When the Trump trade retreats, the US dollar does not benefit even from robust macroeconomic data or a potential vote of no confidence in the French government. This is particularly relevant given the potential for European inflation to accelerate. Let’s discuss these topics and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- The market does not believe in Trump’s plan.

- Portfolio rebalancing puts pressure on the US dollar.

- The ECB will not rush to cut rates.

- The EURUSD pair may climb to 1.0615 and 1.071.

Weekly US Dollar Fundamental Forecast

Investors strongly doubt that the new US administration will be able to fulfill its pre-election promises. The retreat of the Trump trade, rebalancing of investment portfolios at the end of the month, and hawkish speeches of ECB officials allowed EURUSD bulls to counterattack despite a batch of strong data on the US economy and the escalation of the political crisis in France.

Spread Between French and German Bond Yields

Source: Bloomberg.

The market reacted skeptically to Donald Trump’s threat of imposing a 25% tariff on imports from Mexico and Canada, as these countries account for 62% of all oil shipments to the US. American companies are optimizing heavy oil production rather than the lighter oil produced domestically. The latest Fed survey indicates that WTI at $65 a barrel would be profitable, while $89 would encourage increased production.

Furthermore, Scott Bessent has announced plans to increase production by 3 million barrels per day. Even if this can be achieved, prices will fall to $50 per barrel, which will have a significant impact on tax revenues to the budget. The objective of reducing the deficit to 3% of GDP is ambitious and may prove unattainable. Donald Trump’s promises will eventually result in a figure of 7-12% by the end of 2034.

The viability of the new administration’s plans has been called into question, leading to a Trump trade retreat. This, coupled with the rebalancing of investment portfolios at the end of the month, has resulted in an upward rebound in the EURUSD. Barclays has observed that the strengthening US dollar has made overseas assets of US companies more affordable, prompting a sell-off in the greenback.

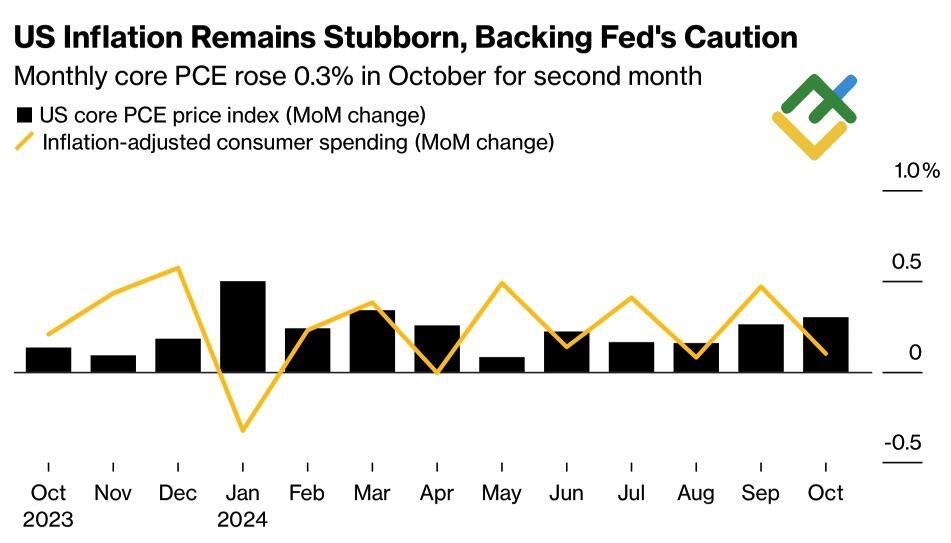

US Inflation Change

Source: Bloomberg.

EURUSD bears are not benefiting from the release of strong US data. The latest data shows that core PCE accelerated to 0.3% m/m and 2.8% y/y in October, in line with the 2.8% growth seen in the third quarter, while jobless claims have fallen to their lowest levels since February. The futures market anticipates that the federal funds rate will remain unchanged, with an 85% probability at one of the two FOMC meetings in December or January.

The euro is supported by Isabelle Schnabel’s statement that caution is needed in lowering the deposit rate, as its neutral level is in the 2-3% range. This caused the derivatives market to reduce the implied scope of the ECB’s monetary expansion from 150 bps to 146 bps. Coupled with expectations of German and European inflation accelerating, this may trigger a rally in the euro, pushing the currency above 1.06.

Weekly EURUSD Trading Plan

Nevertheless, it would be premature to become overly optimistic about long trades on the EURUSD pair. The divergence in economic growth and the greater appeal of US assets tip the scales in favor of bears. A rebound from the levels of 1.0615 and 1.071 could provide an opportunity to open short trades.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.