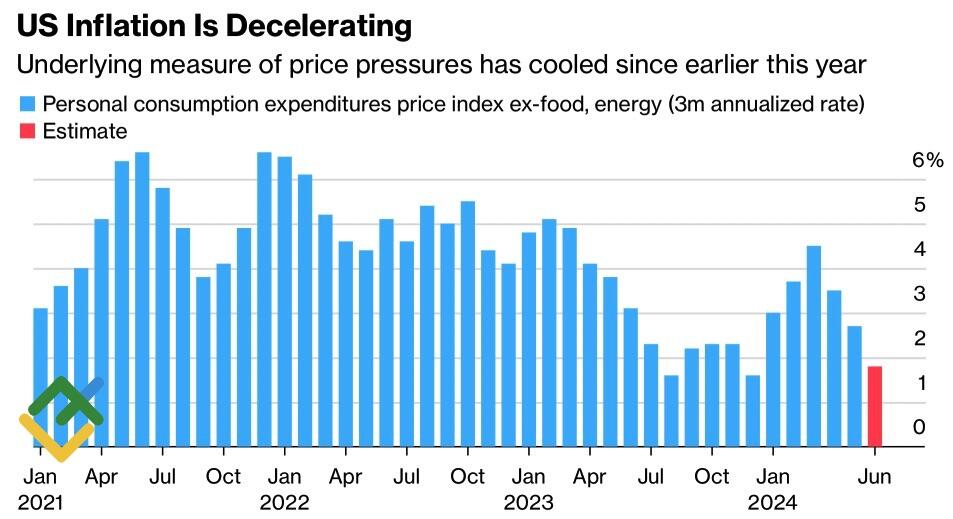

Additionally, Bloomberg experts have forecast a slowdown in the US PCE by 0.1% m/m in June. Should this occur, the three-month indicator will fall below the Fed’s 2% target. The Fed’s approach resembles an ocean liner: the central bank avoids sudden movements when the markets are calm. Consequently, there is a high probability that at the end of July, it will signal a rate cut in September.

US inflation change

Source: Bloomberg.

The recent cyber disruption is not a significant enough factor to trigger a full-blown S&P 500 correction. Additionally, Joe Biden’s withdrawal from the presidential race could temporarily halt asset reallocation and result in renewed interest in tech stocks.

Weekly EURUSD trading plan

Due to these developments, the EURUSD headwind will become a tailwind, creating an opportunity to purchase the pair on a rebound from the 1.086 and 1.0825-1.0835 support levels or upon returning above 1.0905.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.