Trade wars create uncertainty for the Fed, making it difficult to predict market movements and reducing the appeal of US assets. They now face decent competition from their European counterparts, which boosts the EURUSD pair. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Capital spillover from the US to Europe is boosting the EURUSD pair.

- The Fed is facing challenges in its decision-making process.

- Between 2017 and 2018, the euro strengthened to 1.25 from 1.05.

- Long trades can be opened on a breakout of 1.105.

Weekly US Dollar Fundamental Forecast

If you are uncertain about the appropriate course of action, it is better to proceed with caution. Many investors are opting to divest their US assets. Rumors that Japan would set a precedent by agreeing with the US to reduce or eliminate tariffs have led to a rebound in European stock indices. However, the S&P 500 continued to decline, prompting EURUSD bulls to push the price higher.

The markets are currently in a state of uncertainty. More precisely, they do not know what the Fed will do in the current environment. The central bank’s actions and intentions are as uncertain as a goalkeeper wondering which way to jump to save a penalty kick. Rates are poised to fuel inflation and dampen US GDP growth. However, any attempt to lower rates, as Donald Trump demands, could potentially result in rates becoming entrenched in the United States for an extended period. At the same time, maintaining high borrowing costs will only exacerbate the economic challenges.

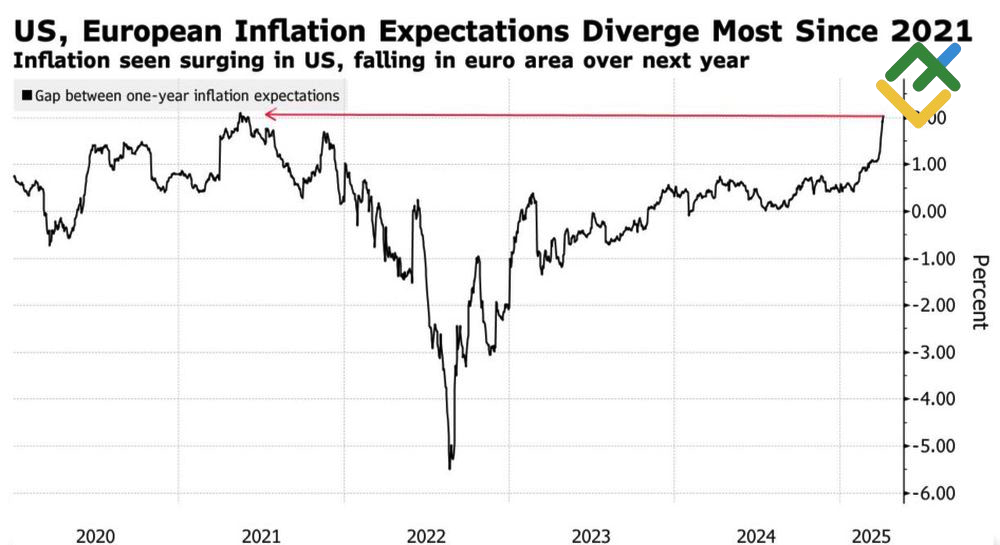

In contrast, Europe’s financial landscape is characterized by greater clarity. If the EU does not retaliate to the White House’s tariffs, GDP growth will likely decelerate, but inflation is not expected to accelerate as much as in the US. This is evidenced by the significant rise in inflation expectations across Europe, reaching levels not seen since the onset of the pandemic.

US–EU Inflation Expectations Gap

Source: Bloomberg.

As a result, the ECB’s mission appears more attainable. It can afford to cut rates, which increases the attractiveness of European stocks and bonds. Yields are soaring as investors anticipate that Germany’s fiscal stimulus will result in increased issuance. While rates on German bonds remain below those of US Treasuries, they are higher when accounting for the costs of hedging currency risks. European assets are perceived as offering greater potential than their US counterparts, leading to capital flows from West to East, pushing EURUSD quotes higher.

German and US 10-Year Bond Yields

Source: Bloomberg.

The weakening of the US dollar is due to a combination of factors, including the loss of American exceptionalism. The protectionist policies of the Trump administration, which imposed the highest tariffs since the beginning of the 20th century against all countries, including former allies, have undermined trust in the US currency. This trend contrasts with the 2018–2019 trade war primarily involving the United States and China.

Nevertheless, the White House’s approach of engaging in negotiations with numerous countries while excluding China has led to a sense of déjà vu. In 2017–2018, the EURUSD pair soared from 1.05 to 1.25. Given this historical precedent, bulls still have an opportunity to boost the major currency pair’s quotes.

Weekly EURUSD Trading Plan

Long positions opened on a decline to 1.09 can be kept open. One can consider initiating more long trades on a breakout of the resistance level of 1.105. The ongoing negotiations between the White House and Japan, along with other countries, present a compelling opportunity to purchase European equities and the euro. The EURUSD pair will likely rise to 1.15 in 2025, making it an opportune time to adopt a “buy and hold” strategy.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.