Following a successful outcome in September, investors are keen to replicate a similar result in November. They are monitoring the comments of FOMC officials and statistics in order to ascertain the extent of the Fed rate cut. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- The PCE slowdown to 2.2% supports the Fed’s large cut.

- Fed centrists are concerned about the return of inflation.

- The S&P 500 and the ECB add to fluctuations in the EURUSD pair.

- The pair is inclined to trade in the range of 1.108-1.121.

Weekly US dollar fundamental forecast

Markets tend to favor established strategies and predictable outcomes. In September, they were rewarded for their confidence in the Fed’s decision to cut borrowing costs by half a point. The focus of investor attention has now shifted to November. What course of action will the Fed take? The question is whether the rate will be cut by 25 or 50 basis points. Traders are closely monitoring the data and comments from FOMC officials, which have caused significant volatility in the EURUSD pair.

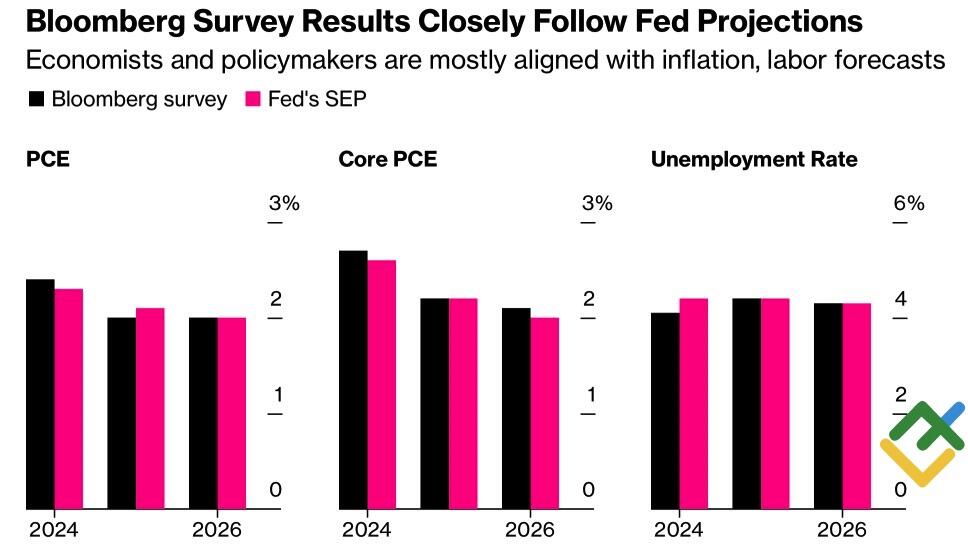

The broad move is supported by the slowdown in the personal consumption expenditure index, which reached 2.2% in August. Bloomberg experts forecast the PCE index to average 2.1% in 2025 and 2% in 2026, aligning with the Fed’s estimates. The slight rise in unemployment, which remains at historically low levels, indicates that a soft landing has been achieved.

Expectations of economists and Fed policymakers

Source: Bloomberg.

The real federal funds rate, the nominal federal funds rate of 5.5% minus inflation of 2.2%, stands at approximately 2.8%. The Fed’s average estimate for that rate is 0.9%. In the event that inflation remains at current levels, a reduction of 190 basis points in borrowing costs would be required to approximately 3%, which is what the derivatives market is demanding. The Fed doves are in agreement.

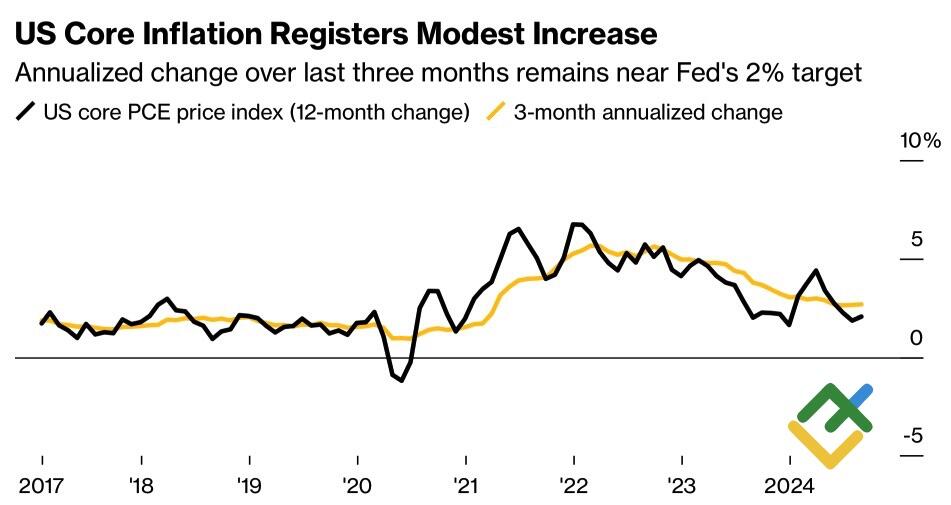

The centrists have a different argument. They pointed to the acceleration in the core personal consumption expenditure index from 2.6% to 2.7%. Unlike the PCE, which will not stand in the way of proponents of a 50 bp rate cut in November, the core indicator speaks in favor of a smaller cut.

US core inflation change

Source: Bloomberg.

St. Louis Fed President Alberto Musalem believes that the path to monetary expansion should be carefully managed, as the US economy could respond strongly to weakening financial conditions, driving demand and extending the Fed’s objective of achieving 2% inflation. Indeed, the leading indicator from the Atlanta Fed has increased its estimate of US GDP from 2.9% to 3.1% in light of recent reports.

Therefore, the US dollar is currently in a state of flux, with proponents and opponents of an aggressive cut in the federal funds rate in September holding opposing views. As a result, the EURUSD pair is fluctuating within a consolidation range of 1.108-1.121.

The contributing factors are the performance of US stock indices and the growing likelihood of the ECB continuing its monetary expansion cycle in October. Meanwhile, the S&P 500 is on track to achieve its best result in three quarters since 1997, which supports the euro. Conversely, the regional currency is under pressure from the forecasts of Goldman Sachs, JPMorgan, BNP Paribas, and T Rowe Price to reduce the deposit rate in October.

Weekly EURUSD trading plan

Given the volatility of the EURUSD pair, the previously announced strategy of selling on the upside and buying on the downside within the trading range of 1.108-1.121 remains relevant. However, this strategy may need to be revisited in light of the upcoming release of US employment statistics for September.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.