As a rule, the Fed’s monetary policy easing measures harm the US dollar. However, this time, the currency is up against a relatively weak opponent, and geopolitical factors favor EURUSD bears. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Eurozone PMIs post alarming figures.

- Political risks in France have returned with renewed vigor.

- The US dollar is usually falling during the Fed rate cuts.

- One can open long trades on the EURUSD pair at 1.1145 and 1.118.

Weekly US dollar fundamental forecast

The decision to buy the dip after the release of European business activity data appeared to be sound. The Fed has initiated a reduction in interest rates, but there is still a long way to go. As history shows, periods of monetary expansion tend to have a negative impact on the US dollar. However, in light of the current market conditions and the relative weakness of other currencies, it is worth questioning whether it is advantageous to divest the US dollar.

This situation is far from ideal. This is a highly unfavorable outcome. The results are disappointing and cause for concern. This is how the statistics from the European purchasing managers can be characterized. German and French PMI declined significantly, reaching a seven-month low, and the euro experienced a sudden and steep decline.

French and German PMIs

Source: Bloomberg.

Germany, a nation with a strong focus on exports, is facing significant challenges due to the instability of the Chinese economy. The yield curve has inverted for the first time since November, indicating that a recession is likely on the horizon. France has reached the limits of its potential following the Olympics, and investor attention has shifted to political concerns.

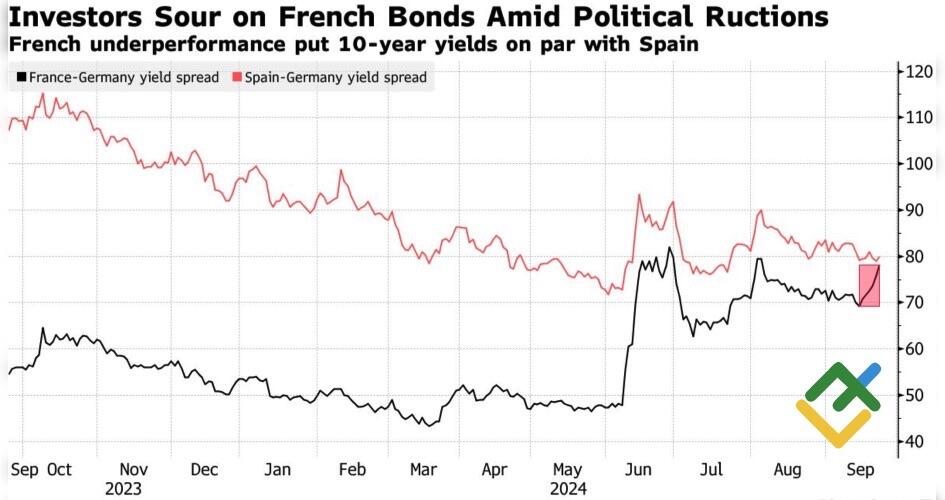

Michel Barnier’s new government is a coalition of conservatives and centrists. Opposition blocs in parliament are threatening a vote of no confidence. As a result, French bond yields have almost reached those of Spain, which has a lower investment grade rating. The yield spread with German counterparts has widened to its highest level in seven weeks, putting pressure on the euro.

EU countries’ bond yield spreads

Source: Bloomberg.

The turbulence in the two leading economies is having a knock-on effect on the eurozone. There are reports that the recovery has stalled and that stagnation is imminent. The likelihood of a deposit rate cut in October is increasing. The derivatives market anticipates a rate of 3.31%, which would represent a nearly 25-basis-point reduction from the current level of 3.5%.

However, the estimated magnitude of the Fed’s monetary expansion in the current cycle is still higher at 175 basis points compared to 160 basis points for the ECB. This enables Goldman Sachs to project a EURUSD rally towards 1.15. Typically, cycles of Fed monetary policy easing result in a decline in the value of the US dollar. However, this is not always the case. In 2001, the USD index saw an increase due to high investor demand for safe-haven assets, including events surrounding the September 11 attacks.

It is not uncommon for historical patterns to manifest themselves in similar ways. The ongoing conflict in the Middle East, the war in Eastern Europe, and the US presidential election are contributing to increased interest in the US dollar. Concurrently, the fragility of the global economy is exerting downward pressure on the euro, which is a pro-cyclical currency.

Weekly EURUSD trading plan

The EURUSD pair’s slide below 1.11 allowed traders to buy the dip. However, if quotes decline below 1.108, long trades should be closed, and short trades should be opened. Meanwhile, long positions can also be opened at 1.1145 and 1.118.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.