The Fed has made an error in judgment once in the past year when the regulator believed it had beaten inflation at the beginning of 2023-2024. Against this backdrop, the US dollar strengthened. Is history repeating itself? Let’s discuss this topic and develop a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- The market is adjusting its views on the Fed’s monetary expansion.

- 90% of Reuters experts await the ECB deposit rate cut in October.

- The previous mistake of the Fed has led to the strengthening of the US dollar.

- The EURUSD pair may collapse to 1.085.

Weekly US dollar fundamental forecast

The US Federal Reserve took the unprecedented step of providing the US economy with a soft landing. In September, the central bank reduced the federal funds rate in anticipation of a continued deceleration in CPI and PCE towards the 2% target, driven by a cooling labor market. However, recent data indicate that the US economy is demonstrating resilience. A robust economy is inherently associated with inflationary pressures. The Fed may have made a mistake. This could prove costly for EURUSD bulls.

Towards the end of 2023, the Fed made a dovish reversal against the slowdown in consumer prices, announcing plans to cut rates in the near future. However, the acceleration of inflation in the first quarter prompted the central bank to reconsider its position. This resulted in a strengthening of the US dollar against major world currencies.

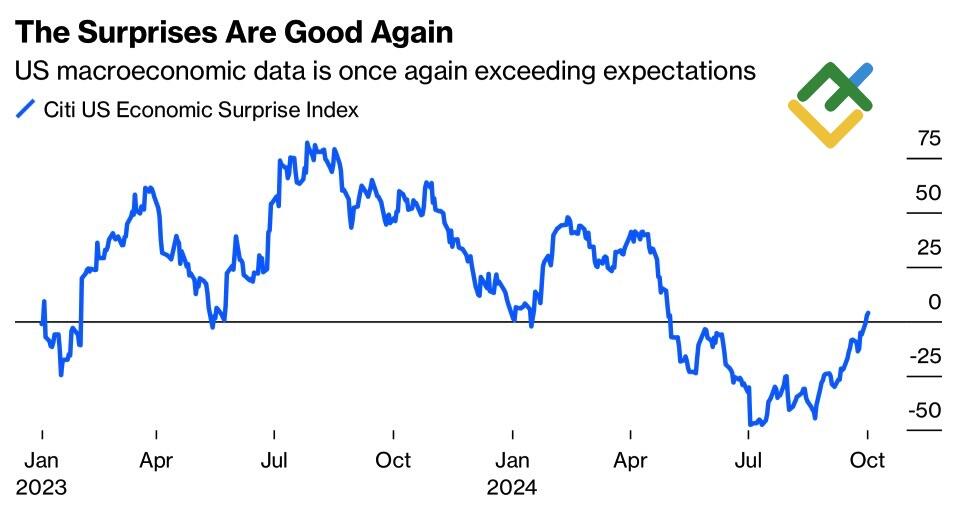

As the summer and fall approached, the Fed anticipated the PCE’s imminent return to the target range and began monitoring the labor market. Jerome Powell took action to prevent a sharp rise in unemployment. However, the reality differed from expectations, with statistics consistently exceeding forecasts, eventually leading to a collapse in EURUSD quotes.

US economic surprise index

Source: Bloomberg.

The market is coming to recognize the unrealistic nature of its expectations of a 150 bp cut in the federal funds rate by the end of 2025. In 1995, the Fed also aimed to achieve a soft landing and reduce borrowing costs by 200 basis points. In reality, the US regulator managed to decrease the rate by 75 basis points.

In its September decision, the Fed opted to make monetary policy less restrictive. A rate of 5% will also exert downward pressure on inflation, albeit to a lesser extent than a rate of 5.5%.

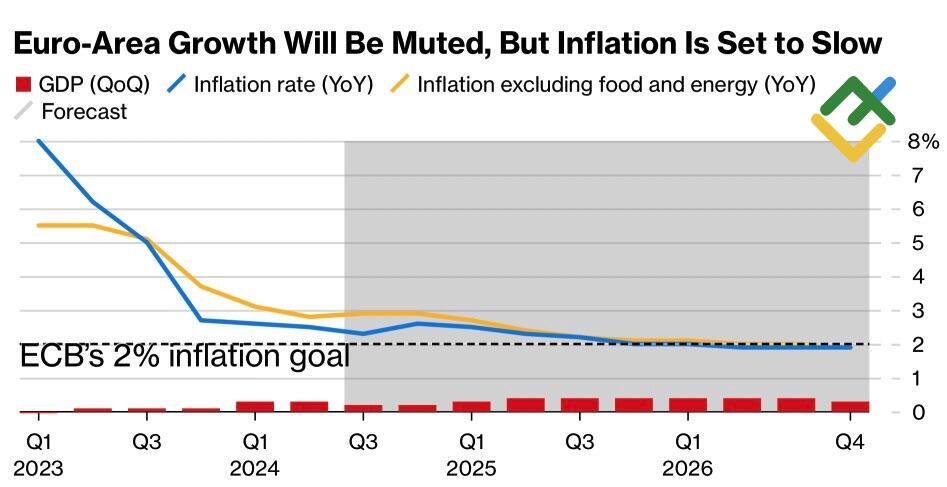

The ECB is confronted with a markedly different set of circumstances. There is no need for it to take a proactive stance. Consumer prices have already fallen below 2%, and the weak business activity statistics indicate significant economic challenges in the eurozone.

EU inflation rate and GDP growth

Source: Bloomberg.

According to a recent survey conducted by Reuters, 70 out of 75 experts, or about 90%, anticipate that the ECB will reduce the deposit rate by 25 basis points to 3.25% at its upcoming meeting on October 17. A month ago, only 12% of respondents projected such a scenario. Currently, 68 out of 75 respondents expect that the October monetary expansion will be followed by another in December. 55% of specialists suggest that the cost of borrowing will decline to 2.5% by the end of March. This represents a more aggressive trajectory than previously assumed, but it aligns with market expectations.

Weekly EURUSD trading plan

The Fed risks appearing more cautious, and the ECB might be more decisive than predicted, which, in the conditions of both central banks’ implementation of monetary expansion cycles, may drive the EURUSD pair downward. Short trades can be initiated with the target of 1.085 on the pair’s growth against the publication of the September FOMC meeting minutes and statistics on US inflation.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.