EURUSD bears continue to bet on widening divergence between US and eurozone economic growth and the expanding Fed–ECB rate spread, which will likely push the euro to 0.97 against the greenback. What factors could prevent this outcome? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- A 25 bps increase in the Fed/ECB rate spread in 2024 has dragged the EURUSD pair down by 5.7%.

- An increase in the differential by another 100 bps may send the quotes to 0.97.

- The dollar may encounter pitfalls along the way.

- The euro’s pullback to 1.0455 allowed traders to open more short trades.

Monthly US Dollar Fundamental Forecast

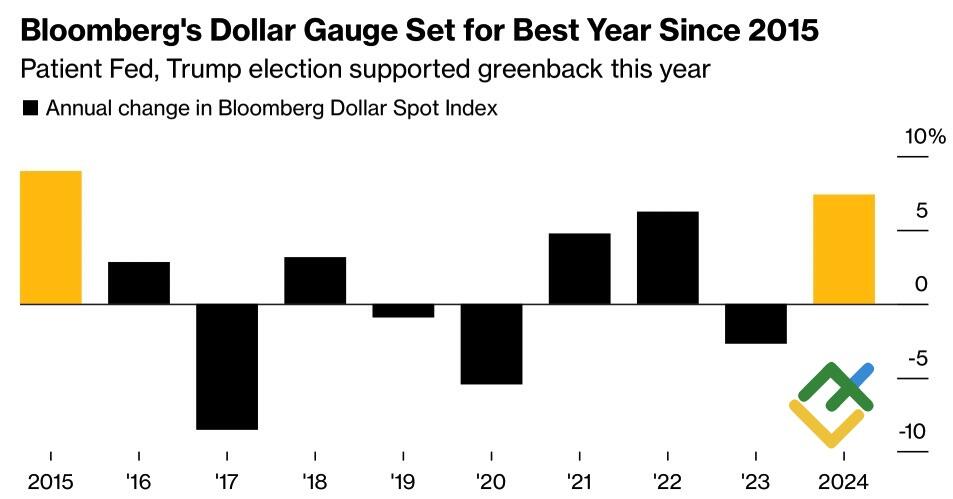

In 2024, American exceptionalism and AI technology dominated the financial landscape. At the beginning of the year, it was anticipated that both of these factors would reach a point of inflection, with the US economy expected to decelerate to a 1% growth rate due to elevated interest rates and AI technology reaching its zenith. However, the outcomes proved to be more favorable for the United States and its national currency. The US dollar outperformed more than three dozen of the most liquid currencies in the Forex market, achieving the best performance since 2015. What does the future hold for the USD index in 2025?

US Dollar Performance

Source: Bloomberg.

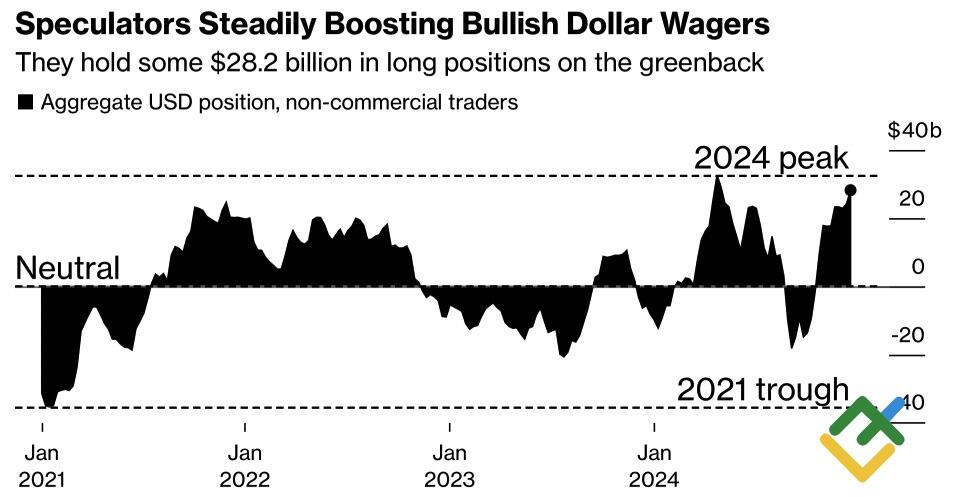

EURUSD bears remain optimistic. They expect tax cuts and deregulation from Donald Trump to accelerate the US economy further, while trade tariffs will slow GDP growth overseas. This will allow US exceptionalism to push the major currency pair towards parity and lower. As it was expected, hedge funds and asset managers have increased their net longs on the greenback to $28.2 billion, the highest level since May.

Speculative Positions on US Dollar

Source: Bloomberg.

The actions of speculators are logical, given the current economic climate. A strong economy is associated with high inflation. The Fed forecasts PCE growth at 2.5%, intending to cut the federal funds rate twice by a total of 50 bps. The derivatives market is anticipating a 100 bp cut from the ECB, influenced by the potential for a CPI slowdown. The shift in trade patterns, triggered by US tariffs, has the potential to trigger a resurgence of deflation in the European economy. This perspective was articulated by Klaas Knot, Governor of the Bank of the Netherlands.

In 2024, the Fed reduced rates by 75 bps, the European Central Bank by 100 bps, and the spread widened by 25 bps, resulting in a 5.7% decline in the EURUSD exchange rate. A 50 basis point increase in the differential would result in a further decline of the major currency pair, with a potential drop of 7–8% to the 0.96–0.97 range.

Meanwhile, the potential impact of Donald Trump’s tariff threats on global trade negotiations is a key concern. Trump’s fiscal stimulus plans are unlikely to be approved by Congress, and Elon Musk’s budget spending cuts are expected to slow US GDP growth significantly. The Fed is expected to accelerate the monetary expansion cycle, marking the end of American exceptionalism and the USD index rally.

Monthly EURUSD Trading Plan

The likelihood of these events occurring in January is low. As Donald Trump’s inauguration approaches, optimism about his ability to reshape global trade and order will buoy the US dollar. The EURUSD pair may reach parity by early to mid-February. The recommendation remains to sell the pair on upward shifts. The rise of the major currency pair to 1.0455 presented a favorable opportunity to implement this strategy.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.