The market expects the fed funds rate to be reduced by year-end, which, when considered alongside the Trump trade retreat, will allow the EURUSD pair to weather the storm. Will the November jobs report boost the US dollar? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The Fed will unlikely leave the rate at 4.75% in December.

- The actual employment numbers may differ from forecasts.

- Investors are getting rid of the US dollar due to the Trump trade retreat.

- The EURUSD pair will show an upward pullback if it settles above 1.054.

Daily US Dollar Fundamental Forecast

Investors have realized that Donald Trump’s statements do not pose a threat until he returns to the White House. It is not a certainty that the President-elect will fulfill all of his pledges. If this is the case, the optimal strategy would be to take profits on short trades opened on the EURUSD pair, divest from the US dollar for a while, and monitor the market shifts, looking for trading opportunities.

The Trump trade is nearing its conclusion, with expectations of a Fed rate cut at the last meeting in 2024, rising risk appetite, and seasonal weakness in the greenback allowing the EURUSD pair to withstand during such a turbulent time. Notably, the fall of the French government is not a serious factor to consider in this case. The key point is that Marine Le Pen has stated that should the next Prime Minister be slower to reduce the budget deficit than Michel Barnier, she will be in a position to retain power.

Investors have increased the implied scope of the Fed’s monetary expansion from 75bp to 84bp, which is exerting pressure on the US dollar. Despite Bloomberg’s consensus forecasts of 220k employment growth in November and unemployment remaining at 4.1%, indicating continued strength in the US labor market, EURUSD bulls remain undeterred.

Market Expectations on Fed Rate Cut

Source: Bloomberg.

Given the inherent risks associated with revising October’s historically low figures, there is a notable divergence of opinion regarding November’s non-farm payrolls. In addition, FOMC officials have cautioned against placing undue reliance on this statistic, citing its potential distortion due to external factors such as hurricanes and strikes. Some experts project an unemployment rate to increase to 4.2%, a rise often preceding an economic downturn.

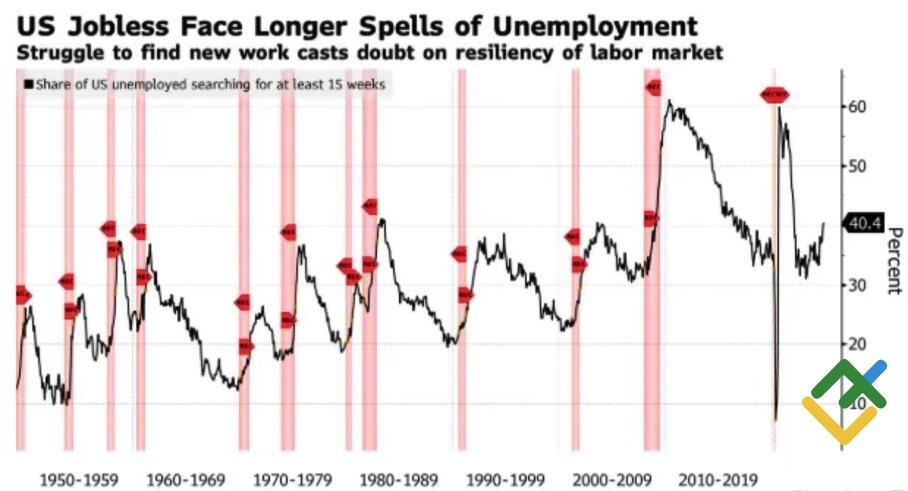

Recessions and Share of US Unemployed

Source: Bloomberg.

Therefore, the likelihood of the Fed maintaining the federal funds rate in December is low. This, coupled with the Trump trade retreat, provides investors with the opportunity to sell the US dollar at any given moment. Therefore, an increase in jobless claims to a one-month high has pushed the EURUSD pair higher.

Closing speculative long positions on the greenback carries the risk of a correction in the major currency pair despite the bearish medium-term outlook. The US economy is outperforming due to accelerated productivity growth, setting it apart from other regions, including the eurozone. This divergence in growth and the impact of fiscal stimulus and trade tariffs from Donald Trump will drive EURUSD quotes downward.

Daily EURUSD Trading Plan

Against this backdrop, the optimal solution is to switch from short-term long positions to selling the EURUSD on growth. The EURUSD pair’s reaction to the US employment report is unpredictable. Weak figures will allow traders to open long positions at 1.0545, while strong figures could send the pair on a roller coaster ride.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.