Politics may become one of the reasons for a federal funds rate cut in September. Donald Trump is steadily moving towards the US President’s chair, and the Fed may want to set up some roadblocks on his way. Let’s discuss this topic and make a trading plan for EURUSD.

Weekly US dollar fundamental forecast

Jerome Powell did not surprise anyone in Sintra, Portugal, by saying that a strong US economy gives the Fed time, but markets viewed his rhetoric as dovish. This led to a decline in Treasury bond yields, which had risen significantly after the debate between Joe Biden and Donald Trump, and allowed EURUSD bulls to push the quotes higher. Why did the Fed Chairman catch investors’ attention?

Jerome Powell said that recent reports convinced that the US economy was getting back on a disinflationary path. In addition, the Fed wants to be more confident of this to start cutting rates. Perhaps the market was impressed by the frequent mention of “progress” in fighting inflation. Meanwhile, these statements are just the tip of the iceberg.

The Fed chief allowed himself to criticize the White House. He said that Joe Biden’s administration is taking excessive risks by running large budget deficits at full employment. It is impossible, he said, to manage such levels for very long in good times for the economy. Jerome Powell urged the President to address the fiscal imbalance, although everyone realized he was not addressing a Democrat.

If Biden intends to extend the current program of preferential taxation from 2017 only for Americans whose income does not exceed $400,000 a year, then for Donald Trump, everyone is equal. His victory in the presidential election will further inflate the budget deficit, which, according to the Congressional Budget Office, is projected to reach $1.9 trillion in 2024. That’s equivalent to 7% of GDP.

The Republican’s policies, including raising import tariffs, will be pro-inflationary. It will force the Fed to keep rates at 5.5% for a long time, increasing recession risks. This is why yields on US Treasuries are rising, creating a tailwind for the US dollar.

USDX and US Treasury yield

Source: Trading Economics.

Donald Trump’s return to the White House is feared not only by investors but also by the Fed. Unlike Joe Biden, the Republican has a habit of meddling in the central bank’s affairs. As a result, rumors began to circulate that the Fed might cut rates in September not only because the US economy is cooling but also to maintain the current government. When Jerome Powell talked about the budget deficit, it became an argument in favor of the soon start of monetary expansion.

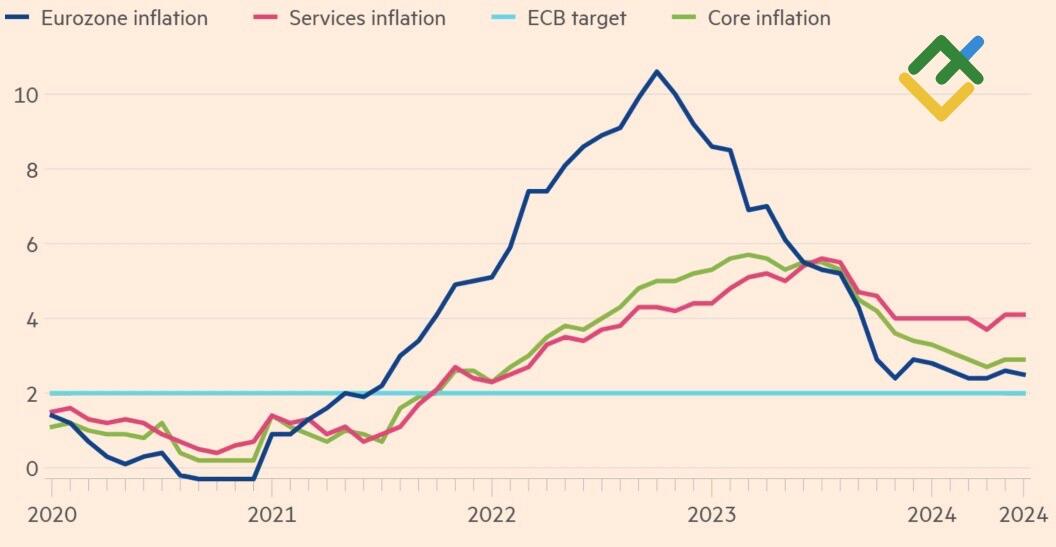

The euro was supported by the reluctance of core inflation and service prices to fall from their May levels of 2.9% and 4.1% in June, as well as statements from Christine Lagarde that the ECB’s job was not done and the central bank must remain vigilant, and Philip Lane that the Governing Council needs more time.

Eurozone inflation

Source: Financial Times.

Weekly EURUSD trading plan

As it is often the case, investors are overreacting. The Fed will remain apolitical, and the reduction of the federal funds rate in September will take place against the background of the cooling US economy. The US employment data for June will confirm this, providing an opportunity to open more long trades on the EURUSD pair, adding them to the ones initiated in the 1.071-1.072 area.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.