The EURUSD pair is expected to remain stable within the next two to three months as auto dealers have stockpiled and the US has not clarified its tariff policy. Meanwhile, Germany has a significant safety net to weather the storm. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Tariffs will hit after 2–3 months as auto dealers have increased inventories.

- The US does not want to clarify what will happen on April 2.

- German fiscal stimulus will offset negativity due to trade wars.

- Long trades can be considered if the EURUSD pair grows above 1.082.

Weekly US Dollar Fundamental Forecast

As America’s Liberation Day approaches, Bloomberg predicts that 25% tariffs on cars will subtract 0.5% from Germany’s GDP. However, the EURUSD pair has shown resilience, maintaining stability despite broader market fluctuations. The euro is attempting to maintain its value at 1.08 while market caution persists. Traders have previously experienced setbacks due to Donald Trump’s policies and are awaiting April 2. It remains uncertain whether the White House will seek to clarify the situation.

According to UBS, the deadline may not offer a clear picture of the trade policy. Instead, Donald Trump could introduce new deadlines, which would extend the suspension of tariffs once again. This would postpone trade wars, which would, in turn, buoy the EURUSD pair.

Notably, auto dealers have accumulated substantial inventories, sufficient for 2–3 months of sales. The euro has this time and is trying to get the most out of it.

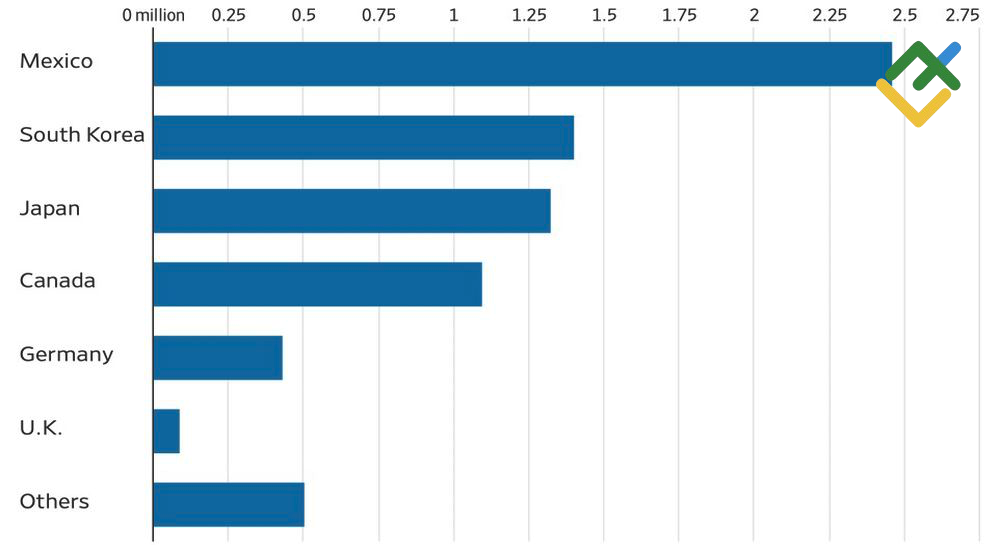

Major Vehicle Exporting Countries to US

Source: Wall Street Journal.

Germany is a major supplier of automobiles to the US market. Notably, Bloomberg has estimated a 0.5% contraction in its economy due to the 25% tariffs. However, experts at the popular media outlet have predicted that without these tariffs, German GDP would grow by 0.2% in 2025 and 1.1% in 2026. The question remains whether the recession will persist for a third consecutive year. Notably, these projections do not account for the fiscal stimulus measures introduced by Friedrich Merz. According to Deutsche Bank, Berlin received €1 trillion in fiscal stimulus, which it must now use responsibly.

Meanwhile, fiscal stimulus will mitigate the impact of trade wars, which, in the context of a slowing US economy, will allow the EURUSD pair to post gains. Alternatively, it could lead to a period of medium-term consolidation for the major currency pair.

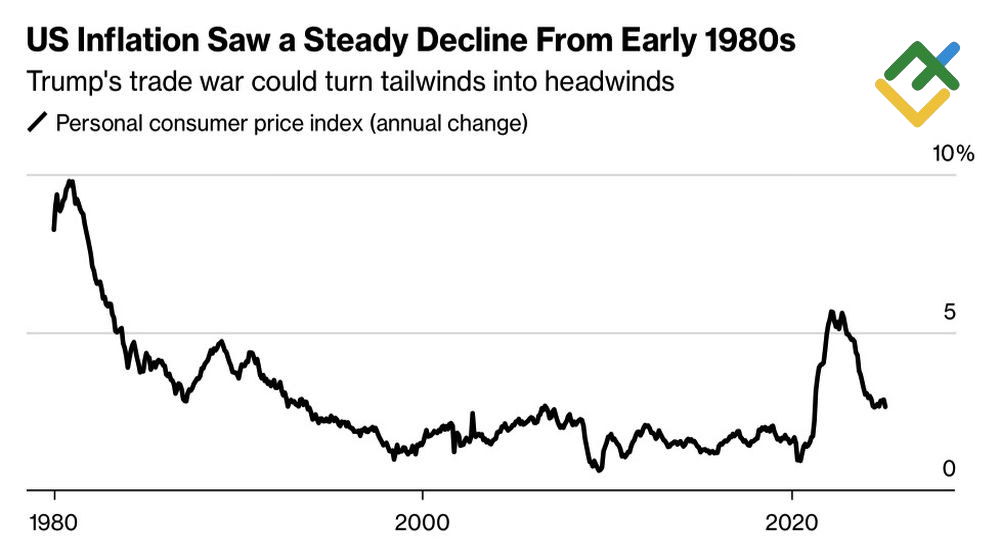

The US, on the other hand, is likely to face a strong headwind from its protectionist policies. Morgan Stanley anticipates an 11–12% increase in car prices. Despite President Trump’s warnings to manufacturers not to raise car prices, the president’s hands are tied in this regard. One might wonder whether social media posts expressing displeasure would be an effective course of action. According to Boston Fed President Susan Collins, tariffs will inevitably lead to inflation.

US Inflation Change

Source: Bloomberg.

Against this backdrop, the Fed will not have the capacity to provide a lifeline to the struggling economy by reducing the federal funds rate, and investors will likely continue to sell the US dollar, labeling it a “toxic currency.”

Weekly EURUSD Trading Plan

The strategy of purchasing the EURUSD pair at the market price assumed opening long positions in the range of 1.0735–1.0755. The growth of the main currency pair’s quotes above 1.082 will set the stage for opening more long positions. While these trades may appear rather risky at the moment, such market context often presents lucrative opportunities due to the inherent volatility.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.