The TTM Squeeze technical indicator and its underlying trading system originate from a fairly simple idea: the market spends about 80% of its time in consolidation and only 20% actively trending in a particular direction. This concept works across all time frames. John Carter, the founder of Simpler Trading, developed an effective trading system around this idea, achieving an impressive 1,270% annualized return in 2020. Sounds intriguing, doesn’t it?

Once you grasp how the TTM Squeeze works, you will definitely want to add it to your trading arsenal. In fact, you may even create a unique trading system centered around this indicator. This article reviews several trading strategies involving the TTM Squeeze technical indicator.

The article covers the following subjects:

Major Takeaways

-

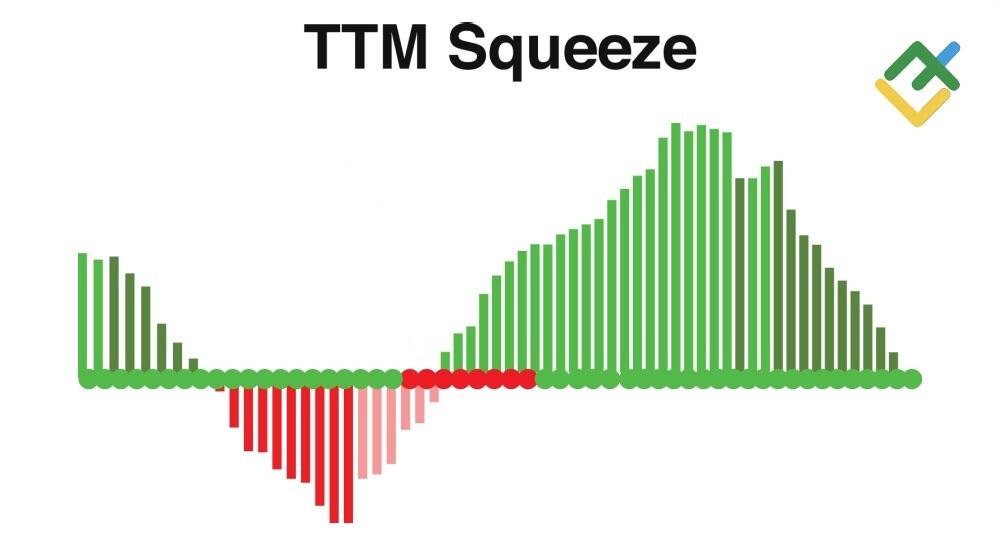

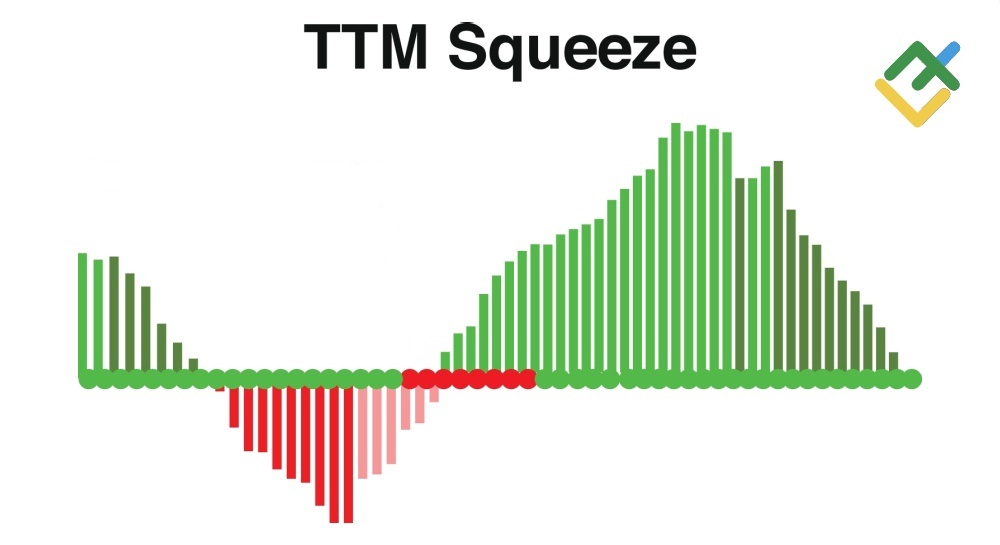

The TTM Squeeze is a powerful volatility and momentum indicator. It reveals low volatility periods and points to a potential breakout. The indicator helps to determine the moments when the price is preparing for an impulse movement after the consolidation phase.

