The political turmoil in France has been contained, forcing EURUSD bears to flee the battlefield against the approaching start of the federal funds rate cut cycle. Let’s delve into this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The political risks in France have been reduced.

- The ECB is in no hurry to cut rates.

- Weak US employment data will drag the US dollar down.

- The EURUSD pair may reach 1.0865 and 1.09.

Weekly US dollar fundamental forecast

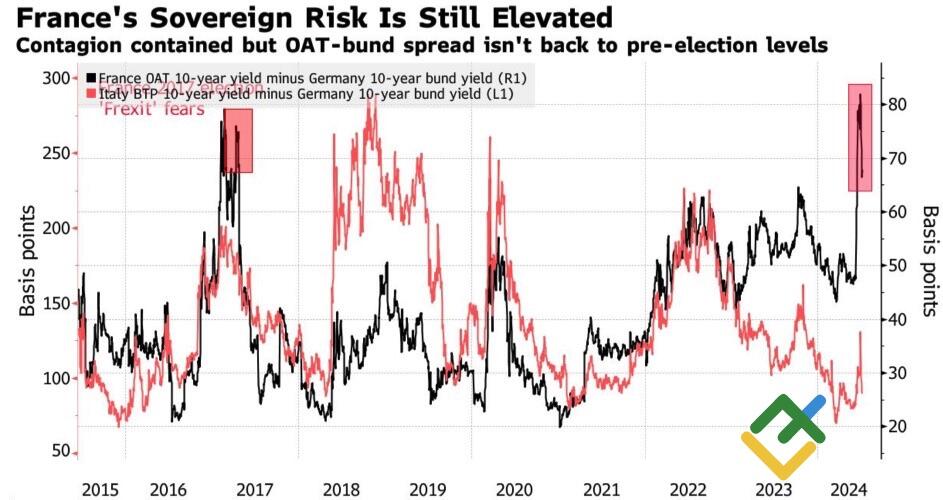

The show is over. Polls show that the right-wing will win between 190 and 250 of the 577 seats in the National Assembly, European bond yield spreads are narrowing, and investors are rushing to buy heavily discounted French assets. The worst for EURUSD bulls is left behind. Moreover, the ECB is in no hurry to soften monetary policy, and disappointing statistics on the US may force the Fed to lower rates.

European bond yield spreads

Source: Bloomberg.

The New Popular Front and Renaissance, which joined forces to keep the right wing out of power, seem to have succeeded. Suppose the National Rally does not get an absolute majority of 289 seats in the new parliament. In that case, it is not worth counting on increased public spending and confrontation with the EU, as well as on Frexit or parity in EURUSD.

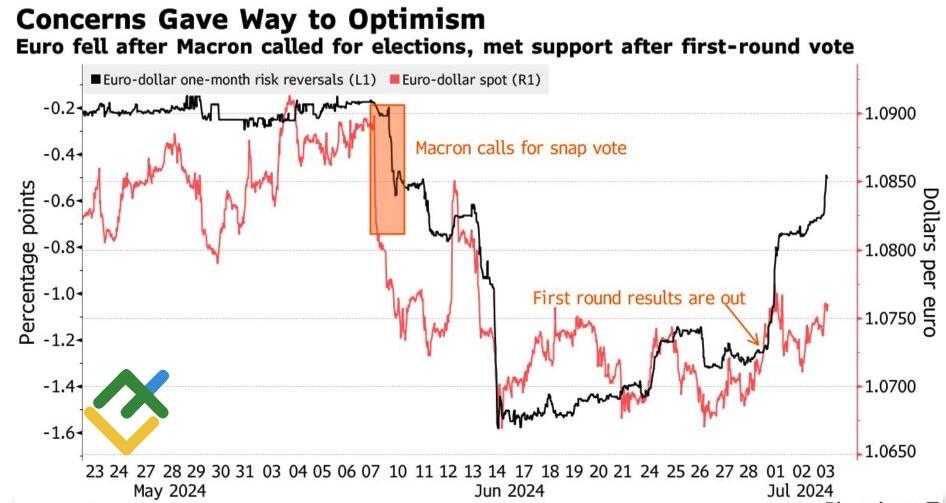

Morgan Stanley warns that it is too early for the euro to celebrate. The bank predicts that the EU currency will fall to 1.05 amid the weakness of the eurozone economy and political risks in Germany. The derivatives market demonstrates that good times for EURUSD bears are over after the first round of the French elections. The risk reversal in the single currency elevated sharply.

EURUSD price and risk reversal

Source: Bloomberg.

The minutes of the June ECB meeting were a pleasant surprise for the euro. Following the results of that meeting Christine Lagarde noted that only one member of the Governing Council out of 26 voted in favor of keeping the deposit rate at 4%, the rest decided to reduce it to 3.75%. It turned out that such a verdict was possible with preconditions. Officials are concerned about the still high rate of wage growth and the persistence of inflation, especially in the services sector.

It was also noted that new headwinds for the disinflationary process could arise from geopolitical fragmentation, supply chain disruptions, rising commodity prices, and protectionism. As a result, low goods inflation will not reliably offset high services prices.

Such rhetoric rules out a cut in the deposit rate in July and casts doubt on the possibility of two additional acts of monetary expansion by the ECB in 2024. In contrast, after disappointing data on ADP private sector employment, jobless claims, trade balance, and US services PMI, derivatives are certain of a cut in the federal funds rate to 5% from 5.5% this year.

If June’s non-farm payroll data disappoints, traders will have nothing to do but sell the greenback since wages are at risk of rising by 3.9%, the slowest pace in three years.

Weekly EURUSD trading plan

The disappointing US labor market data will allow the EURUSD pair to continue rallying towards 1.0865 and 1.09. Against this backdrop, one can open more long trades, adding them to the ones initiated in the area of 1.071-1.072.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.