Despite some challenges, the US economy is showing resilience and is not as weak as it initially appeared. Meanwhile, its counterparts are consistently underperforming. In light of the ongoing tensions in the Middle East, this presents a potential opportunity for selling the EURUSD pair. Let’s discuss these issues and make a trading plan.

The article covers the following subjects:

Highlights and key points

- There is a resurgence of American exceptionalism.

- The pace of monetary expansion by the Fed and ECB is leveling off.

- Geopolitical factors support the US dollar.

- If the EURUSD pair drops below 1.1, it will likely continue to plunge.

Daily US dollar fundamental forecast

One of the primary factors contributing to the decline in the USD index during the third quarter was the erosion of American exceptionalism. The US dollar was previously regarded as the safest investment, but the recovery of the European economy and concerns about a potential recession in the US have shifted the balance of power in the EURUSD market. In October, investors began to recognize that the US economy is not in the best shape but is not in a dire situation either. In contrast, its rivals are exhibiting signs of vulnerability. Given these circumstances, it is unsurprising that the US dollar has returned its crown.

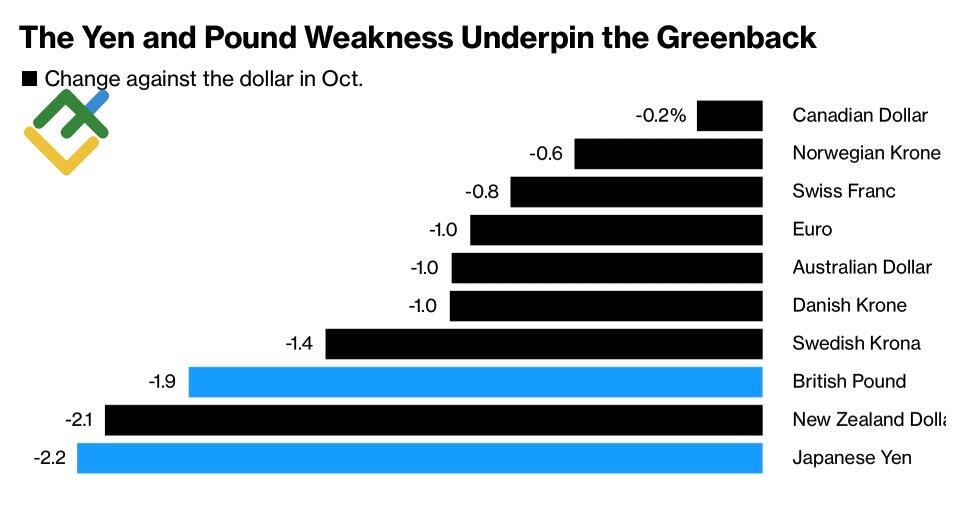

The yen was hurt by statements from Japan’s new Prime Minister, Shigeru Ishiba, indicating that the country is not yet prepared for a rate hike. Meanwhile, Bank of England Governor Andrew Bailey’s hints of accelerating monetary expansion have caused the pound to lose ground. The New Zealand dollar has also been affected by a sharp deterioration in global risk appetite due to events in the Middle East. Finally, the euro has suffered its worst weekly performance since April amid growing expectations of a deposit rate cut by the ECB in October.

US dollar performance against G10 currencies

Source: Bloomberg.

The derivatives market anticipates a decline in borrowing costs by 180 basis points in the United States and 170 basis points in the eurozone by the end of 2025. The differential has narrowed significantly recently in response to disappointing business activity data from the currency bloc and European inflation falling below the 2% target.

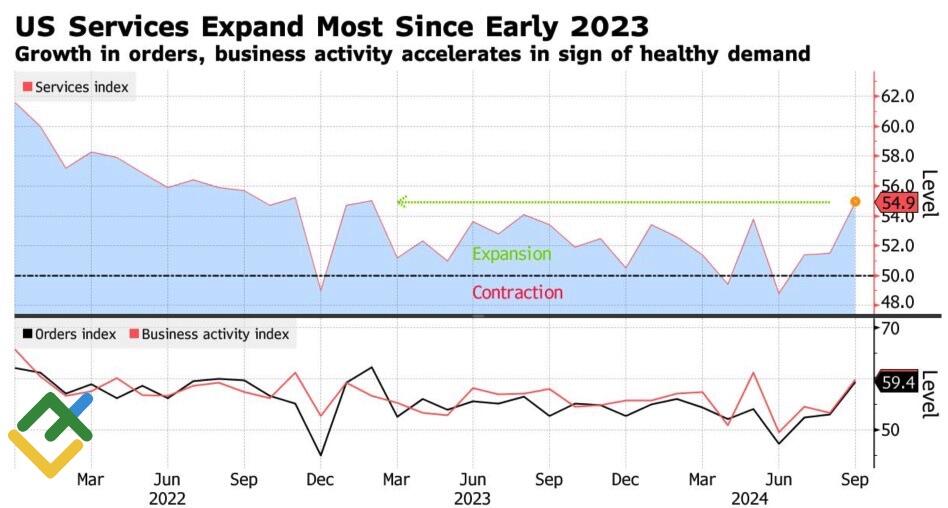

The weakness of major peers amid positive data on the US economy is prompting markets to turn to the greenback. Given the encouraging news on the US economy, including the fastest pace of business activity in the US manufacturing sector from ISM in September in 2.5 years and an expected 150K increase in Non-farm employment by Bloomberg experts, it is clear why markets are gravitating towards the greenback.

US ISM Services PMI

Source: Bloomberg.

Despite Austan Goolsbee’s dovish remarks, the EURUSD pair remained under pressure. The Chicago Fed president stated that the Fed was committed to preventing a significant increase in unemployment, which would result in a notable decline in the federal funds rate by 2025. The medium-term outlook for the US dollar may appear bearish, but short-term expectations of Israeli retaliation against Iran and robust US labor market data are providing support for bears in the major currency pair.

Further clarification is anticipated in the coming days. The US government has expressed opposition to Jerusalem’s attack on nuclear energy facilities but has not objected to an attack on oil infrastructure. This information has increased oil prices and heightened the risk of high inflation in the US, which supports the US dollar.

Daily EURUSD trading plan

The current market situation suggests that a weak employment report could save the EURUSD pair’s bullish trend. Should the pair soar above 1.105, a buy signal will be generated. On the contrary, strong economic data could push the quotes below the 1.1 mark. In this case, the major currency pair may continue to decline, particularly in the event of further escalation in the Middle East.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.