Investors believe that US inflation will accelerate due to tariffs, forcing the Fed to keep rates unchanged for an extended period. However, a slowdown in the economy could present a challenge. Such a scenario would likely boost EURUSD quotes. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Trump 1.0 accelerated inflation only slightly.

- Slowing GDP forced the Fed to cut rates in 2019.

- January FOMC meeting is the most predictable in years.

- Long trades can be maintained as long as the EURUSD pair trades above 1.0415.

Weekly US Dollar Fundamental Forecast

History has demonstrated that no individual or entity is immune to errors. At the onset of Donald Trump’s previous presidential term, there was a substantial amount of discourse surrounding the expectation that his policies would boost GDP and spur inflation. However, the reality proved to be contrary, as prices experienced a modest increase, and the decelerating economy prompted the Fed to reduce rates in 2019. Will EURUSD bears make the same mistake again?

In 2018–2019, tariffs were negligible in comparison to the current threats posed by Trump 2.0. However, the US manufacturing sector faced significant headwinds due to supply chain disruptions. Instead of generating new jobs, this sector has been experiencing job cuts. Investment in business ventures has declined, production has decreased, and real median household income has seen a decline for the first time in five years. According to one estimate, consumer incomes were slashed by $8 billion.

As the economy experienced a slowdown, the Fed was compelled to lower its GDP growth forecasts and eventually responded by reducing the federal funds rate.

Fed Forecasts on US GDP Growth

Source: Bloomberg.

According to Wilbur Ross, the former head of the Commerce Department, President Donald Trump is committed to enforcing tariffs. While these tariffs did not contribute to a surge in inflation during the Trump 1.0 term, economic conditions are in a constant state of flux. At that time, the Fed was combating low prices. However, the current environment is marked by the opposite approach. Consumer price indices, such as the CPI and the PCE, have reached significant levels, compounded by the White House’s protectionist policies.

In response, President Trump has devised a comprehensive strategy to curtail inflation through diverse means. This strategy involves a combination of factors, including the decline in oil prices due to increased production by OPEC and US oil producers, as well as the streamlining of government agencies. Many officials have been requested to resign and receive their salaries for eight months in advance or face the prospect of layoff later. The White House suggests that 5–10% of officials will opt for early resignation, which will reduce budget spending by $100 billion.

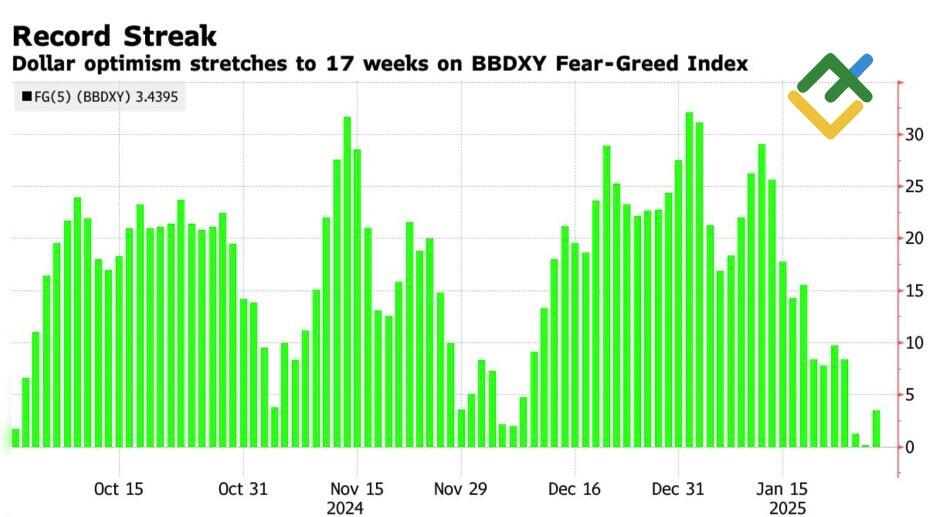

Notably, oil prices are not determined by the president, and such measures as sanctions against Russia may spur oil prices. The deferred resignation program may potentially hinder GDP growth due to the associated uncertainty. Consequently, investors are seeking refuge in the US dollar, and the greenback has maintained a bullish outlook for 17 consecutive weeks.

US Dollar BBDXY Fear-Greed Index

Source: Bloomberg.

There is a popular opinion in the Forex market that the US dollar will remain strong until proven otherwise. However, if Donald Trump’s policy really slows down the GDP, the USD index will face a sweeping wave of sell-offs.

Weekly EURUSD Trading Plan

Meanwhile, investors are focusing on the upcoming Fed meeting in January. According to DoubleLine Capital, the central bank is expected to be relatively predictable in the coming months. The Fed will refrain from rate cuts while maintaining ample flexibility in its economic policies. As long as the EURUSD pair remains above 1.0415, it will be advantageous to adopt a bullish stance.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.