The future trajectory of the EURUSD pair will be influenced by key economic indicators, particularly US employment statistics, and developments in the Middle East. Should the outlook for the euro prove favourable, the decline may well come to an end and even reverse. Let’s discuss this further and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Investors await Israel’s retaliation against Iran.

- Strong employment data from ADP helped the greenback.

- ECB hawks are sticking to the dovish rhetoric.

- The EURUSD pair may stabilize in the 1.100-1.105 range.

Weekly US dollar fundamental forecast

Historically, periods of global unrest and financial turmoil have been associated with a strengthening of the US dollar against major world currencies. Despite the escalation of the conflict in the Middle East, markets reacted with restraint in early October, with the exception of oil. The EURUSD pair is declining due to robust US labor market data and expectations of a potential ECB deposit rate cut. Geopolitical concerns are mounting, yet investors remain undaunted.

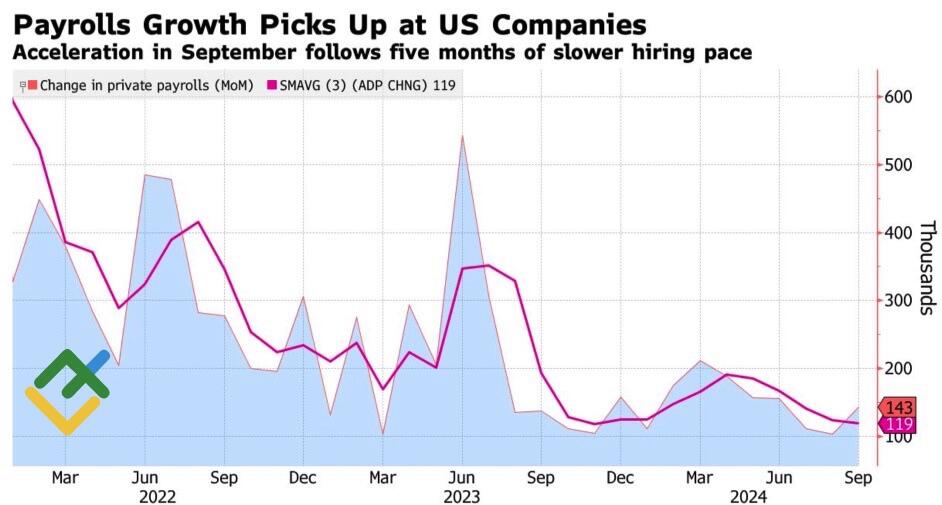

Following the uptick in private sector job openings in August, the ADP employment report for September was a source of optimism. The indicator expanded by 143K, exceeding the Bloomberg expert consensus forecast. Consequently, the probability of a 50 bp cut in the federal funds rate in November declined to 33% from 37%. By the end of September, this probability had reached 63%.

ADP private payrolls

Source: Bloomberg.

Should the jobless claims and labor market report demonstrate growth, the Federal Reserve will be reassured that the current cooling trend is not a cause for concern. To fulfill the dual mandate, a gradual normalization of monetary policy will be necessary. Furthermore, not all members of the Federal Open Market Committee (FOMC) are confident that inflation can be defeated. For example, Thomas Barkin, Chairman of the Federal Reserve Bank of Richmond, believes that the Fed will still have to exert considerable effort to finally get inflation under control.

The Bank for International Settlements also highlights the potential risks associated with a resurgence in inflationary pressures. The financial institution believes that central banks will have to raise rates more decisively in the future in response to surges in inflation due to factors such as armed conflicts, climate change, and trade tensions. In this regard, the intensification of tensions in the Middle East could provide dual support to the US dollar as a safe-haven currency and if Brent crude reaches $100 per barrel. The derivatives market is increasingly betting on such an outcome.

In contrast, OPEC+ does not anticipate any cause for concern. The alliance reaffirmed its plan to boost production by 180,000 bpd starting in December. Saudi Arabia cautioned that if members fail to fulfill their obligations, oil prices could plunge to $50 per barrel.

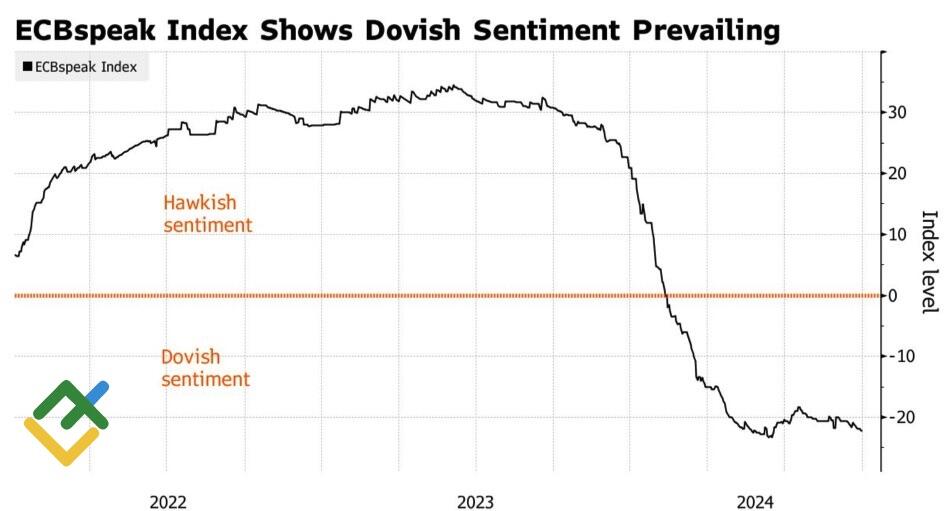

Therefore, market participants have proposed their own ideas regarding Israel’s potential response. Should the outcome prove to be merely symbolic, akin to the events of April, then market conditions will revert to their previous state. Will this prevent further declines in the EURUSD exchange rate? This is unlikely to be the case. There is a clear contrast in the rhetoric of the ECB and the Fed. Even the most hawkish member of the Governing Council, Isabel Schnabel, acknowledges the headwinds to economic growth and the risk of deflation. The central bank is expected to reduce the deposit rate in October as the rhetoric is becoming increasingly dovish.

ECBspeak index

Source: Bloomberg.

Weekly EURUSD trading plan

It is better to refrain from making big trading decisions before the US labor market report for September. Consequently, the EURUSD pair will likely stabilize within the 1.100-1.105 range. Nevertheless, short trades initiated above 1.12 can be kept open.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.