-

Main indicator components. The TTM Squeeze indicator also combines Bollinger Bands, Keltner Channels, and a momentum oscillator to assess market conditions.

-

Benefits of the advanced version. The TTM Squeeze Pro indicator adds compression gradations, marked by black, orange, and red dots, to help you more accurately evaluate market performance.

-

Application in trading strategies. The indicator is universal and can be used both in intraday and longer-term trading strategies. Besides, it can be effectively combined with other technical analysis tools, such as the RSI and the supertrend indicator.

-

The key rule is to trade only in the trend direction, avoid opening trades during a reversal phase, and strictly adhere to risk management principles.

-

Entry and exit signals. Red dots on the TTM Squeeze indicate a strong market compression, signaling a possible breakout, while confirmation by candlesticks and other indicators and trading tools increases entry accuracy.

-

Market adaptability. The TTM Squeeze works on various time frames, from 15-minute to daily ones, and can be used in any market.

-

Additional recommendations. Trading volumes and volatility analysis enhance the efficiency of the indicator. Moreover, combining it with other technical analysis tools will reduce the number of false signals.

What Is the TTM Squeeze Indicator?

This article explains how the original system created by John Carter works and describes an improved trading system that uses the TTM Squeeze, a trading indicator for identifying market entry points. The TTM Squeeze indicator measures both volatility and momentum, helping traders spot periods of low volatility and prepare for a possible price breakout from the consolidation phase, offering trading opportunities based on price compression and its potential movement.

Components of the TTM Squeeze Indicator

The TTM Squeeze incorporates three technical analysis indicators and actually looks like a series of dots plotted in a line, as highlighted by the green arrow on the screenshot. The rest of the chart shows the indicators that determine the positioning of these dots.

The TTM Squeeze indicator’s main components:

-

Bollinger Bands shows price deviation from the average, indicated by the light blue lines on the chart. When the bands are within the Keltner Channel lines, it signals low volatility and potential market compression. When the bands expand outside the Keltner Channel, the market begins to trend.

-

Keltner Channels, represented by the dark blue lines, reflect the average volatility of the asset. When Bollinger Bands and Keltner Channels squeeze, it indicates lower volatility and potential momentum ahead.

- Momentum is a histogram at the bottom of the chart that shows the rate at which prices change in either direction. It reveals the expected direction of the move when the squeeze fires. Although his momentum oscillator can indicate an oversold and overbought condition, relying on the RSI indicator is more effective for this purpose.

Combining Bollinger Bands and Keltner Channels

This colorful indicator may seem complicated, but it is quite straightforward. If Bollinger Bands are located inside the Keltner Channel, it signals a tight trading range when the market consolidates and volatility decreases. This state of low volatility often precedes a powerful impulse and a price breakout.

Actually, Bollinger Bands and Keltner channels are very similar. The only difference lies in the way how their channel lines are calculated. Keltner Channels use the average true range, while the Bollinger Bands indicator utilizes the standard deviation, which allows Keltner Channels to react a bit faster. This is why combining these two very similar indicators allows you to achieve high accuracy in determining the market compression ratio and identifying potential trading opportunities. Given that the market tends to be flat about 80% of the time while waiting for a breakout, it is crucial to be aware of the current market phase.

What truly sets this indicator apart from most popular technical tools is its unique ability to signal halts in price movement. This capability allows you to incorporate the TTM Squeeze indicator into almost any trading strategy. Besides, it lets you assess the current market phase and identify potential trade entry points.

