The EURUSD pair shows signs of recovery after a precipitous collapse, supported by heightened geopolitical tensions in Eastern Europe and declining US Treasury yields. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Geopolitical risks have boosted demand for safe-haven assets.

- Falling Treasury yields have deprived the US dollar of its key advantage.

- The Fed will start reacting to Donald Trump’s policies earlier.

- The EURUSD pair’s pullback is a great selling opportunity, with the target at 1.03.

Weekly US Dollar Fundamental Forecast

The Trump trade is losing momentum, which, when coupled with rising geopolitical risks in Eastern Europe, allows the EURUSD currency pair to recover. The decline in the value of the main currency pair following the US presidential election occurred with undue haste. As the market recovers, investors are adopting a more cautious approach. Consequently, the upward trajectory of the US dollar is encountering turbulence.

The defining characteristic of the Trump trade is a surge in stock indices and US Treasury bond yields. However, the use of US weapons in Ukraine and Moscow’s revised nuclear doctrine have prompted investors to seek more secure investments. In a market with stretched valuations, this resulted in a decline in debt rates and forced EURUSD bears to retreat. If the conflict does not escalate further, market conditions will soon return to normal.

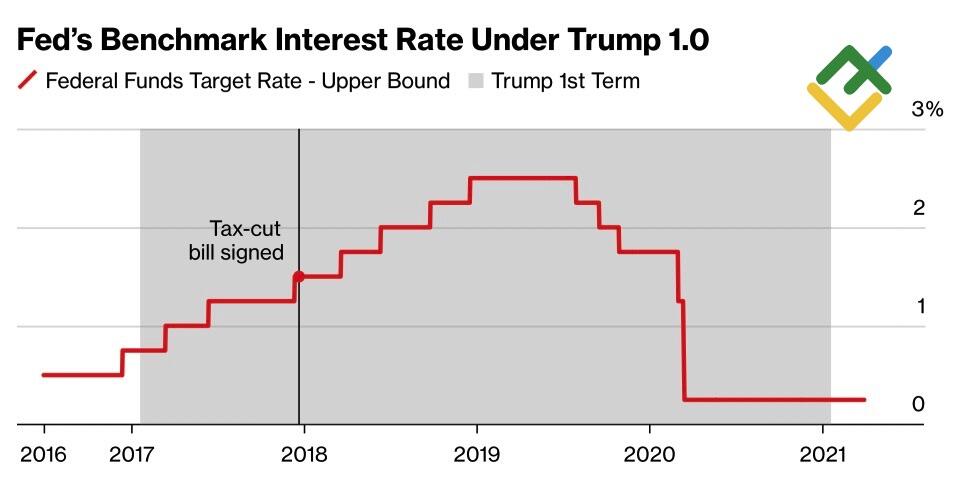

Despite the Fed’s assertion that it will not alter its plans due to the Republican victory in the election, historical precedent suggests otherwise. In late 2016, before Donald Trump’s inauguration as US president, the US regulator began forecasting a fiscal impulse, which prompted it to start a cycle of monetary restriction.

Federal Funds Rate Change

Source: Bloomberg.

History is repeating itself. As anticipated, the odds of a federal funds rate cut in December reached 59.1%, although, after the release of US consumer price data, they exceeded 80%.

In contrast, the probability of the ECB adopting a more accommodative monetary policy stance by the end of the year is increasing. The derivatives market indicates a 77% probability of a 25bp cut in the deposit rate at the December meeting and a 23% probability of a 50bp adjustment. Bank of Italy Governor Fabio Panetta stressed that the European regulator should accelerate its monetary expansion. Given that inflation is close to the target level and domestic demand is stagnant, a restrained monetary policy is no longer required.

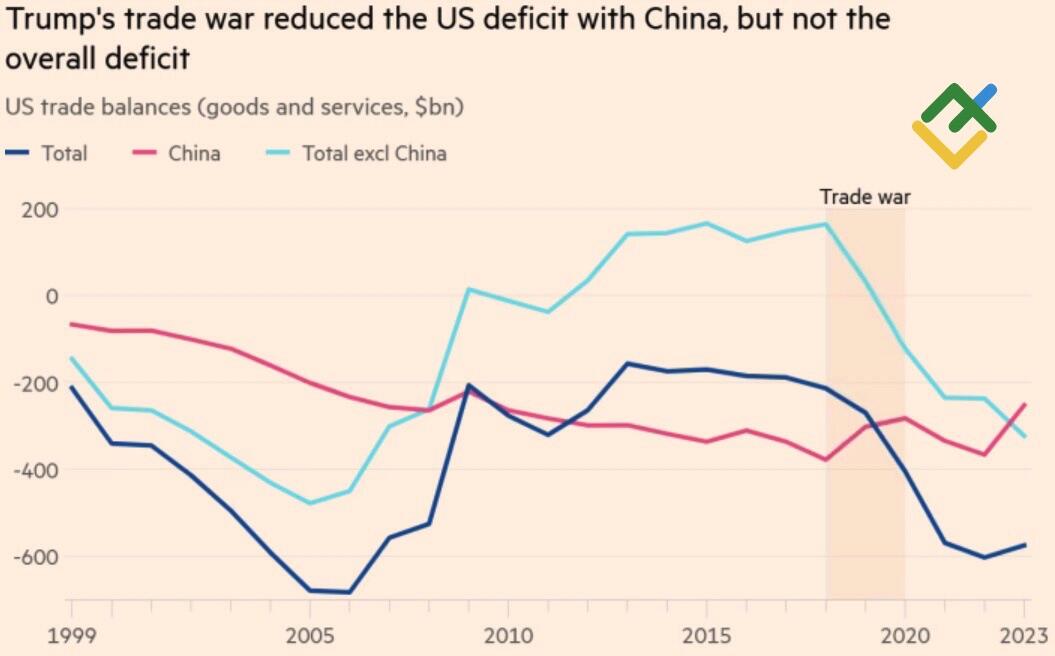

The loss of momentum in the Trump trade may be linked to the anticipation of new tariffs on imports, which will prompt US companies to actively purchase Chinese goods. This is already occurring. In October, shipments from China to the United States increased by 13%. This was also the case in 2018 when the US trade deficit surged instead of shrinking as Donald Trump had hoped. In fact, his protectionist policies have not achieved their intended result.

US Trade Balance

Source: Financial Times.

Weekly EURUSD Trading Plan

The continued influence of American exceptionalism and varying paces of monetary expansion by the Fed and ECB will continue to exert downward pressure on the EURUSD exchange rate. Geopolitical factors may have a short-lived effect but can trigger an upward pullback, creating an opportunity to open short trades on the EURUSD pair with the target at 1.035.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.