The market received a clear signal that the Federal Reserve’s monetary expansion cycle would begin in September, and it started buying the EURUSD pair against the European Central Bank’s actions. However, the central banks’ decisions will depend on the incoming data. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The Fed is not satisfied with the labor market cooling.

- The US regulator intends to adjust monetary policy.

- Its decisions will depend on the incoming data.

- Traders will likely lock in profits on EURUSD long trades if the pair slumps below 1.118.

Weekly US dollar fundamental forecast

The market is responding to information that aligns with its expectations. Jerome Powell’s remarks at the Jackson Hole symposium, in which he expressed the Fed’s confidence in a cooling labor market and indicated a willingness to adjust monetary policy in response, were well received. It was precisely the type of transparent indication that investors were anticipating regarding the commencement of the monetary expansion cycle in September. Consequently, stock indices increased, Treasury yields decreased, and the US dollar posted the largest daily losses since November.

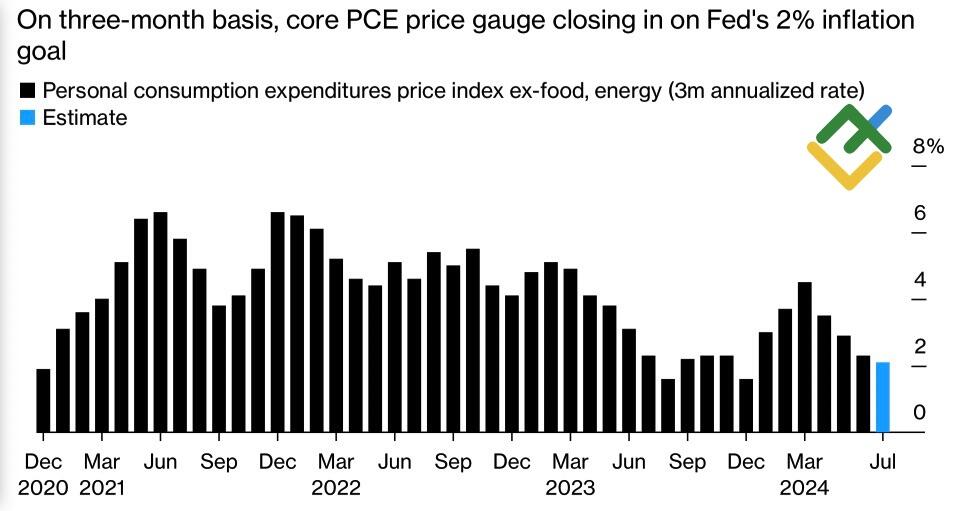

The derivatives market has increased the implied scope of the monetary expansion in 2024 from 93 bp to 103 bp. Concurrently, the release of data on personal consumption price indexes for July should finally persuade analysts that the federal funds rate at 5.5% has already outlived its usefulness. According to Bloomberg experts’ forecasts, the three-month PCE will approach the 2% target.

Market expectations on Fed rate

Source: Bloomberg.

US inflation change

Source: Bloomberg.

The issue is that there is a lack of clarity regarding the precise sequence of events. Not even the Fed can provide a definitive answer. It appears that both the central bank and the markets have overlooked the fact that monetary policy is data-dependent. Furthermore, the Fed’s confidence in a cooling labor market may be as misguided as its assurances about the temporary nature of inflation in 2021.

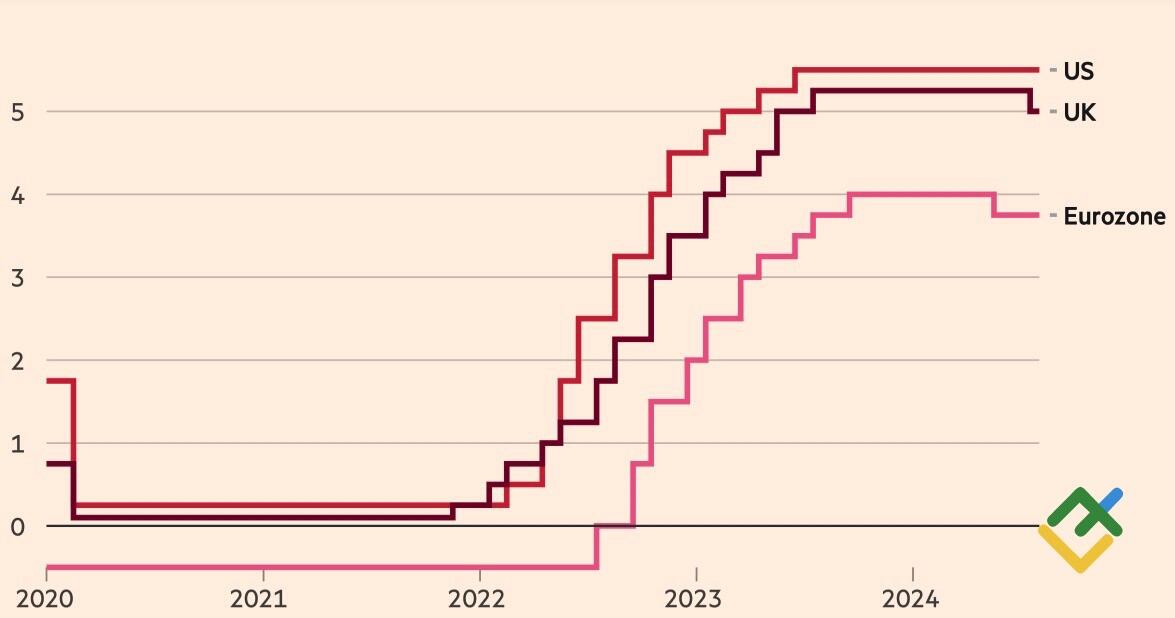

Investors saw as a clear signal from Jerome Powell speaking in Jackson Hole that the monetary easing cycle would begin in September, as well as a differentiating factor in comparison to other central banks. Bank of England Governor Andrew Bailey stated that it is premature to declare victory over inflation. ECB Chief Economist Philip Lane has stressed that the battle against elevated prices is still ongoing and that a return to the 2% target is not a certainty.

As anticipated, the derivatives market projects that the Bank of England and the European Central Bank will reduce rates by a maximum of 50 basis points in 2024, twice as low as anticipated by the Fed. This provides a straightforward explanation for the performance of the pound and euro, but it raises the question of whether Europe and North America will actually take such different approaches to monetary policy. It is possible that the Old World is adopting a more cautious stance because it has already initiated a loosening of monetary policy. In contrast, the Fed is eager to implement its plans.

Major central banks’ key rates

Source: Financial Times.

It was not previously anticipated that the first cut in the Fed Funds rate would be followed by a second and third at every FOMC meeting. Furthermore, at one of the meetings, cuts of 50 bps were expected to be made at once. This would require a significant cooling of the US economy, which is unlikely to occur. Against this backdrop, there is no cause for concern about a recession in the US.

Weekly EURUSD trading plan

The Federal Reserve’s decisions will be influenced by data. Initially, labor market statistics will be a primary focus. It is likely that speculators will engage in profit-taking on long positions on the EURUSD pair, with the main currency pair undergoing consolidation until early September. If the pair fails to consolidate above 1.118, a sell signal will be generated.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.