Another batch of disappointing US data, combined with reduced political risks in France, has had a profound impact on the EURUSD pair, leading to a significant strengthening. However, the Trump factor remains a key player. Let’s delve into these topics and make a trading plan.

Weekly US dollar fundamental forecast

No matter how much the Fed says it is in no hurry to cut rates, it will have to do so sooner or later. The latest US statistics suggest sooner rather than later. Disappointing data raised the odds of monetary expansion starting in September from 63% to 73%, lowered the yields of US Treasuries, and allowed the S&P 500 to hit its 33rd record high in 2024. Against this backdrop, EURUSD quotes soared, and bulls took advantage of it.

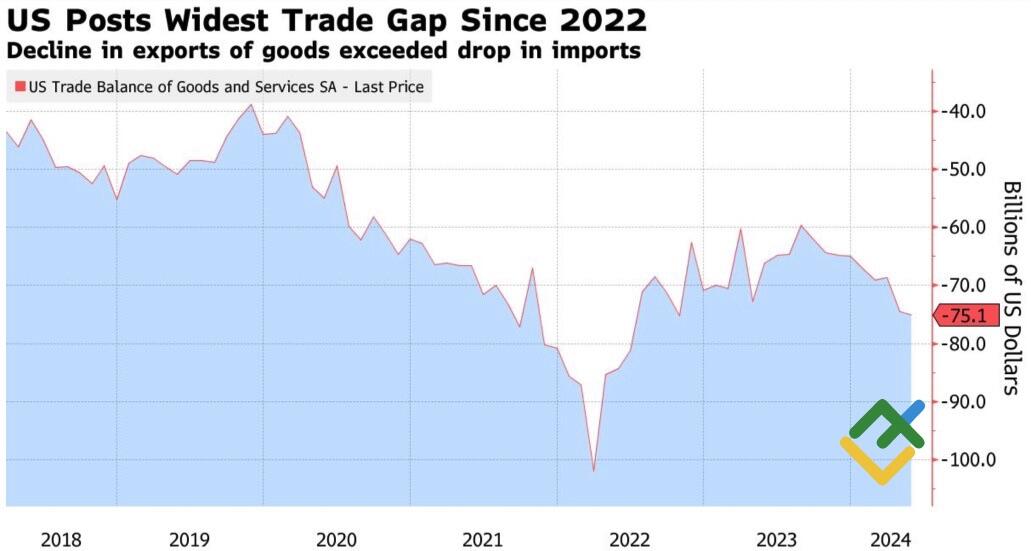

Disappointing statistics on private sector employment from ADP and an increase in unemployment claims for the 9th week indicate the cooling of the labor market. The US services PMI slowing at the fastest pace in 4 years and the foreign trade deficit widening to the highest level since 2022 prove that the cracks in the building of the US economy are getting bigger. The Fed will be forced to act, and the central bank is gradually preparing investors for this.

US trade balance

Source: Bloomberg.

In the June FOMC meeting minutes, several officials noted that monetary policy should be prepared to respond to economic weakness. Some of the Fed’s governors believe that high immigration creates imbalances in the market when the growth of unemployment goes hand in hand with high employment. Non-farm payrolls statistics may be inflated.

Such rhetoric further fuels investors’ interest in the June US labor market report and makes it clear that the Fed is on the verge of signaling the start of monetary policy easing in September. This will create a pessimistic scenario for EURUSD bears.

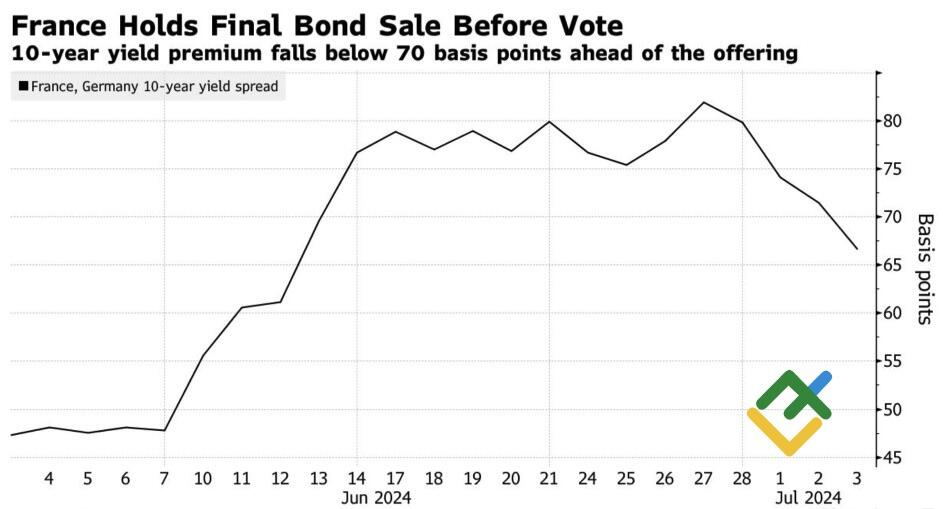

All the more so as the political drama in France has come to its climax. The yield differential between French and German bonds declined after the New Popular Front and Renaissance coalition emerged. The parties withdrew their third-place candidates in the first round to prevent an absolute right-wing majority in the new parliament. If the National Rally does not get it, getting Frexit and parity in EURUSD will be impossible.

France-Germany bond yield spread

Source: Bloomberg.

Does that mean the US dollar threw in the towel? Many doubt that the greenback is giving up. The Trump factor persists. After the debate, the Republican’s lead over an ailing Joe Biden reached 6 points and increased to 48% against 42%. A Wall Street Journal poll has not seen such a gap since 2021. Meanwhile, 80% of respondents say the incumbent is too old to run for another term, 63% are dissatisfied with his performance, and less than 40% approve of his policies on inflation, immigration, the economy, and the White House administration.

Weekly EURUSD trading plan

Thus, wherever the major currency pair is moving, you can be sure of one thing. It will follow that direction for a long time. The weakening of monetary policy will push EURUSD quotes higher, but the Trump factor will hamper a bullish trend. However, as long as the euro trades above 1.076, nothing threatens current long trades, so you can keep your positions open.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.