Markets should take their time to adapt to the new developments resulting from Trump’s words and actions. The future of the EURUSD pair will largely hinge on the president-elect’s stance. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Strong US statistics have made the Forex market focus on parity in the EURUSD again.

- A roller coaster ride for the US dollar will be the hallmark of the year.

- The chances that the Fed will not cut rates in 2025 increased to 17%.

- Short positions can be opened if the euro fails to increase above 1.0375.

Weekly US Dollar Fundamental Forecast

The recent speculation surrounding Donald Trump’s tariffs has prompted a dead cat bounce in the EURUSD pair, a term used in technical analysis to denote a short-lived recovery of asset prices from a prolonged decline. Since the cat is dead anyway, things quickly return to normal. As the global community awaits Donald Trump’s inauguration, the currency market anticipates a parity between the euro and the US dollar. According to Bank of New York Mellon and Mizuho, this parity is expected to be achieved as early as January.

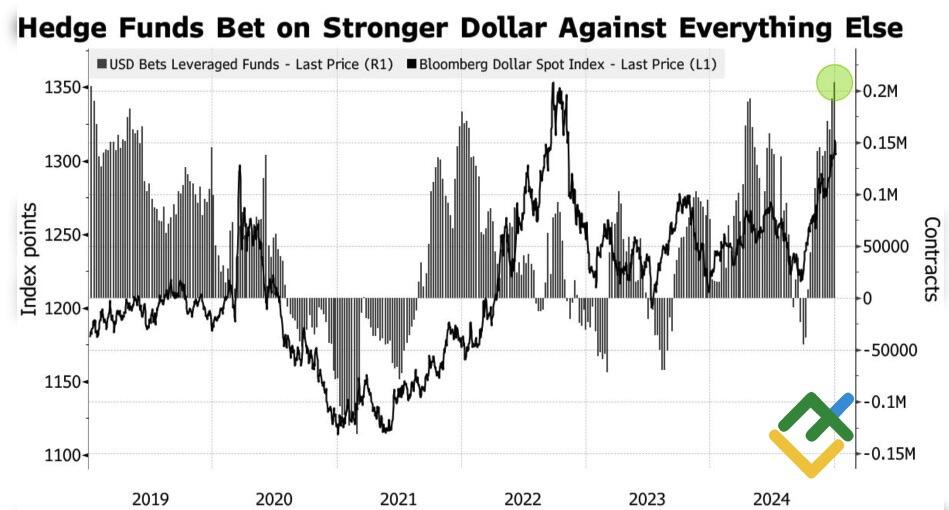

The new year’s beginning and the subsequent months will likely influence the trajectory of the EURUSD exchange rate. The significant fluctuations in the major currency pair during the past year have served as a preview of the potential challenges and opportunities that traders may encounter in 2025. The market expresses confidence in the strength of the US dollar, but a slight uncertainty emerges, as bullish positions on the greenback are shrinking, leading to a surge in EURUSD quotes. Meanwhile, hedge funds have accumulated net-long positions on the US currency to the highest level since January 2019. However, they are taking a risk, and as soon as market conditions change, they may opt to exit the market.

USD Index Performance and Hedge Funds’ Positions on US Dollar

Source: Bloomberg.

It is likely that significant fluctuations in the EURUSD exchange rate will be a prevalent feature this year. Investors should prepare for sharp ups and downs and anticipate the potential impact of Donald Trump’s erratic economic policies. Just as oil exhibited significant fluctuations at the turn of the 20th and 21st centuries, driven by geopolitical developments and Saudi Arabian policies, the greenback’s value will be influenced by the economic initiatives and policies of the US president.

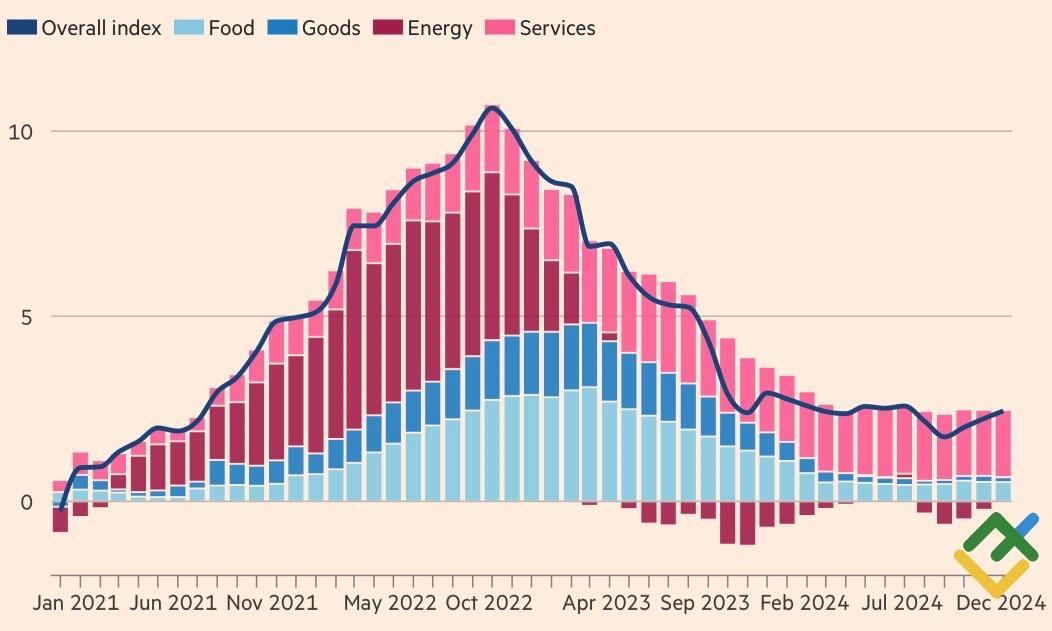

However, without a deterioration in the macroeconomic statistics of the United States and an improvement in the eurozone, the EURUSD pair will resume trading in a downtrend. The recent acceleration of European inflation from 2.2% to 2.4% in December, marking the third consecutive month of increase, may offer some hope to those who favor the euro. However, robust JOLTs Job Openings data and the improved ISM Services Business Activity index underscore the resilience of the US economy. This suggests that the major currency pair may still reach parity. The derivatives market indicates a 40% likelihood of parity being achieved in the first quarter.

EU Inflation and Its Main Components

Source: Financial Times.

Robust macroeconomic data from the US has led to increased bond yields and a decline in the stock market. The derivatives market has revised its projections, indicating a 17% likelihood that the Fed will not cut interest rates in 2025, up from 12% at the end of 2024. The markets are anticipating one act of monetary expansion by July, with a 35% probability of a second move before the end of the year. Prior to the release of data on job openings and business activity in the services sector, the figure stood at 70%.

Weekly EURUSD Trading Plan

However, only the US employment report for December will be able to dot the i’s and cross the t’s, allowing us to consider the duration of the Fed’s pause in its monetary easing cycle. As for now, short trades can be opened as long as EURUSD bulls are too weak to push the quotes back above 1.0375.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.