Earlier, the Fed did everything possible to beat inflation; now, it has to think about how not to drive the economy into recession. A shift in outlook is a reason to cut rates. Let’s discuss this topic and make a trading plan for the EURUSD.

The article covers the following subjects:

Highlights and key points

- EURUSD reacted incorrectly to Jerome Powell’s speech.

- The Fed is focusing on the employment sector.

- The labor market is cooling down.

- CPI slowdown will accelerate the risks of the euro rallying to $1.09 and $1.0935.

Weekly US dollar fundamental forecast

Markets did not want to scrutinize Jerome Powell’s speech. Ahead of the Fed chief’s testimony before the Senate Banking Committee, asset managers have been traders building up bullish bond wagers since July 1, betting on a federal funds rate cut signal in Powell’s remarks. As a result, the EURUSD is trading almost unchanged, although the Fed chair actually gave a signal in his speech.

The Fed chairman made a cautious but important shift, bringing the central bank closer to loosening monetary policy. He said that employment was not a source of widespread inflationary pressure for the economy. In fact, FOMC officials have long cited an overheated labor market as the main risk to lower prices. Interestingly, a little later, US Treasury Secretary Janet Yellen repeated Jerome Powell’s statement almost verbatim. She believes that the labor market no longer fuels US inflation.

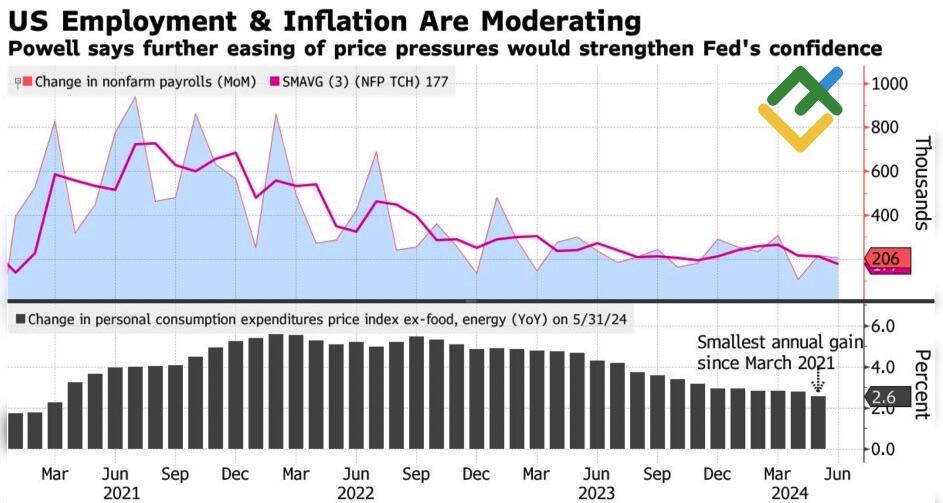

US Employment and inflation change

Source: Bloomberg.

The Fed Chairman noted the bilateral risks and recognized that there was a cooling in employment. Indeed, the three-month average growth rate is 177K, the worst since the pandemic. Unemployment rose for the third consecutive month and wage growth slowed to 3.9%, the lowest since 2021.

While previously the Fed did everything it could to reduce inflation, it is now forced to compromise. If it drags its feet on cutting rates, it could cool the economy so much that it plunges into recession. On the other hand, if monetary policy is loosened too soon, high inflation could return. Nevertheless, Jerome Powell’s words that higher prices are not the only risk the Fed faces should be seen as a shift in the Fed’s stance. The central bank’s focus is on the labor market. It has done a good job, and it is time to start cutting rates.

The market considered Jerome Powell’s speech not dovish enough. He refused to send any signals about the timing of the Fed’s future actions and said that the central bank needed more data. Investor frustration culminated in the closing of long positions on US Treasuries, pushing their yields higher. The odds of the monetary expansion starting in September fell to 73% from 78%. The US dollar stood still instead of falling.

Weekly EURUSD trading plan

Traders decided to wait for June’s CPI data. Only the progress in disinflation can inspire EURUSD bulls. At the same time, a breakthrough of resistance at 1.0835 will be a reason to build up long positions. If this happens, the pair may quickly climb to the targets at 1.09 and 1.0935. On the contrary, its fall below 1.0805 will make bulls feel worried.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.