The first presidential debate in the US destroyed the euro’s potential rally. The risks of Donald Trump returning to power were higher than the deterioration of the US economy and Frexit. Let’s discuss this topic and make a trading plan for EURUSD.

Weekly US dollar fundamental forecast

About a week ago, I noted that EURUSD was stuck between a hammer and a hard place. The hammer of French politics was about to smash the euro, while the major currency pair was facing a slowing US economy, which created a roadblock on the pair’s way down to lows. Since then, talks about Frexit have subsided, and the disappointing statistics coming from the US made it possible to argue that the euro had finally hit the bottom. However, someone knocked from below, and this someone was Donald Trump.

The US presidential election resembles a surreal narrative. A criminal takes one side, and the other side is taken by a man who looks like he is pumped up with performance-enhancing drugs. The first debates showed the advantage of Donald Trump, whose protectionist policy can destroy supply chains and lead to a new upsurge in inflation. This will force the Fed to keep the rate at 5.5% and speculate about resuming the cycle of monetary restriction. This is great news for EURUSD bears.

As I noted yesterday, the presidential debate can overshadow Frexit and US statistics. The fastest decline in orders for US business equipment since the beginning of the year and the rise in unemployment claims to their peak since 2021 confirmed a slowdown in the US economy. However, Donald Trump outdid all of these factors.

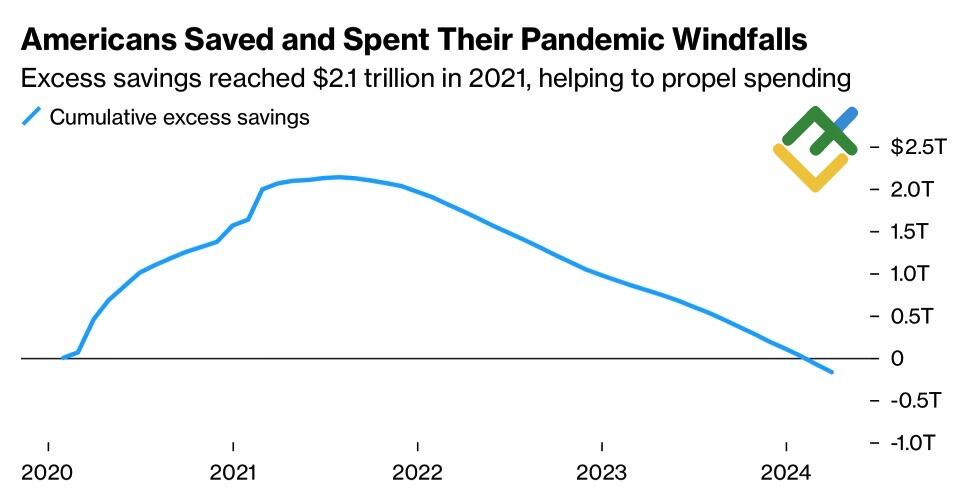

The political risks of the Republican’s return to power overshadowed the complete depletion of Americans’ excess savings, making them dependent on wages and increasing the risks of a sharp deterioration in the labor market and Raphael Bostic’s dovish speech. According to the president of the Federal Reserve Bank of Atlanta, the federal funds rate cut will be the first in a series of steps by the Fed to loosen monetary policy.

US households’ excess savings

Source: Bloomberg.

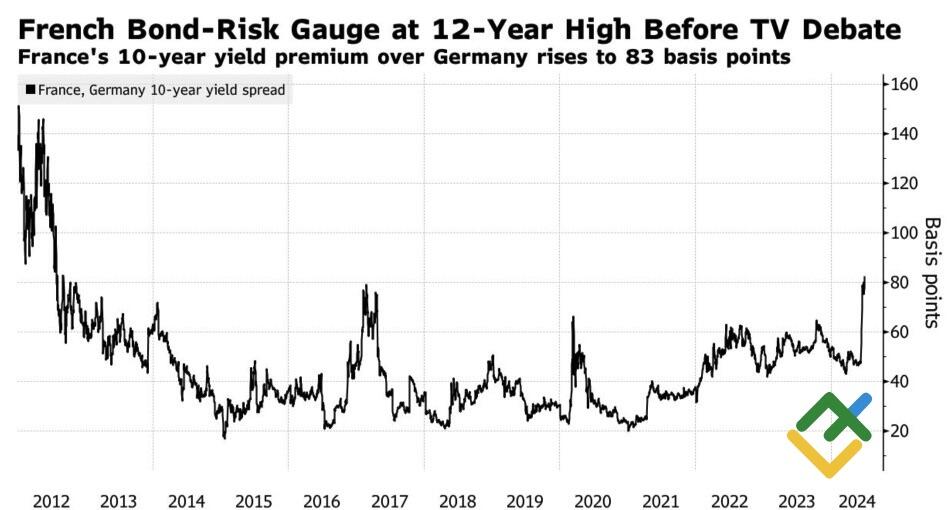

The widening spread between French and German bonds fueled the EURUSD decline. With the first round of the National Assembly elections just around the corner, investors are worried whether the right-wing will be able to secure an absolute majority. Fears were also heightened after Berlin announced that Germany would oppose ECB intervention in the debt market to support French bonds.

France-Germany bond yield differential

Source: Bloomberg.

Political tensions will likely decrease, removing the threat of Frexit weighing on the euro. Sooner or later, worsening US statistics will force the Fed to consider lowering the federal funds rate. Against these factors, the EURUSD has hit the bottom, and it is the right time to consider long trades. However, one cannot rule out Donald Trump taking office, trade wars, and a potential pullback in the clearly overbought S&P 500 index. These factors assume that the pair may plummet deeper.

Weekly EURUSD trading plan

Considering all the above, both long and short trades can be an option. If the pair breaks through the support level of 1.0665, short trades can be opened on the EURUSD pair. At the same time, if the price soars above the resistance at 1.0725, long trades can be initiated.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.