Trade wars are inevitable. However, the response from other countries to US tariffs varies. Some countries are retaliating, while others are exercising caution. The upcoming “American Liberation Day” is causing concern in the EURUSD market. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Everyone will suffer from US tariffs, including the US.

- The lower the duties, the lower the risks of a recession in the US.

- The reaction of countries to import duties varies.

- Long trades on the EURUSD pair can be opened on a rebound from 1.0715.

Weekly US Dollar Fundamental Forecast

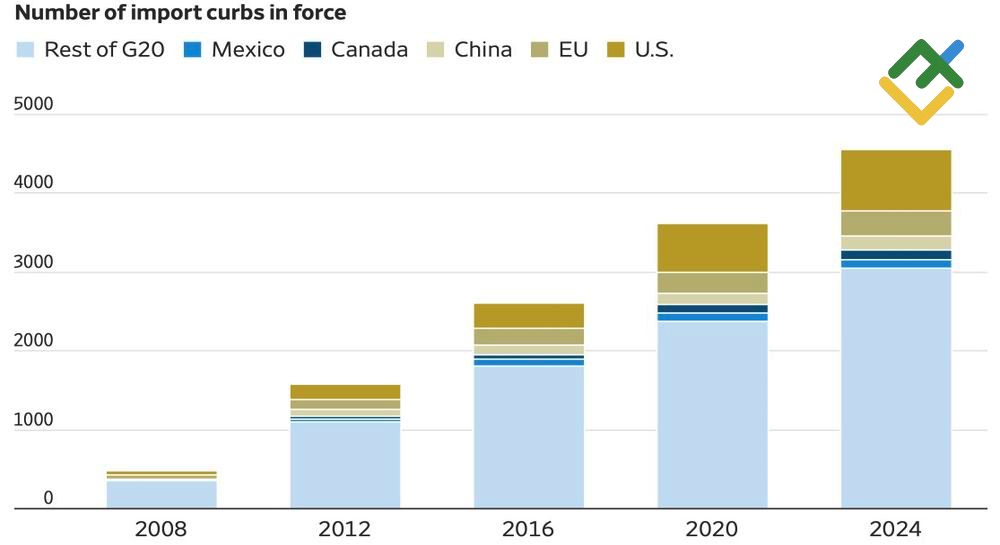

The unfortunate aspect of Donald Trump’s economic policies is that they have turned the game of positive-sum economics into a game in which everyone loses. This perspective is shared by Bank of France Governor François Villeroy de Galhau, and it is difficult to disagree with his assessment. According to Global Trade Alert, as of March 1, G20 countries had implemented 4,650 import restrictions, including tariffs, anti-dumping duties, and quotas. This represents a 75% increase since 2016 and a tenfold increase compared to 2008. It is reasonable to conclude that the global economy is facing significant challenges.

G20 Import Restrictions

Source: Wall Street Journal.

In light of these developments, the euro, as a pro-cyclical currency, should have experienced significant losses. In fact, the US dollar is on track for its worst monthly performance in over a year. Investors are currently engaged in a fundamental rethinking of their strategies. In early 2025, investors anticipated an acceleration in US GDP due to fiscal stimulus and a slowdown in the rest of the world due to tariffs. However, by spring, these expectations shifted significantly.

Import duties were perceived as part of Donald Trump’s negotiating strategy. These duties were intended to provide the US with additional benefits and to decelerate, but not to pose a threat to the rest of the global economy. However, it has become evident that tariffs are not a trivial matter. The White House has identified a $2.5 trillion budget deficit resulting from $4.5 trillion in tax cuts and $2 trillion in budget cuts, and the implementation of tariffs is intended to address this issue. Meanwhile, many have reservations about the efficacy of this approach.

Other countries are compelled to respond. However, the manner in which they will do so remains uncertain. Some countries and regions, such as the European Union and Canada, are considering a response based on a principle of reciprocity, anticipating a reaction from Washington that aligns with this approach. At the same time, Mexico adopts a more measured approach, preferring to assess the situation before taking any action. They believe that it is more prudent to wait and see what happens next.

However, reacting without a well-thought-out plan will not resolve the underlying issues. Tariffs are expected to decelerate global economic growth. Notably, EURUSD bulls seem to be benefiting more from these tariffs than their opponents. Investors’ predictions of a slowdown in European data have not materialized. The front-loading of US imports and the fiscal stimulus from Friedrich Merz have improved the figures. On the other hand, concerns over a US recession have led to a depreciation of the US dollar.

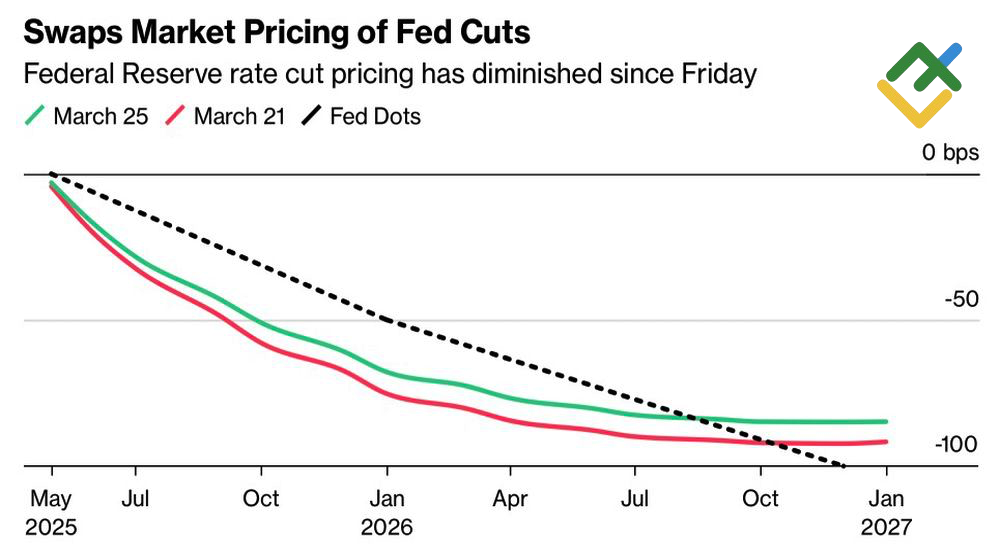

Market Expectations on Fed Cuts

Source: Bloomberg.

As a result, an alternative narrative to that of early 2025 emerged in the market: the lower the White House’s duties, the lower the likelihood of a recession. This suggests that the Fed may not have as strong of an incentive to reduce the federal funds rate. Against this backdrop, the US dollar will likely strengthen. Therefore, the EURUSD pair fell from the 5-month highs reached at the end of March.

Weekly EURUSD Trading Plan

While symbolic tariffs on April 2 will temporarily strengthen the US dollar, large-scale tariffs will also temporarily hit the euro. As a result, as the EURUSD pair declines, it becomes more advantageous to purchase it. Long positions can be initiated on a rebound from 1.0715.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.