How to Read the TTM Squeeze Indicator?

Let’s analyze a refined version of this indicator called TTM Squeeze Pro, which is available on the MetaTrader 5 platform for free.

The advanced version operates similarly. However, it introduces an extra parameter: the degree of price squeeze. The closer Bollinger Bands and Keltner Channels converge, the more severe the compression is considered to be. This range is represented by colors, starting from black dots, indicating weak compression (the initial stage of consolidation), orange ones, and red dots, signaling strong compression. Meanwhile, green dots indicate the squeeze is off.

The basic indicator displays only red dots, signifying strong price compression, while the updated version introduces black and orange dots, representing a wider range of price compression and allowing you to prepare for a potential breakout.

Let’s review the example on the chart below:

Initially, the price fluctuates dramatically, followed by a period of consolidation (indicated by the purple arrows on the screenshot). During this phase, the indicator displays a sequence of black, then red, and orange circles, suggesting an opportune moment for traders to enter positions and potentially gain substantial profits. After that, a strong impulse occurs, and the price breaks through the resistance line. Notably, there is an initial false breakdown in the opposite direction before this movement.

TTM Squeeze Indicator vs. Popular Technical Indicators

The TTM Squeeze is difficult to compare with other popular technical indicators. As a rule, most of them are aimed at detecting pivot points, which is a highly profitable strategy, or showing the direction of market movement, so-called trend indicators. However, very few indicators can accurately monitor price compression during flat phases as the TTM Squeeze does.

Momentum and Bollinger Bands can obviously serve this purpose, but the TTM Squeeze indicator already incorporates them. Therefore, it stands out as the best combination of popular indicators that traders can use for pinpointing price consolidation zones ahead of an impulsive movement.

Since the TTM Squeeze indicator also contains all the tools for determining consolidation periods, it is difficult for any single indicator to compete with it.

This advantage opens up exciting possibilities for combining it with other indicators. By incorporating trend technical indicators, such as the moving average or the supertrend line, into your trading system, you can significantly boost its effectiveness. Understanding the trend direction always makes the indicator signals more valid.

How to Use the TTM Squeeze Indicator

The indicator shows you when the price is squeezed in a particular range. As a trader, you should discern whether positions are accumulating in anticipation of an upcoming breakout or capital is flowing out and further declines are expected.

Generally, the TTM Squeeze helps traders determine the potential price movement direction. If the momentum histogram is rising, the price will likely grow. Conversely, if the momentum is falling, the asset may drop.

Based on these parameters, you can create numerous profitable strategies with the TTM Squeeze Pro indicator. Let’s look at some of these strategies, ranging from straightforward to more intricate.

The TTM Squeeze Strategy in Action

The TTM Squeeze chart indicator is highly versatile, and it is impossible to cover all potential ways of using it within a single explanation. However, traders can incorporate it into their own strategies. This guide will reveal the original purpose of the TTM Squeeze momentum indicator and how it can be combined with other tools effectively.

TTM Squeeze Basic Application

-

Identify the prevailing trend on higher time frames. Trading in the trend’s direction significantly enhances this strategy’s success rate, as aligning with the market flow is generally more effective than going against it.

-

If the market is in a consolidation phase, marked by the TTM Squeeze indicator dots, and you believe that the asset will continue to climb, consider long trades. Conversely, if the market is expected to decline, consider short trades.

-

Switch to a lower time frame, as the TTM Squeeze indicator is designed for day trading. The screenshot below shows the 15-minute time frame. Let’s wait until at least 3–5 dots appear on the chart.

-

Open a trade during the compression period, set a stop-loss order just below the consolidation level, and place a take-profit order depending on the volatility of an asset. Stick to at least a 1/2 risk/reward ratio. The screenshot illustrates the British American Tobacco stock price chart. Its price is quite volatile, allowing us to use even a 1/3 ratio.

