Donald Trump’s policies will likely accelerate inflation in the US and dampen economic growth outside the country. As a result, the Fed will likely have to adopt a more cautious approach with regard to interest rate cuts, whereas the ECB may stick to a more proactive stance. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major takeaways

- Fiscal stimulus and trade duties will fuel inflation in the US.

- The Fed will be forced to pause rate cuts.

- Markets are speculating about the parity of the euro to the US dollar.

- Consider short trades on the EURUSD, adding them to the ones opened at 1.0905.

Weekly US dollar fundamental forecast

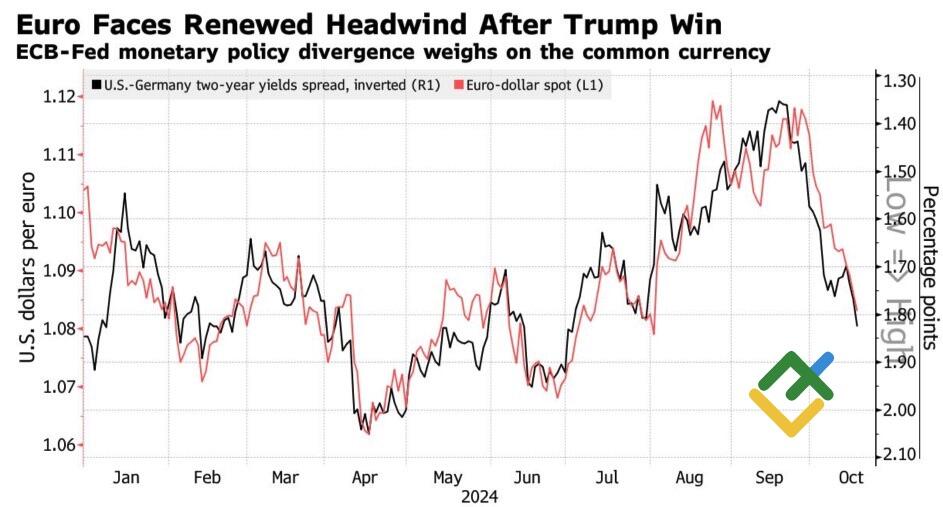

Donald Trump is returning to the White House with his slogan “America First.” This policy shift is expected to result in slower economic growth abroad and accelerated inflation in the US. These factors are likely to drive up debt rates in the US and lower rates abroad. The widening spread between US and German bond yields has caused the EURUSD pair to post its worst daily performance since 2016.

EURUSD performance and US-Germany bond yield spread

Source: Bloomberg.

In response to Donald Trump’s victory, the US stock market saw a $1.62 trillion increase in capitalization, marking the fifth-highest surge in history. In contrast, Germany is preparing for the most challenging phase in its economic postwar history. The export-oriented eurozone, led by Germany, is vulnerable to the potential impact of Republican policies, including increased tariffs on imports and reduced military aid to allies.

In contrast, US stock indices count on economic growth driven by deregulation and fiscal stimulus. Donald Trump has pledged to reduce the corporate tax rate from 21% to 15% for corporations that make their products in the US. During his first term, the implementation of fiscal stimulus measures ballooned the budget deficit from 3.1% to 4.6% of GDP. The current figure is 5.5%.

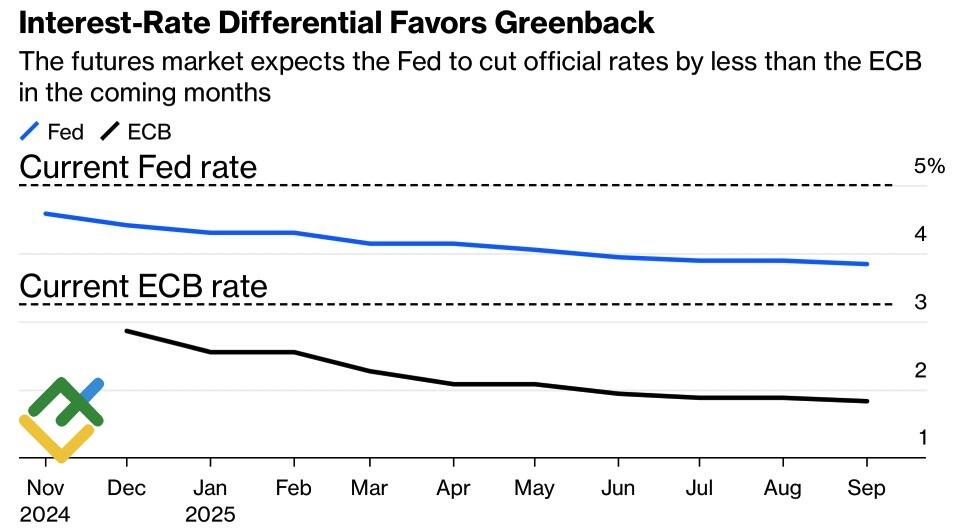

The tax cuts, anti-immigration policies, and tariff hikes are causing inflation to accelerate, which will force the Fed to slow the pace of monetary easing and support the US dollar. Following Donald Trump’s election victory, the derivatives market reduced the projected scope of monetary expansion from 110 bps to 100 bps by September 2025.

Market expectations on Fed and ECB rates

Source: Bloomberg.

The situation in Europe is quite different. Before Donald Trump, the economy is struggling to maintain stability. Imposing high tariffs and reducing military support will only exacerbate the situation. The ECB will be compelled to reduce interest rates at a more accelerated pace than previously expected. As anticipated, the derivatives market has increased the projected amount of monetary stimulus from 116 bp to 130 bp by September 2025. Lombard Odier estimates that the ultimate deposit rate will be 1.5% or even below 1% compared to the current federal funds rate of 3.5%.

If the ECB accelerates monetary easing and the Fed slows it down, the EURUSD pair will not be immune to these changes. Mizuho Financial Group and Deutsche Bank expect the pair to plunge to 1.03 and 1.05, respectively. Meanwhile, ING projects the pair to slump to 1.05. By the end of next year, the euro could fall to one US dollar. ABN Amro Bank and Manulife also believe parity is a distinct possibility.

Weekly EURUSD trading plan

Should the EURUSD pair’s decline accelerate, it may provide the Fed with a signal that a pause in monetary expansion is appropriate in December. Therefore, short positions initiated at 1.0905 can be kept open. One may form more short trades on upward pullbacks.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.