What is the future trajectory of the EURUSD pair? The current performance of the pair shares similarities with the events that transpired eight years ago, when it underwent a similar decline and subsequent recovery. The tariff policy of the White House, which directly impacts the US dollar rate, will define the major currency pair’s direction. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The EURUSD pair is repeating the 2016–2017 scenario when a decline was replaced by growth.

- The aggressive tariff policy of the White House may change everything.

- The euro is backed by events in Europe.

- The EURUSD pair should surge above 1.05 to allow traders to open long positions.

Weekly US Dollar Fundamental Forecast

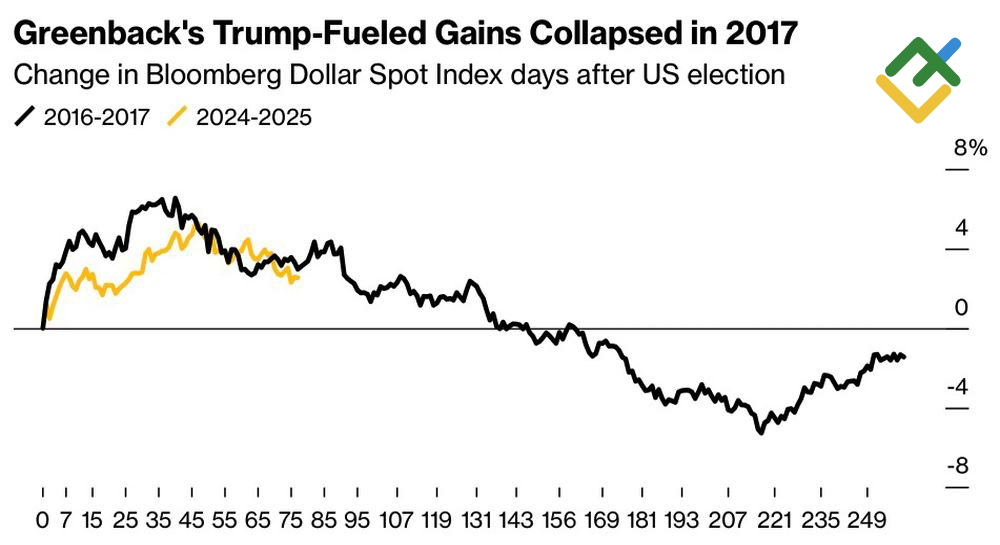

History appears to be repeating itself, prompting the question: Will the US dollar follow a similar trajectory to its 2016–2017 performance when the USD index declined after Donald Trump’s presidential election victory? Goldman Sachs has observed parallels between the present circumstances and those of eight years prior. However, should the White House adopt a tariff-focused approach, the greenback may witness a resurgence similar to its 2018 pattern. Which perspective is more accurate?

US Dollar Performance

Source: Bloomberg.

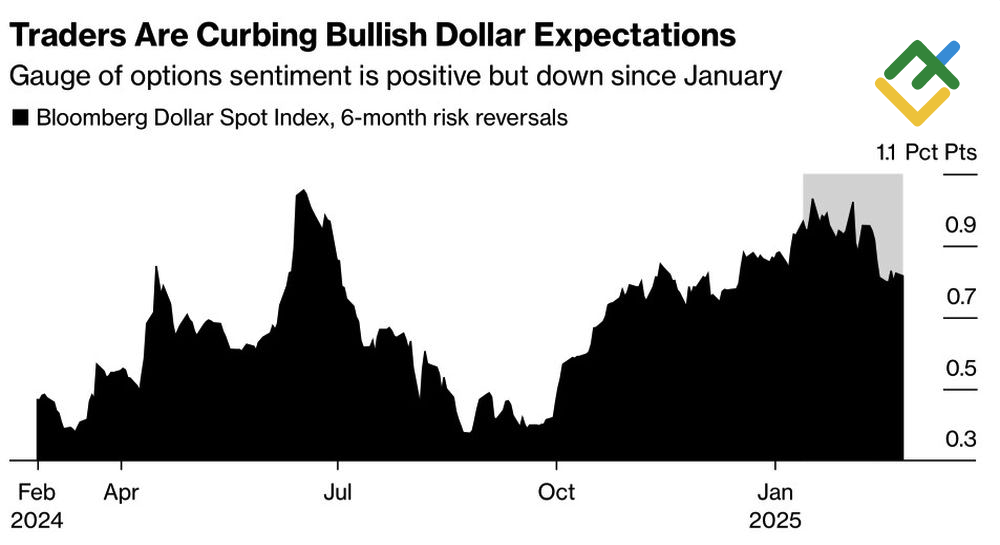

The 2016-2017 scenario is unfolding as anticipated, with the EURUSD pair experiencing a 7% decline from the November election to Donald Trump’s inauguration. Following this period, the major currency pair has shown a 3% uptick, attributed to investor concerns regarding the United States’ protectionist policies. Tariff threats by the White House are perceived as part of the negotiation strategy, and 30–40% of investors surveyed by Morgan Stanley believe that the US will not impose reciprocal tariffs. The delay until April 1 is necessary to push other countries to lower their tariffs.

The fact that no significant tariffs will be imposed on imports and that there will be no impediments to accelerating global GDP is good news for a pro-cyclical currency like the euro, especially as the German economy is starting to revive. While investors consider the challenges Friedrich Merz may encounter in forming a coalition and lifting the fiscal brake, he is already negotiating a €200 billion increase in defense spending with the Social Democratic Party.

In addition, Washington’s swift action to end the armed conflict in Ukraine, which will primarily benefit Europe, has prompted speculators to abandon long positions on the US dollar.

Speculative Positions on US Dollar

Source: Bloomberg.

At the same time, a 2018 scenario remains a possibility. In 2017, the US delayed decisive action, and the USD index slumped by 8%. However, the following year, the US took a more proactive stance, supporting the US dollar. This period was characterized by the imposition of duties on steel and aluminum, ongoing negotiations with neighboring countries, and the preparation of levies on China.

President Trump has indicated that tariffs on Mexico and Canada will be imposed as scheduled. Mexico is contemplating the imposition of import duties on China as the US demands, and a Bloomberg insider has suggested that the 25% levies could be replaced with reciprocal ones in April. The White House’s assertiveness could soon bear fruit, potentially buoying the US dollar.

Weekly EURUSD Trading Plan

The EURUSD pair has failed to settle above the 1.05 threshold several times, pointing to a retreat in the bullish sentiment. Against this backdrop, short trades can be opened once the pair violates the support level of 1.0445. Long trades can be considered if the pair manages to breach the upper boundary of the consolidation range of 1.028–1.05.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.