The divergence in economic growth between the US and the eurozone is narrowing, the scale of the ECB’s proposed monetary expansion is shrinking, and Donald Trump is not rushing to implement tariffs. Could these factors be reasons to consider buying the EURUSD pair? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Donald Trump prefers negotiations to tariffs.

- Strong PMIs have supported the euro.

- Rumors that the Fed is ready to comply with the White House are exaggerated.

- Short trades can be opened if the EURUSD pair fails to settle above 1.047.

Weekly US Dollar Fundamental Forecast

President Donald Trump’s policies have been characterized by a notable emphasis on empty rhetoric, with minimal tangible action. His approach involves making promises, such as imposing tariffs, which are then postponed in exchange for his opponents’ willingness to compromise. This strategy could potentially lead to a recurrence of historical events when the US dollar’s gains were erased amid Trump’s election victory in 2017. Furthermore, stretched positions on the US currency underscore the potential risks of an upward movement in the EURUSD pair.

A notable example of Trump’s negotiating style was his demand that Colombia accept undocumented migrants returned from the United States. Colombia’s refusal to accept military aircraft for this purpose led Trump to threaten the country with 25% tariffs, which could have escalated to 50%. However, the imposition of import duties was postponed as the South American nation agreed to all of the US president’s conditions.

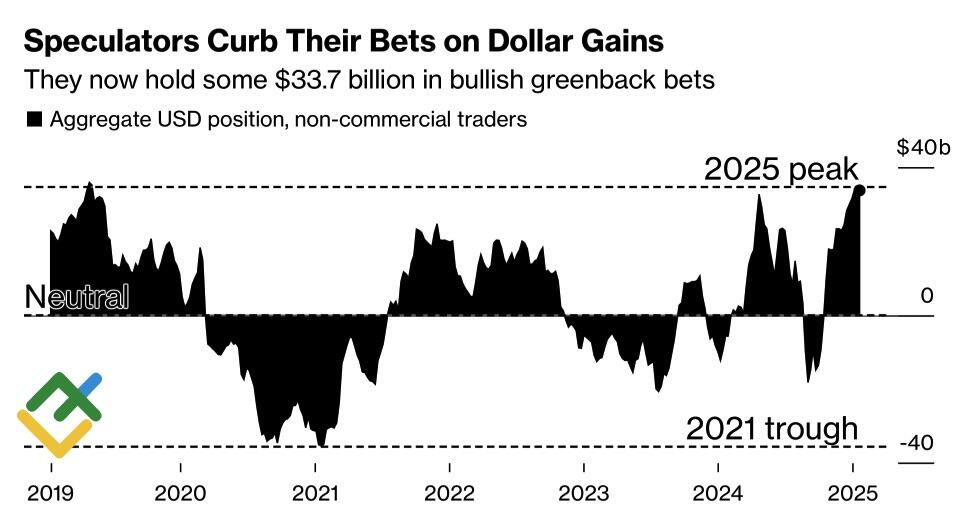

Hedge funds and asset managers have been actively building up longs on the greenback since the fall and brought them to their highest point since 2019 for several reasons. These include fears of trade wars with speculation of tariffs being imposed immediately after the inauguration of Donald Trump, the divergence in US and eurozone economic growth, and the potential risks associated with a rapid decrease in the ECB deposit rate against the anchored federal funds rate.

Speculative Positions on US Dollar

Source: Bloomberg.

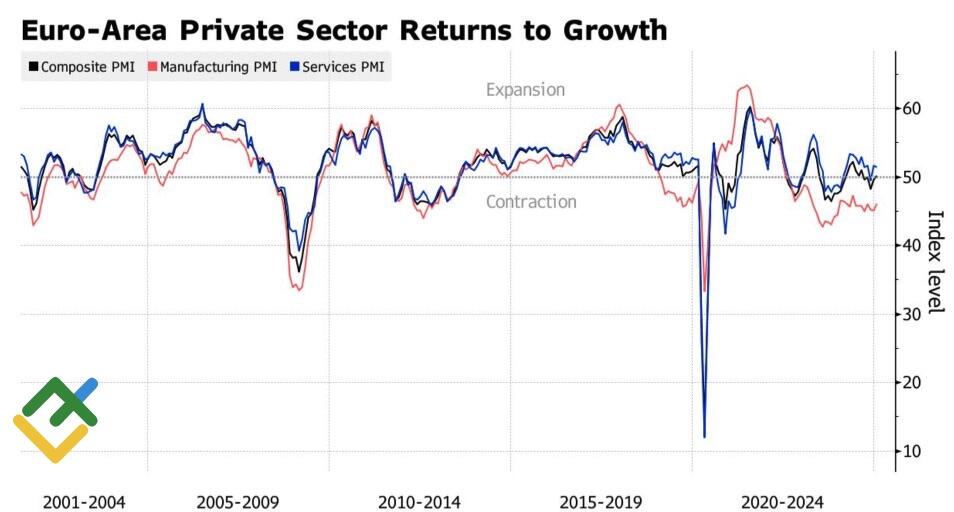

In fact, the devil was not as scary as he was painted. Investors are progressively recognizing that Donald Trump’s words may not align with his actions. While his words may appear imposing, they are ultimately ineffective. The eurozone’s recent uptick in business activity stands in contrast to the slowdown in US PMIs. The narrowing of economic growth disparities may trigger a bounce in the EURUSD.

Eurozone Purchasing Managers’ Indexes (PMI)

Source: Bloomberg.

In light of the strong PMIs, the derivatives market reduced the estimated scale of the ECB’s monetary expansion from 95 bps to 88 bps, contributing to the growth of European bond yields and the strengthening of the euro.

Consequently, the three key factors that had been favoring EURUSD bears ceased to be effective, leading to the unwinding of net longs on the US dollar and triggering a correction. The question remains: how long will this correction persist?

Weekly EURUSD Trading Plan

Investors are concerned by Donald Trump’s statement that he has a better understanding of monetary policy than the Fed and will demand rate cuts, which impacts the US dollar. However, this statement is in contrast to his previous actions, which suggests that he is able to set expectations but not necessarily act on them. In my opinion, some of the previously announced tariffs will be implemented, reviving a downtrend in the EURUSD pair. Short trades can be considered if the pair fails to consolidate above 1.047 or rebounds from 1.054.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.