In autumn, US consumer prices accelerated even without Donald Trump’s tariffs and fiscal stimulus measures. However, inflation will unlikely accelerate significantly in 2025. However, it is essential to consider all factors when making decisions. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- Bloomberg expects US inflation to continue declining in 2025.

- Donald Trump’s policies pose a risk to this scenario.

- Accelerating November CPI is a reason for the Fed to pause in January.

- Short trades on the EURUSD pair can be opened and added to the ones formed at 1.0615.

Daily US Dollar Fundamental Forecast

It is often said that “man proposes, but God disposes.” Donald Trump is eager to assume a deity-like role. Bank of America does not anticipate any notable acceleration in inflation. The US labor market has reached a new equilibrium, supply constraints have largely dissipated, and inflation expectations remain firmly anchored. Bloomberg projects global growth at 3.1% in 2025, matching the 2024 figure, and a deceleration in consumer prices from 6% to 3.4%, with CPI returning to 2% in advanced economies. However, does the new US president concur with this outlook?

US Inflation Expectations

Source: Bloomberg.

In a recent statement, Treasury Secretary Janet Yellen highlighted the potential negative impact of broad tariffs on the competitiveness of certain US economic sectors, which could lead to a significant increase in household spending. Major business leaders view import duties as a strategic negotiating tool. Rather than a broad, sweeping approach, the administration plans to target specific imports. In any case, this is a pro-inflationary measure.

The key question is how fast prices will rise. The question remains whether this will occur in 2025 or as early as 2026, given that the impact of tariffs and fiscal stimulus on the economy is typically time-lagged. Notably, the inflation rate of 10% under the Biden administration was due to both fiscal stimulus measures and supply chain disruptions caused by the pandemic. Donald Trump’s actions risk triggering a significant shift in monetary policy, potentially leading to a sudden reversal by the Fed. Instead of pursuing an easing cycle, the central bank may opt to tighten its stance, a move that could have far-reaching implications for financial markets. Against this backdrop, markets will favor the US dollar.

However, there is a discrepancy between the opinions of economists and the reality of market movements. It is unclear what strategy Donald Trump will ultimately pursue, which has led to a cautious approach from market participants. The EURUSD pair has been trading in the 1.045-1.06 range for approximately a month, indicating a willingness to accept that even accelerating inflation will not deter the Fed from lowering the federal funds rate from 4.75% to 4.5%.

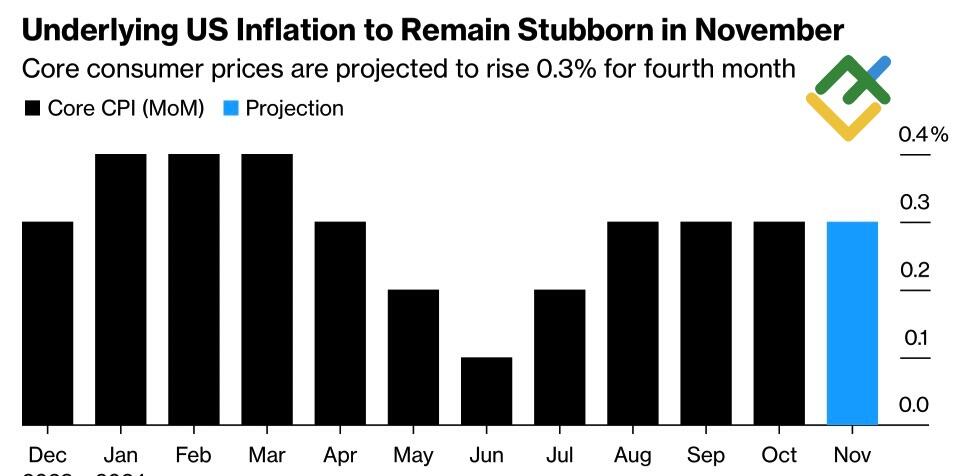

US Inflation Change

Source: Bloomberg.

Analysts predict that consumer prices will increase from 2.6% to 2.7% y/y in November. In September, the rate was 2.4%, indicating a reversal of the disinflationary trend, which is contrary to the Fed’s plans. In addition, there is a need to address the 0.3% m/m CPI growth and the 3.3% core inflation rate, which is above the central bank’s target. There is a significant amount of work to be done, and a rate cut could further stimulate the economy and push consumer prices away from the 2% target.

Daily EURUSD Trading Plan

In light of the accelerated growth in US inflation, there is a compelling case for the Fed to pause its monetary policy easing cycle in January. This will allow EURUSD bears to open short positions, adding them to the ones initiated at 1.0615.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.