The United States’ protectionist measures are intended to address the foreign trade deficit. While this objective may be achieved, it is unlikely to be accomplished through implementing tariffs. Europe and China will likely focus on domestic demand, reducing exports. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- Trade wars will slow the US economy.

- Speculators are bearish on the dollar for the first time since the US election day.

- The US will impose less tariffs than expected on April 2.

- Robust EU PMI data will allow traders to open short trades with a target of 1.0715.

Weekly US Dollar Fundamental Forecast

President Donald Trump’s administration is pursuing policies aimed at revitalizing the US economy, with April 2 designated as a “liberating day.” This announcement follows Trump’s proposal of substantial reciprocal tariffs. The US President believes that these measures will encourage other countries to contribute to the US economy. This approach is expected to hinder the economic growth of these countries and, in turn, contribute to America’s prosperity. However, this scenario has prompted a shift in market sentiment, with experts revising downwards their forecasts for the US GDP and speculators divesting from the greenback, notching a net bearish stance on the dollar for the first time since the November election.

Speculative Positions on US Dollar

Source: Bloomberg.

In January, Wall Street Journal experts anticipated the US economy to expand by 2.2% in 2025, but now they expect only 1%–1.5%. At its March meeting, the Fed lowered its forecast from 2.1% to 1.7%. Before the central bank, the OECD and Fitch Rating also revised their forecasts downward.

The White House is not ruling out short-term pain either. It wants to use tariffs to balance the trade deficit. This goal can be achieved, but not by the method Donald Trump is counting on. The US president’s actions have prompted Europe and China to open the fiscal taps to offset the negative effects of trade wars by stimulating domestic demand. Beijing is even looking at Japan’s experience in the 1980s when Tokyo began restricting its exports to the US and dodged higher tariffs.

Instead of making America great again while ditching other countries, Donald Trump risks slower growth in the US economy and faster growth in competing regions. Against this backdrop, the EURUSD pair’s downtrend has reversed, and the outlook for the major currency pair has turned bullish. However, every trend needs corrections from time to time.

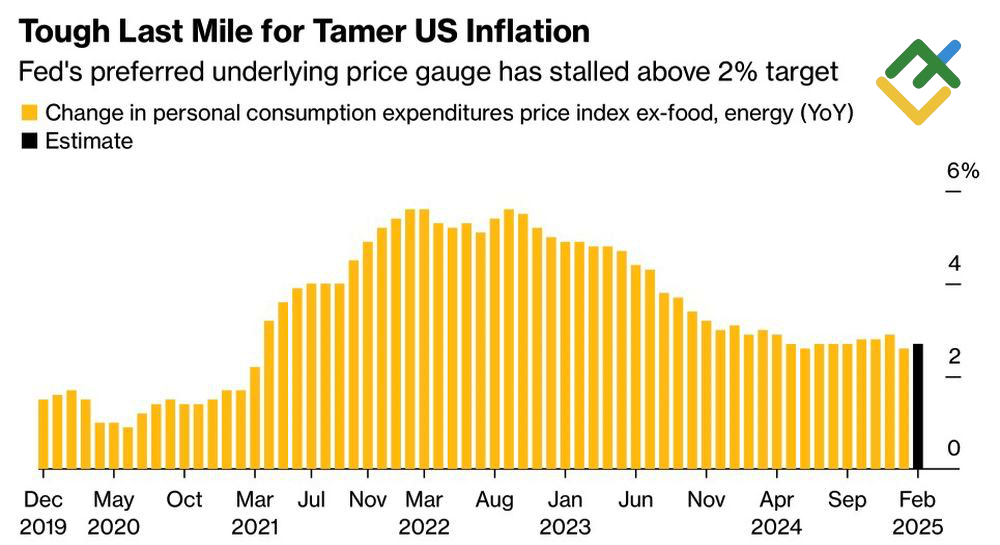

The reason for locking in profits on long trades will not be the Personal Consumption Expenditures data, the Fed’s preferred inflation indicator. It will most likely be “Liberation Day in America” on April 2, when the White House will announce a list of reciprocal tariffs.

US Inflation Rate

Source: Bloomberg.

At the same time, the situation may not be as gloomy as it seems at first glance. According to Bloomberg, the import tariffs will not affect every country, but only the so-called “dirty 15” countries that impose significant tariffs on goods and services from the US or with which the United States has a foreign trade deficit.

Weekly EURUSD Trading Plan

Less severe tariffs could lead to a more limited correction in the EURUSD pair. However, the correction is looming, and a strong EU PMI for March could set the stage for opening short positions on price increases with a target of 1.0715. When everyone is buying, there is a great opportunity to sell.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.