It appears that the challenges confronting the European economy are gradually dissipating. However, President Trump’s imposition of 25% tariffs on automobiles has exerted downward pressure on the EURUSD pair. Let us discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The US may impose 25% tariffs on cars from April 2.

- German business confidence is growing.

- US inflation continues to accelerate.

- The EURUSD pair’s trajectory depends on a test of support at 1.044.

Weekly US Dollar Fundamental Forecast

The question of when Donald Trump will calm down is a burning one for investors. Until April 1, they can take a breather and not worry about tariffs. It is by this date that the US administration has been instructed to study unfair practices of other countries against the US in order to set the stage for reciprocal tariffs. However, the US president is demanding more. Another threat in the form of 25% levies on automobiles, semiconductors, and pharmaceuticals pushed the EURUSD pair down. The pair may return to the downtrend sooner than expected.

It might seem that Europe is finally seeing some positive developments, with the US and Russia negotiating peace in Ukraine at pace. What would take months for any other president to achieve, Donald Trump is able to do in a week. After the phone call with his Russian counterpart, high-ranking officials have already met in Saudi Arabia. These discussions focused on the potential lifting of sanctions, which is expected to be part of the agreement regarding Ukraine.

Meanwhile, German businesses have expressed optimism about the current economic climate, citing the reduced geopolitical risks and the upcoming parliamentary elections on February 23. The party of Friedrich Merz, which is leading in the polls, is expected to implement fiscal stimulus measures that could stimulate economic growth.

German Investor Confidence Index

Source: Bloomberg.

The 25% duties on car imports could have a negative impact on the German economy, with the Bundesbank predicting a 1.5% reduction in the country’s GDP. However, the implications of these tariffs may be more significant than anticipated. These threats could be part of Donald Trump’s negotiating tactics, as the US President’s recent remarks may have been a product of wishful thinking. He claimed that the EU had already reduced levies on US cars, although this was not actually true. They are 10% compared to the US’s 2.5%. However, if tariffs are adjusted for the US, they should be applied to all WTO members.

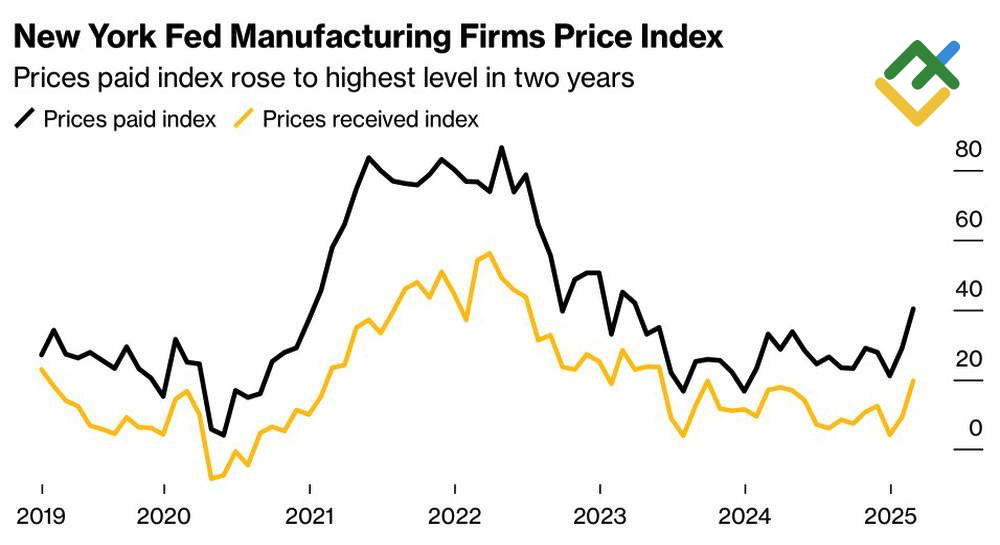

Meanwhile, the worst-case scenario for the EURUSD pair is starting to materialize. According to research by the Federal Reserve Bank of New York, US producer spending in February rose at the fastest pace in two years. This follows the acceleration of the US CPI and PPI, indicating rising inflationary pressures. As a result, the Fed may be compelled to maintain high interest rates for an extended period.

Manufacturing Firms Price Index

Source: Bloomberg.

Weekly EURUSD Trading Plan

The major currency pair may revert to the downtrend earlier than expected, but the question now is the question now is whether investors were alarmed by Donald Trump’s recent outburst. If markets quickly calm down and conclude that this is nothing more than part of the US President’s negotiating tactic, the euro will likely increase. Anyway, the support level of 1.044 remains the line in the sand for the EURUSD pair.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.