-

For additional confirmation, wait for the candle to close above or below the Keltner Channel. Once it exits the compression, you can enter the market. Although there will be fewer entry points, they will be more reliable.

- An alternative exit strategy is to skip setting a take-profit order and instead trail a stop-loss order slightly below the Bollinger Bands. This way, you can capture the entire price movement while still protecting your trades against reversals.

Nevertheless, you should backtest every strategy on each specific instrument to find the most effective approach.

Using this risk management strategy will allow you to generate profit even with a success rate of just 45%. This means that even if you incur losses on 55 trades out of 100 and only have 45 successful ones, you can remain a profitable trader by following this risk management strategy.

Even such a simple strategy will allow you to trade profitably. However, if you aim to improve your results, consider incorporating additional indicators to confirm the signals.

Enhanced Strategy Involving Additional Indicators

Let’s analyze a more complex trading strategy based on the TTM Squeeze Pro indicator. For this purpose, it is effective to incorporate the Triple Screen trading strategy, developed by Dr. Alexander Elder, and additional technical indicators.

Step 1: Define Global and Short-Term Trends

Alexander Elder’s approach involves assessing global and short-term trends on higher time frames and trading in the direction of the global trend while using pullbacks on the short-term trend. This strategy has proven quite effective. However, instead of focusing on pullbacks within the short-term trend, it may be more beneficial to evaluate asset overbought or oversold conditions, as the TTM Squeeze indicator is better suited for trend-following rather than pinpointing reversals.

For this purpose, you need to:

-

Determine the dominant trend. Look at the chart on a time frame that is at least four times higher than the one you are working with. For example, if you trade on a 15-minute time frame, you can identify the short-term trend on a 4-hour or even daily chart.

-

Detect the smaller trend. If the global trend is identified on the daily chart, it is better to look for the short-term trend on the 4-hour time frame.

Step 2: Use the Supertrend Indicator

Elder suggested utilizing moving averages to spot trends. However, there is a more modern and convenient indicator for identifying trends.

This indicator is called supertrend in MetaTrader 5.

Add it to your chart, and you will see areas similar to the Ichimoku Clouds, showing the direction of market movement.

-

Green area: bullish trend, long trades only.

- Red area: bearish trend, short trades only.

Step 3: Identify Market Overbought Condition Using the RSI

Since the oversold condition is quite common on the hourly time frame and often leads to significant price moves, closely monitor RSI readings on the same time frame used to identify the overall trend. In the example, we use the 4-hour chart with the customized RSI Divergence indicator.

The RSI Divergence indicator resembles a standard RSI, but it also shows price divergences and hidden divergences. By the way, these divergences can be traded independently.

Now, look at the market overheating on the 4-hour chart. For instance, if the supertrend indicator shows a red area, suggesting a bearish trend, you should additionally check the RSI value, which should be above 30. If the RSI reading falls below 30, the trade may carry significant risk. In this case, consider applying an additional risk factor or simply opting to bypass those signals.

If the supertrend indicator is in the green zone and you want to go long, the RSI value should be below 70.

Since the customized RSI additionally shows divergences, it is important to remain cautious, especially if the indicator shows a bullish signal (noted by a green underline at the bottom of the RSI) while considering short trades or a bearish signal (marked by a red underline at the top of the RSI) when entering long trades.

Given the market situation depicted on the chart, it is better to refrain from trading and look for another asset that offers a clearer and more reliable signal.

While this strategy may lead to fewer trades being opened, it will undoubtedly result in a higher success rate.

Step 4: Use the Supertrend Indicator to Set Stop-Loss Orders

Additionally, you can use the supertrend indicator to determine the optimal stop-loss level. The tool helps traders to estimate asset volatility. Thus, you can place a stop-loss order at a safe distance, considering the current market volatility. Just place a stop-loss order on the red or green line of the supertrend indicator.

Improved Strategy Trading Example

Let’s take a look at the British American Tobacco stock chart.

