Fears of trade wars were among the main drivers of the EURUSD pair’s collapse in the fourth quarter. As soon as there were rumors in the market that the tariffs were not so dangerous, the major currency pair soared sharply. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- An insider’s report on tariffs hitting critical imports has shocked the markets.

- Donald Trump called the Washington Post report a fake.

- The president-elect’s words may be more dangerous than his deeds.

- The EURUSD pair may continue collapsing if it returns below 1.0375.

Weekly US Dollar Fundamental Forecast

If you want to learn about the president’s plans, you should ask him directly. The market’s response to the Washington Post’s report, which indicated that Donald Trump’s team is brewing tariffs for selected countries intended to target only critical imports rather than all imports, might have appeared somewhat exaggerated. However, this reaction was actually a valid one, given the current state of the market, which is experiencing significant growth.

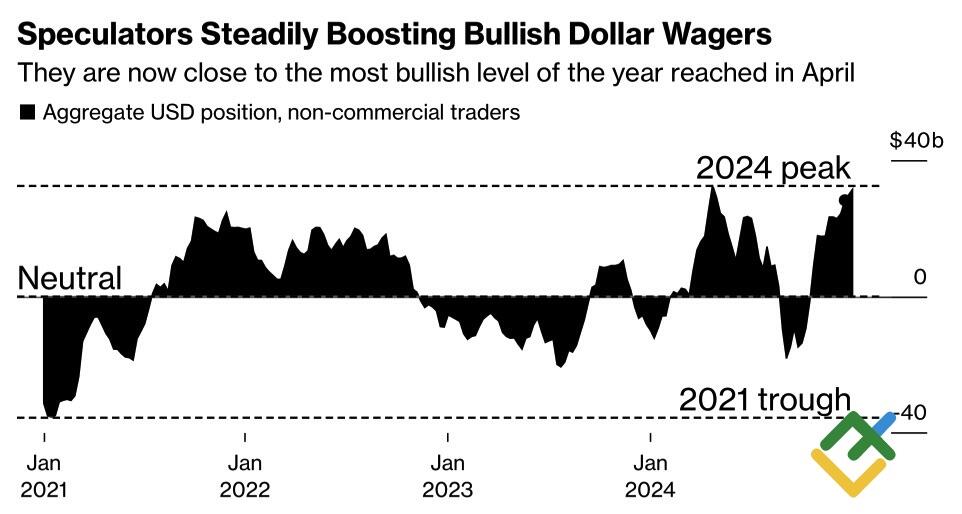

Speculative Positions on US Dollar

Source: Bloomberg.

The EURUSD pair surged by 1%, US Treasury yields slumped, and foreign stocks saw an uptick as investors assessed that Donald Trump places a higher priority on inflation and the economy than he had previously indicated. According to Bloomberg research, the proposed tariffs of 60% on Chinese imports and 10–20% on imports from other countries would result in a 0.8% reduction in US GDP by 2028 if China were to retaliate and a 1.3% reduction if a global trade war sparks.

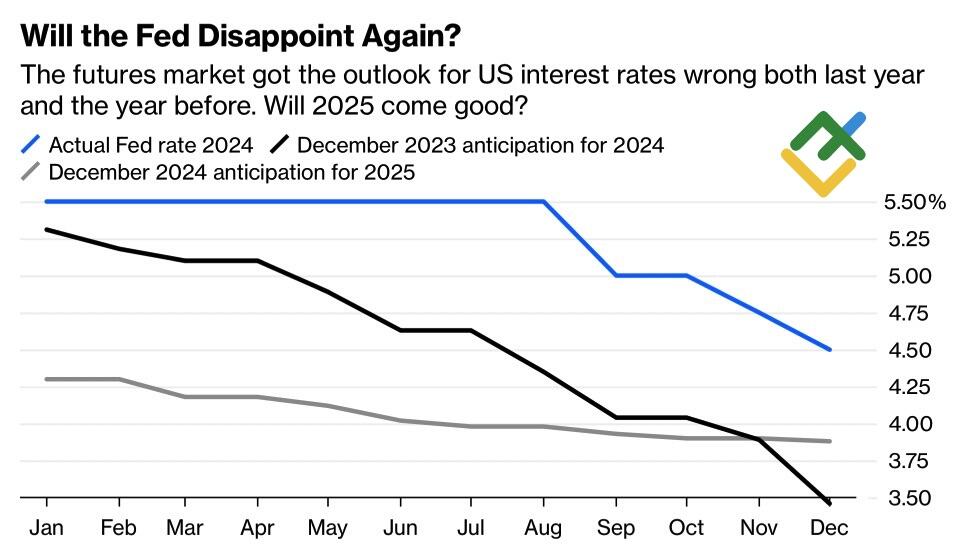

However, suppose tariffs are applied not to all imports but only to those deemed critical. In that case, the global economic slowdown may not be as detrimental, potentially benefiting a pro-cyclical currency like the euro. US Treasury yields decreased as the derivatives market increased the perceived scope of the Fed’s monetary expansion. If inflation does not begin to accelerate, the central bank may cut rates further.

Market Expectations on Fed Rate

Source: Bloomberg.

However, the consequences of Donald Trump’s return to the White House remain uncertain, as he has not revealed his plans. According to him, the Washington Post cites anonymous sources that are not verified, and the newspaper claims that rates will be reduced, which is inaccurate.

Initially, Donald Trump proposed increasing duties on imports from China to 60% and discussed 10–20% tariffs on other countries. Following his electoral victory, he has suggested 10% tariffs on Chinese goods and 25% on those from Canada and Mexico. As Trump outlined, these duties are intended to fund a tax cut program. However, the viability of this proposal remains uncertain, as it could face significant opposition from Congress and potentially result in a deluge of lawsuits against tariffs similar to those that emerged during his first tenure.

Weekly EURUSD Trading Plan

Markets are currently in a state of disbelief, as evidenced by a pullback in the EURUSD pair following the recent upswing. The initial reaction to the unverified Washington Post insider report could point to the direction of a new trend, particularly if tariffs are targeted, as Goldman Sachs anticipates. Conversely, Citigroup asserts that Donald Trump’s verbal attacks do more damage than his concrete actions and that these statements will likely become more intense, potentially prompting investors to reallocate their assets back to the US dollar. In my view, short positions can be opened once the pair slides below 1.0375.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.