The question on many investors’ minds is how low the EURUSD pair can fall before the release of the US labor market and inflation data for July. The answer to this question will depend on the Trump trade, which has taken the Fed’s monetary policy to the back burner. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Investors are paying no heed to bets on the Fed’s monetary expansion.

- Markets are focused on the negatives of tariffs for the global economy.

- They fear chaos in the market caused by Donald Trump.

- The 1.083 level is the line in the sand for the EURUSD pair.

Weekly US dollar fundamental forecast

The key issue for investors in July will be the interplay between the Federal Reserve’s monetary policy and the so-called “Trump-victory trades.” In the first half of the month, the slowdown in the US labor market and inflation increased the likelihood of a federal funds rate cut in September to 100% from 73%. This led to a EURUSD rally. However, in the second half of the month, the situation reversed. Investors are expressing significant concern about the policies of the presidential nominee, which is contributing to a surge in the value of the US dollar.

UBS estimates that a 60% tariff on Chinese imports would result in a 2.5% reduction in China’s GDP growth. The bank anticipates economic expansion of 4.6% and 4.3% for the 2025-2026 period. However, in the event of a trade war, the forecast would decline to less than 3%. The eurozone is likely to be one of the main victims of the current situation, given its ongoing difficulties with China. Meanwhile, a modest reduction in PBoC rates is unlikely to have a significant impact.

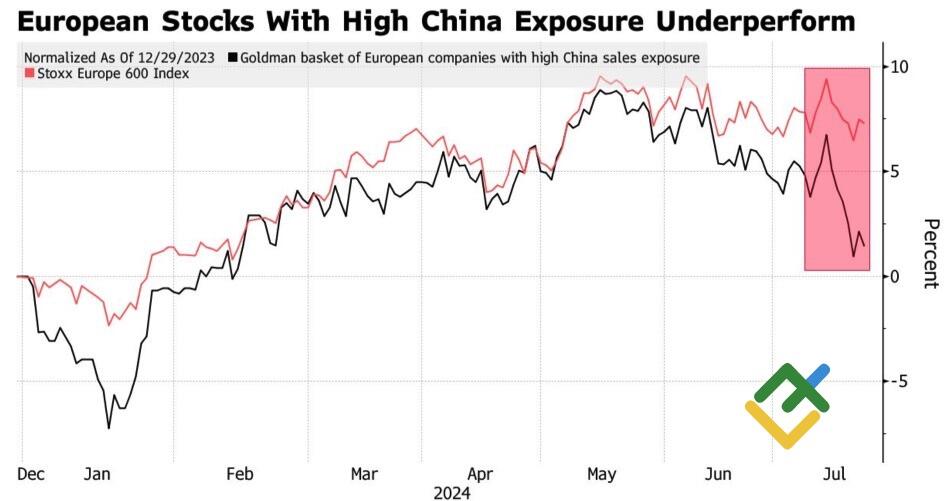

Major European brands report declining sales in China. Goldman Sachs recommends selling their shares, and so far this strategy has been effective. The deterioration in corporate results could be followed by mass layoffs and production cuts, which would have a negative impact on the currency bloc’s GDP.

EuroStoxx and stock basket of companies exporting to China

Source: Bloomberg.

Germany, which accounts for half of the EU’s exports to China, will suffer the most from Donald Trump’s new tariffs. The slowdown in Asia’s largest economy is a long-term drag, but until recently, it has been offset by accelerating US GDP growth. Now that the US economy is also slowing, Europe’s economic rebound is at risk.

The euro is the currency of the optimists, and the US dollar is the currency of the pessimists. Not surprisingly, the EURUSD pair is heading lower amid the S&P 500 correction, the potential slowdown in global GDP due to renewed trade wars, and the chaos that Donald Trump could bring. What else can we call the political pressure on the Fed to cut rates aggressively and return to the practice of currency intervention as part of a weak US dollar policy?

No wonder investors forgot about the Fed and focused on the Trump trade, which came too early in the markets. Donald Trump’s victory in the presidential debate and the assassination attempt on him boosted the presidential race and forced the EURUSD pair to react.

Weekly EURUSD trading plan

Most likely, the Trump trade will persist until November, and investors will turn to the Fed at the beginning of the month after the release of employment and inflation data. The EURUSD pair will likely face a roller coaster ride, and its trajectory depends on its ability to stay above 1.083. If it does, there will be a chance to resume the bullish trend. If not, one may sell the euro until July’s release of the US Nonfarm Payrolls.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.