While the stock market is following a “Goldilocks” scenario, EURUSD bears are gradually taking control of the market. Will the pair be able to find a bottom amidst the slowing of inflation? Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The US dollar saw its best weekly gain since September 2022.

- The odds of a 50bp Fed rate cut in November fell to 2% from 63%.

- Accelerating inflation could force the Fed to end the cycle.

- The EURUSD pair may slip to 1.085.

Weekly US dollar fundamental forecast

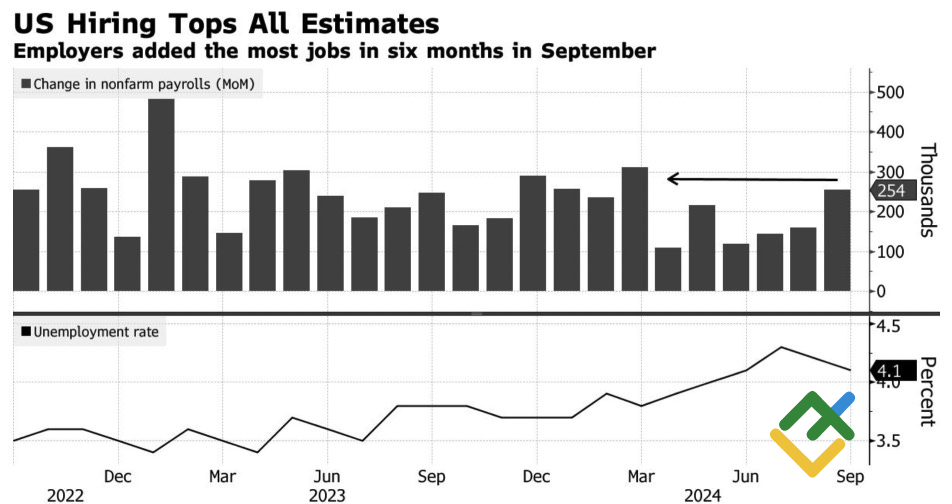

If the recent report on the labor market has not yet dissuaded those who still believe in an impending recession, it is unlikely that anything will. Employment in September grew by an impressive 254K, exceeding all Bloomberg expert forecasts. The previous two-month data was revised upward by 72K. Unemployment fell to 4.1%, while average wages accelerated to 4%. The US economy is strong, which has led to a collapse in EURUSD quotes.

US Nonfarm payrolls and unemployment rate

Source: Bloomberg.

The US dollar posted its strongest weekly gain since September 2022 as the probability of a federal funds rate cut in November shrank sharply by 50bps from 63% to 2%, and US Treasury yields soared to their highest levels in three months. The greenback’s performance as a safe-haven asset stands in contrast to the robust rally in US stock indices, which have benefited from positive economic news.

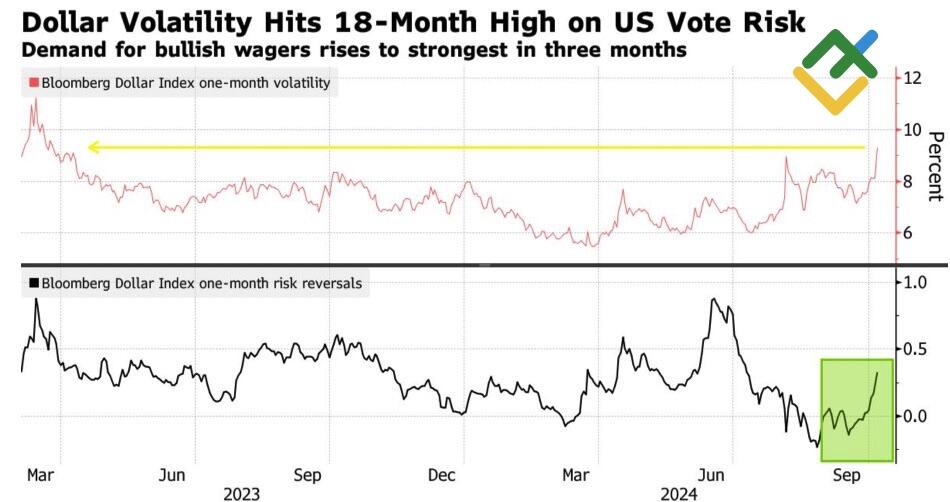

The S&P 500‘s surge can be attributed to the Goldilocks economy, which encompasses a growing above-trend economy and slowing inflation. However, we must not forget that Goldilocks was in charge of the house until the bears arrived. There are several reasons why sellers may return, including geopolitical issues, increased market volatility ahead of the US presidential election, and, finally, accelerating inflation. These factors may trigger a correction in stock indices and strengthen the US dollar.

US dollar volatility and risk reversal

Source: Bloomberg.

If Chicago Fed President Austan Goolsbee, a dovish member of the FOMC, is concerned about the risk of inflation exceeding the 2% target, what are the views of the other members of the FOMC? A robust labor market and economy, the prospect of Brent crude reaching $100 a barrel due to geopolitical tensions in the Middle East, and the possibility of new fiscal stimulus regardless of the outcome of the US presidential election are all factors that could increase the chances of consumer prices accelerating.

The economic situation is beginning to mirror that of the 1970s when the Fed prematurely declared victory over inflation and subsequently experienced a double-dip recession. As reported by Yardeni Research, the Fed ceased reducing interest rates in 2024. If the consulting firm’s assessment is correct and the markets that are anticipating a 50 bp cut are incorrect, we should anticipate a further decline in the EURUSD pair.

However, inflation remained relatively subdued in September. Bloomberg experts project consumer prices to decelerate to 2.3%, indicating the potential for a disinflationary process and a Goldilocks scenario for the stock market. However, this may be short-lived as bearish sentiment could emerge. The euro may find support on the back of the S&P 500 regaining its uptrend, but this is unlikely to be sustained.

Weekly EURUSD trading plan

Short positions on the EURUSD pair established above 1.12 and accumulated at 1.1045 can be kept open as the pair may return to 1.085 and decrease lower. It would be prudent to adhere to the current selling strategy.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.