US inflation declined on a month-on-month basis for the first time since the pandemic, providing further evidence that the economy is cooling. This factor is forcing the Fed to cut the federal funds rate. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- Slowing US inflation has raised September cut odds to 93%.

- The market sees three Fed rate cuts in 2024.

- Slumping stock indices hampered the EURUSD’s rise.

- The euro may soar to 1.1-1.11.

Monthly US dollar fundamental forecast

Markets have digested the US economic data. Against the fresh statistics, the Fed may cut the federal funds rate in September. After a slowdown in the labor market and inflation in June, the odds of a monetary expansion starting in early fall have jumped to 93%. Treasury yields and the US dollar tumbled, and it was only the sell-off in tech stocks to reallocate the portfolio in favor of other securities that prevented the EURUSD pair from settling at 1.09.

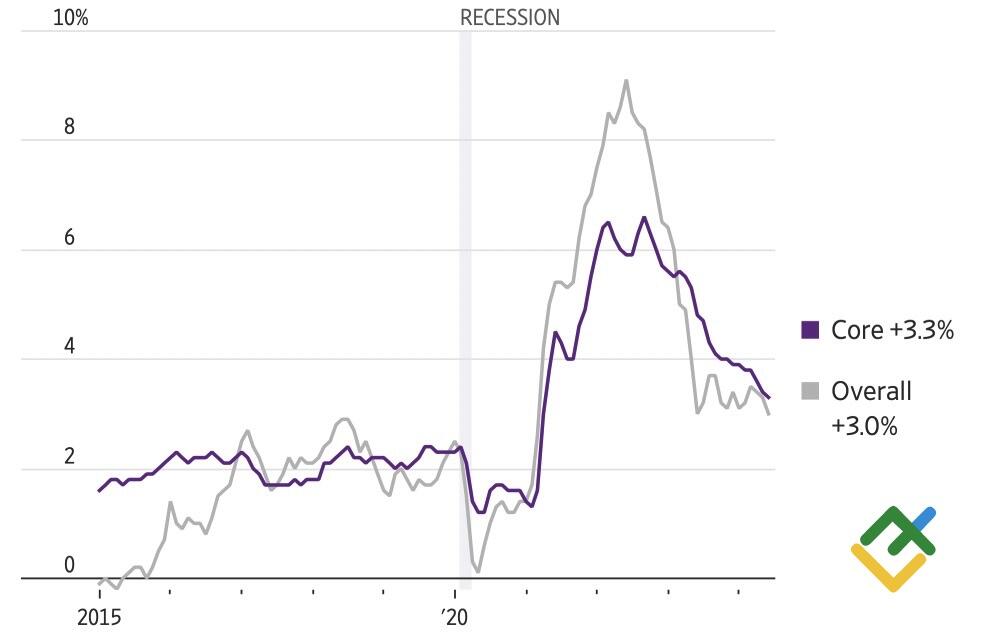

According to Jerome Powell, the Fed does not need to see inflation fall towards the 2% target. If you wait that long, you will probably wait too long. The Fed chairman called the May CPI and PCE reports good; the June one was even better. Consumer prices went negative month-over-month for the first time since the pandemic and marked the smallest annualized increase of 3% since March 2021. Only 4 out of 71 Bloomberg experts predicted that core inflation would grow by 0.1% on a monthly basis, while the rest expected higher figures.

US inflation change

Source: Wall Street Journal.

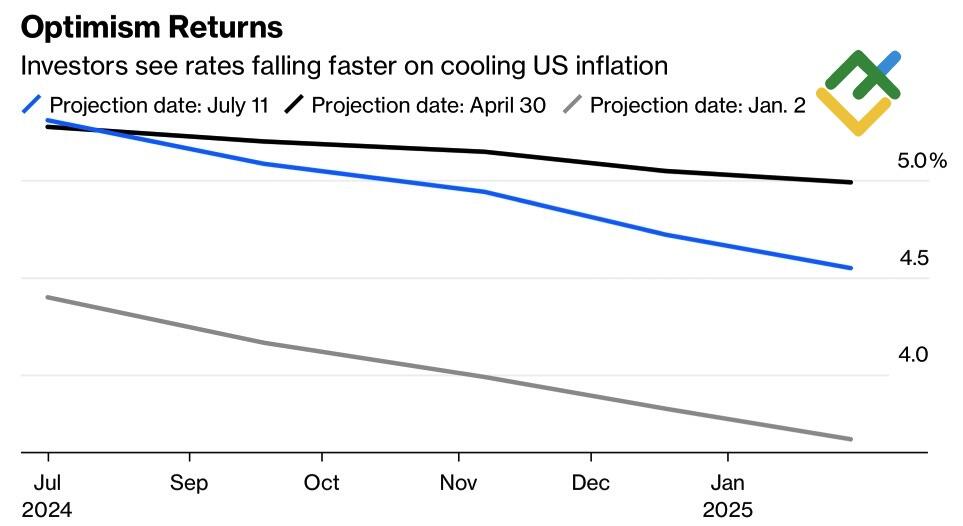

The June report is the last one before the FOMC meeting on July 30-31. It gives grounds for the central bank to signal the start of the monetary easing in September. Cooling inflation has brought back into play the option of three federal funds rate cuts in 2024 at the last three Fed meetings. This is certainly not the six acts of monetary expansion the market hoped for at the beginning of the year, but it is enough to trigger a US dollar sell-off.

Market expectations on Fed rate

Source: Bloomberg.

The September cut will definitely occur. If US inflation continues to slide, the Fed will respond to the market’s calls and reduce the cost of borrowing to 5% or 4.75%. If not, it will keep the rate unchanged, supporting the greenback.

The slowdown in consumer price growth in June was not the final nail in the US dollar’s coffin. HSBC believes the greenback will end 2025 at roughly the same levels it is now, as the US economy will continue to outperform its global counterparts, and the advantage of Treasury yields will persist even if the Fed cuts rates this year. The company believes the US dollar will not be able to escape the embrace of American exceptionalism, but whether the rest of the world can catch up is the big question.

Monthly EURUSD trading plan

The EURUSD pair may continue to rally towards 1.1-1.11 in the short term, but the growing risks of Donald Trump’s return to the White House with his pro-inflationary policies will allow bears to push the price lower. Against this backdrop, one can keep long trades open and initiate more at 1.071-1.072 and 1.0835.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.