The political crisis in France is slowing down economies and contributing to capital flight from Europe. Capital is fleeing to North America, causing EURUSD quotes to fall. Let’s discuss this topic and make a trading plan.

Weekly US dollar fundamental forecast

The US economy remains resilient, but the case for a Fed rate cut is unclear if statistics do not deteriorate. Meanwhile, central banks in other countries are easing monetary policy. If we add political uncertainty, it is hard to understand why the US dollar should weaken in 2024. This is the opinion of Societe Generale, and it is hard to disagree. The EURUSD pair tested the key support level at 1.067 for the third time in the last dozen days, beyond which is the abyss.

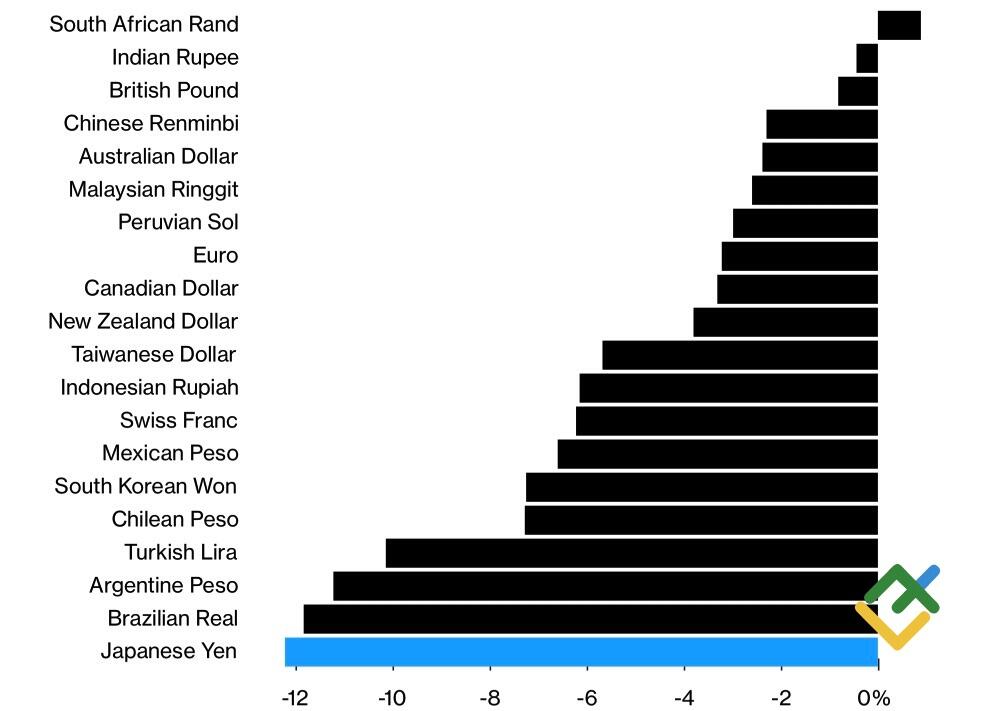

The greenback had been predicted to suffer a miserable fate since the end of 2023. However, the unexpected acceleration of inflation in the US in the first quarter and then the unwillingness of the Federal Reserve to cut rates forced investors to change their minds. The US dollar is a clear leader on Forex, and it should thank the Fed for that. The longer the central bank keeps the cost of borrowing at 5.5%, the higher the attractiveness of US assets. The faster capital flows to North America, the higher the USD index climbs.

World’s major currencies against US dollar in 2024

Source: Bloomberg.

Indeed, US stock indices are poised to post another impressive quarterly result, and the Treasury is easily finding buyers for $70 billion worth of bonds. Political uncertainty is adding fuel to the EURUSD plummet.

Elections in Mexico and India have already put pressure on the peso and rupee, with France and the UK following. The euro and the pound are struggling as political uncertainty is starting to take its toll on the economy. European purchasing managers indices, German business climate, and consumer confidence indices disappointed. This proves that the political crisis in the currency bloc’s largest economy has the potential to derail its fragile recovery.

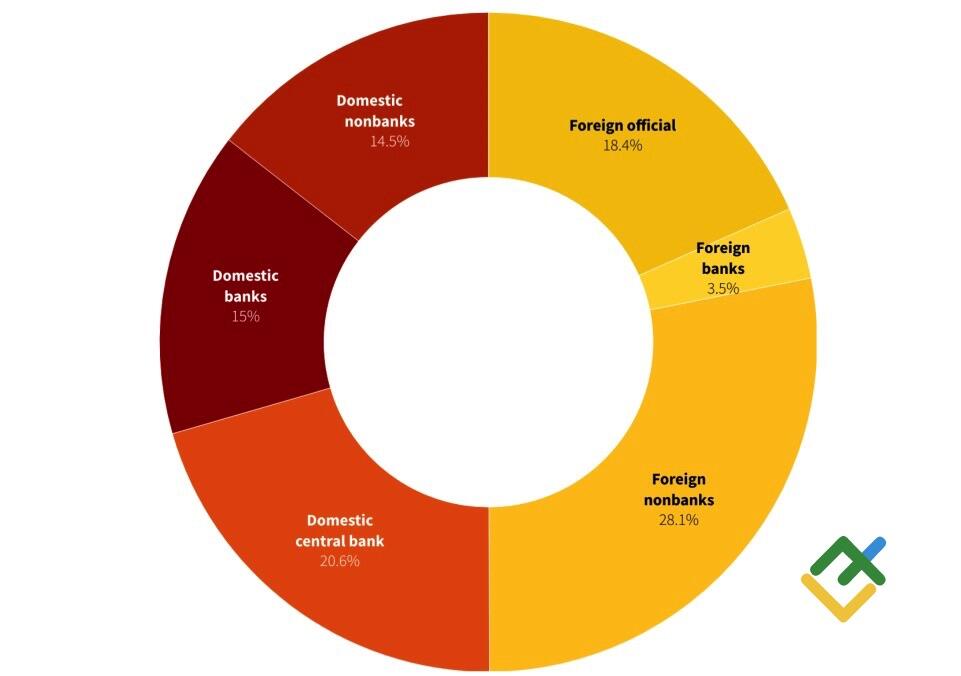

The same is true for the French debt market, 50% of which is owned by non-residents. That is more than Italy’s 28%, 30% in the US, 40% in Spain, and 45% in Germany. Foreign investors do not count to three. They withdraw their money quickly, and it is incredibly difficult to attract them back.

French bond market breakdown

Source: Reuters.

Investors have serious doubts no matter how much the National Rally tries to calm the markets with its willingness to adhere to EU rules. Will the right-wingers leading in the polls be able to fulfill their election promises, and where will they get the money to do so? Coupled with a slowing economy and an extremely difficult recovery in France’s bond market, the euro risks sagging in the long term.

Weekly EURUSD trading plan

The greenback can receive support from Donald Trump’s protectionist policy if he is elected, which is destructive for the whole world. The first debate between the former and current US presidents will take place on June 27 and may affect the greenback no less than the releases of GDP and durable goods orders data. Breaking through the support of 1.067, the EURUSD pair may face increased risks of falling to 1.055. Against this backdrop, short trades can be considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.