History shows that the US dollar has consistently demonstrated resilience during periods of economic downturns, but recent developments in US policy, characterized by the targeting of allies, have led to a decline in investor confidence. The sell-off in US stocks is exacerbating the situation. Will the EURUSD pair surge to 1.15? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Having inherited a strong economy, Trump is destroying it.

- The US dollar is facing a crisis of confidence.

- Falling US stock indices are boosting the euro.

- Short trades can be considered if the EURUSD pair fails to settle above 1.1055.

Daily US Dollar Fundamental Forecast

Fear, frustration, recession, and even a crisis of confidence are among the reasons cited by investors for the decline of the US dollar in response to Donald Trump’s sweeping tariffs. The market is buying the EURUSD pair, anticipating that the United States’ growth in import duties, reaching unprecedented levels since the 20th century, will primarily damage its economy and currency.

Tariffs, by their very nature, are expected to accelerate inflation in the country imposing them. Concurrently, the nation responsible for the tariffs experiences a deceleration in economic growth. This could heighten the risk of recession in the eurozone, which, combined with a massive influx of cheap Chinese goods into its markets, would force the ECB to cut interest rates aggressively. Conversely, the Fed will likely maintain its current rate policy, anticipating a potential surge in the PCE to 4.5%.

The EURUSD pair has showcased a significant surge, driven by concerns over the state of the US economy. Donald Trump inherited a country whose 2.8% GDP growth rate was the envy of the rest of the world, unemployment was low, and the Fed had almost tamed inflation. Investors expected that the 47th president would improve the situation. However, the prevailing sentiment among investors is that the current administration will only damage the US economy. A recent survey by Bloomberg revealed that 92% of its experts believe the risks of a recession have increased.

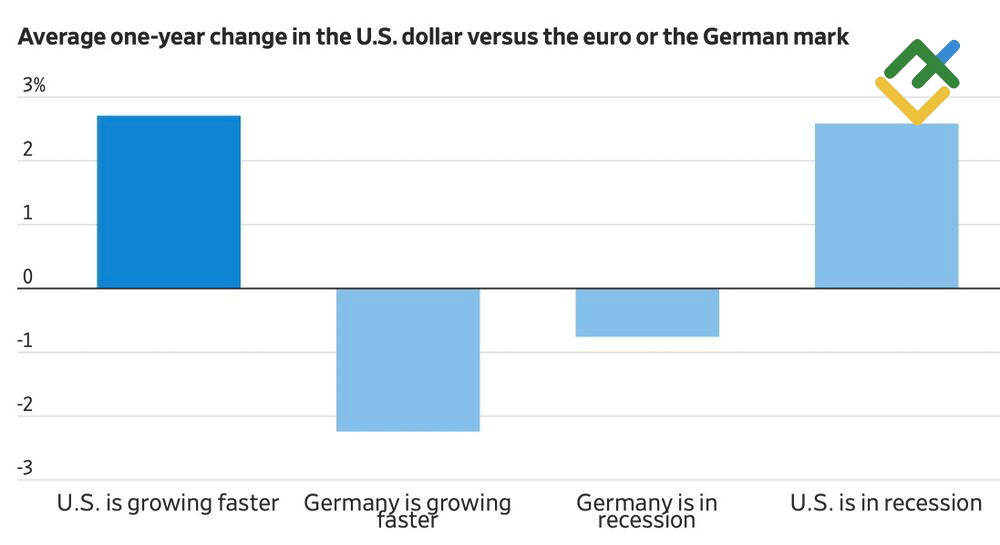

EURUSD Performance in Different Scenarios

Source: Wall Street Journal.

History demonstrates that the US dollar is resilient in periods of economic downturn. In such conditions, it is used as a safe-haven asset. However, in the current economic climate, the greenback is not the primary safe haven. According to Deutsche Bank, the Japanese yen has emerged as the leading safe-haven asset, as the US dollar has lost credibility due to President Donald Trump’s unconventional policies, which have led to the formation of strategic alliances and the emergence of new competitors.

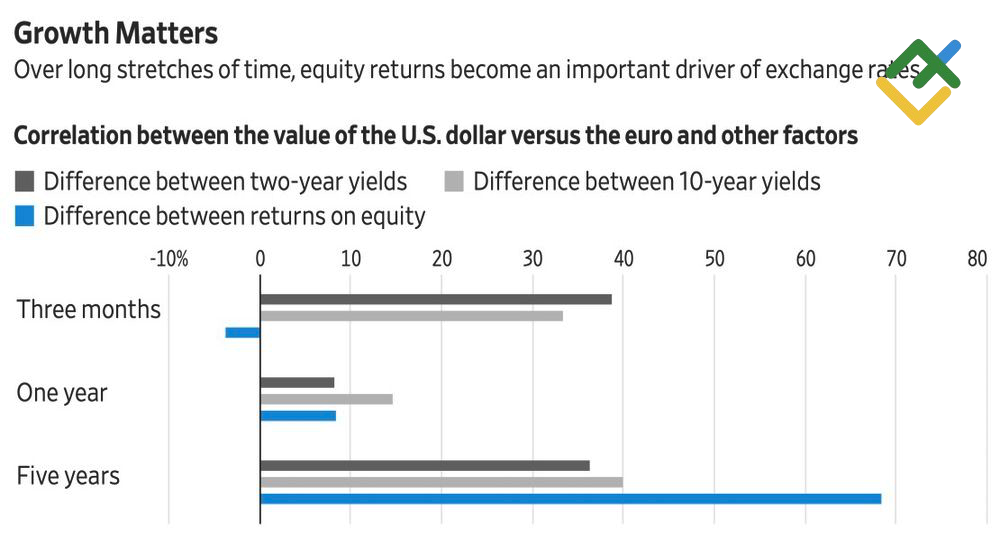

In the near term, investors are seeking to capitalize on yield differentials, leading to net purchases of the EURUSD pair in response to the narrowing of the spread between US and German bond rates. However, capital flows from the US equity market to Europe are a more significant driver of the major currency pair’s rally in the long term.

EURUSD Performance Against Different Factors

Source: Wall Street Journal.

Citi forecasts that the EURUSD pair will rise to 1.15 in 2025, as the US tariffs will cause US stock indices to plunge by 11%, while their European counterparts will lose only 5%.

The future trajectory of the major currency pair is, in my opinion, contingent on the actions of the EU. If the European Union navigates negotiations with the White House and implements new fiscal stimulus packages to support its economy, the currency pair will likely soar to 1.15. Conversely, a global trade war with the United States could potentially trigger a decline in EURUSD quotes.

Daily EURUSD Trading Plan

Notably, as the US economy continues to demonstrate resilience, the S&P 500 index has more chances to rebound from the bottom and support the greenback. In light of this, the robust US employment data for March may force traders to lock in profits on their long positions on the EURUSD pair and start selling the euro if the quotes fail to remain above 1.1055.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.