In 2016, investors were taken aback by Donald Trump’s victory in the presidential election. However, the S&P 500 saw a 20% surge. Could the markets be misguided about the Trump trade once more? Let’s delve into this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- Not everyone believes that Trump’s victory will strengthen the US dollar.

- Republican policies may not accelerate inflation.

- The Trump trade is still dragging the Fed’s monetary policy.

- the EURUSD rally may continue if the resistance of 1.0905 is broken through.

Weekly US dollar fundamental forecast

Investors have made a significant commitment to the Trump trade, focusing on pro-inflationary assets, including bitcoin, gold, small-cap stocks, and banks. It would be prudent to sell Treasuries with long maturities and securities of tech companies. However, even in 2016, when the Republican candidate first won, traders were concerned that the S&P 500 would experience a significant decline due to the prevailing uncertainty. However, following tax cuts and deregulation, the stock index exhibited a 20% growth over 12 months. This raises the question of whether the markets may have been misguided in their previous assessments.

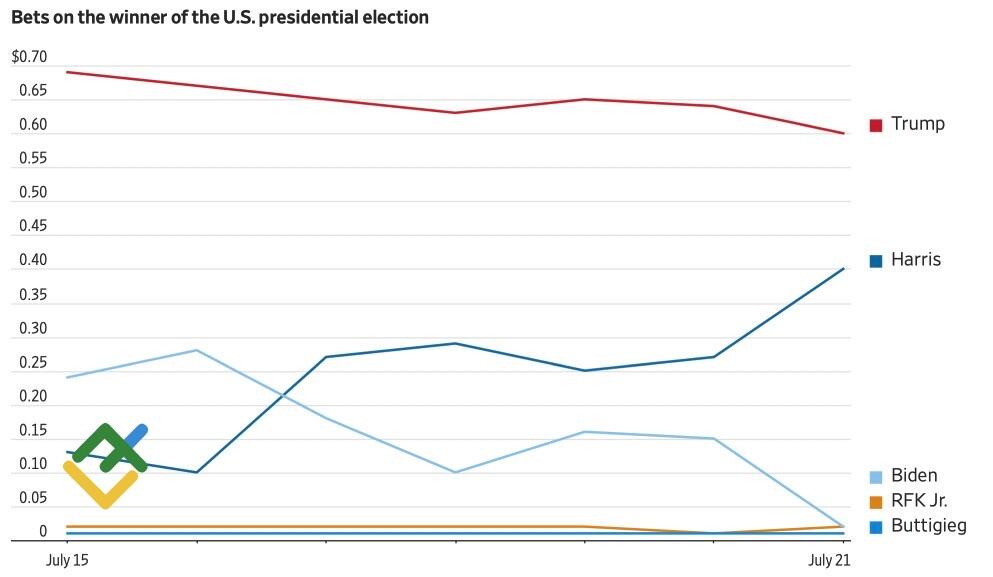

The withdrawal of Joe Biden from the presidential race has not resulted in any significant changes. Kamala Harris is expected to assume her position with an 89% probability, and her chances of winning are estimated at approximately 40%. Despite this, investors remain inclined to pursue the Trump trade, albeit with mounting doubts.

Ratings of US presidential candidates

Source: Wall Street Journal.

The return of trade wars would disrupt supply chains, which, when coupled with fiscal stimulus, could accelerate inflation. However, a reduction in imports could diminish domestic consumption and decelerate price growth. Furthermore, the government is not interested in accelerating inflation and creating public discontent.

Analysts at Deutsche Bank, Barclays, and Morgan Stanley anticipate that a red wave will bolster the US dollar. It is anticipated that the response of China and other countries to the new duties will result in a deceleration of the global economy, which will hurt the greenback’s competitors. Concurrently, the US Federal Reserve will maintain the federal funds rate at its current level for longer than anticipated, boosting the US dollar index. In contrast, Jefferies believes that political pressure from the White House on the Fed will erode the US dollar’s status as a reserve currency.

This is the nature of the market: there is no way of knowing exactly what will happen. It is not possible to make an accurate prediction at this time. The prevailing market narratives influence the pricing of a range of financial instruments. However, if these narratives prove inaccurate, there can be a sudden and significant reversal in the opposite direction. A case in point is the expectation among investors that there will be six or seven cuts to the federal funds rate in 2024, which was expressed at the beginning of the year. However, the US dollar has recently become a leader in the market despite initial expectations that it would not.

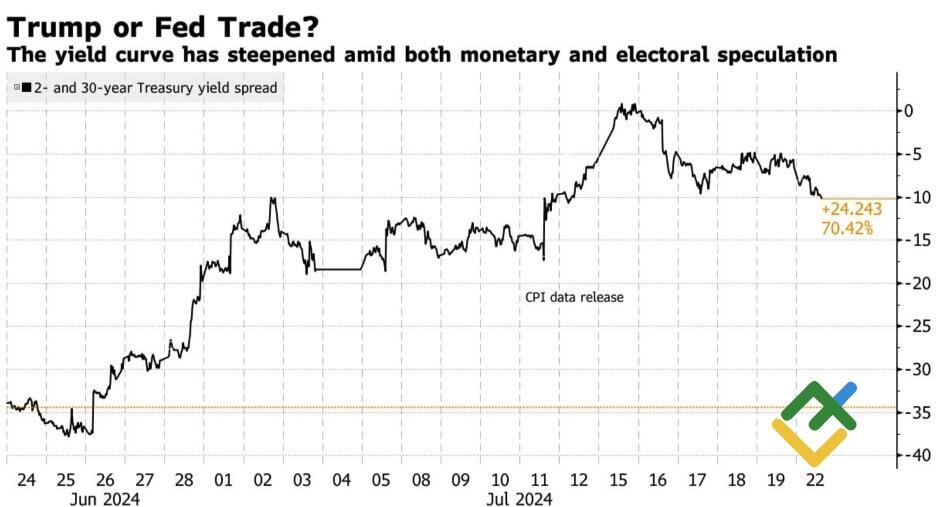

This summer, the key issue shaping the market is the ongoing tension between Trump’s trade policies and the Federal Reserve’s monetary stance. To assess the relative influence of these factors, it is essential to monitor the difference in short- and long-term Treasury bond yields.

US bond yield differential

Source: Bloomberg.

Weekly EURUSD trading plan

Following the release of US inflation data, the markets were driven by expectations of rate cuts by the Federal Reserve. However, with politics now at the center of attention, the EURUSD trading strategy remains the same: buy on a rebound at support levels of 1.086 and 1.0825-1.0836 or on a breakout of the resistance level of 1.0905.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.