1. The 15-minute time frame reveals price compression, highlighted by over five red dots, signaling the first indication for action. In the classic TTM Squeeze strategy, the momentum histogram is declining (noted by the red arrow below), pointing to a potential price drop. The transition from a strong squeeze (red dots) to a weaker squeeze (the black dot, marked by the purple arrow) occurs as the price breaks below the Keltner Channels line (noted by the red arrow above). This breakout is accompanied by a noticeable surge in trading volume, which could suggest the release of significant news or reports, which serves as an additional confirmation to consider entering a trade.

2. Let’s switch to the daily time frame, the second screen in the Triple Screen trading strategy, to determine the short-term trend. The supertrend indicator shows a red area. Therefore, only short trades can be considered.

3. Move to the 4-hour time frame, the third screen, and check if the market is in the oversold condition. The RSI reading of 54 indicates that there are no such indications.

The current situation suggests that a short trade can be opened.

Let’s return to the 15-minute time frame, which is the first screen. The candle has closed below the Keltner Channels, and all the screens have been checked. After some time, the price has slightly retraced, and a supertrend line has appeared, offering a clear level for setting a stop-loss order. With the crosshair tool, The stop-loss order (noted by a red line) is calculated at 0.5% using the crosshair tool. Based on this, the take-profit level can be determined. It is advisable to set the take-profit order at least double the stop-loss order size. However, in this example, a 3:1 ratio is applied, resulting in a take-profit of 1.5% (marked by a green line). With everything in place, a trade can be finally opened (shown by the blue line).

-

A stop-loss order should be set near the supertrend indicator’s red line if it shows it. If it does not, you can set it just above the top, where the compression started.

-

A take-profit order is calculated based on the risk/reward ratio you are used to working with. In this case, a 1/3 ratio was applied.

A trade is finally open. The only thing left is to wait for the result and take a 1.50% profit!

Additional Tips and Recommendations

-

Utilize filters to confirm signals. Using additional indicators to confirm signals will help you eliminate false signals and increase the effectiveness of your strategy.

-

Pay attention to market volatility. During periods of high volatility, strategies based on price compression may perform less effectively. Therefore, it is essential to take into account the current volatility and adjust your strategies accordingly.

-

Monitor bulls and bears’ behavior. Analyzing trading volume and exploring market depth can provide valuable insights into market sentiment and help make informed decisions.

- Options trading. The TTM Squeeze strategy can be particularly effective when trading options, as they allow traders to capitalize on strong price movements that follow periods of low volatility.

Conclusion

The TTM Squeeze is a volatility and momentum indicator developed by John Carter. It not only helps you spot market compression but also serves as a valuable tool for grasping market movements. Besides, the indicator can be integrated into intricate strategies, giving traders an edge in a competitive landscape.

By utilizing the momentum histogram, you can assess both the direction and strength of a potential market movement. This deeper insight enables you to make more informed decisions, filter out signals, and pinpoint favorable entry and exit points in the market.

Remember that no indicator gives a 100% guarantee of success. Therefore, it is important to use a comprehensive approach by conducting technical and fundamental analyses and considering the peculiarities of financial markets.

TTM Squeeze Indicator FAQ

The TTM Squeeze method is a strategy designed to identify market entry points during periods of low volatility when major traders open their high-volume positions. This approach relies on a particular technical indicator, which is reputable among experienced traders.

There is no best time frame for this indicator because the market is fractal, and its phases repeat on all time frames. Regarding intraday trading, it is advisable to use a 15-minute or higher time frame. Lower time frames tend to give too many false signals.

The indicator’s red dots signal that the asset’s volatility is strongly decreased, the price is tightened in a small range, and an impulsive movement can be expected soon.

The only difference between the Pro and standard versions is that the Squeeze Pro indicator shows various levels of price compression. In addition to displaying a fully compressed phase marked by red dots, it also features two additional levels indicated by black and orange dots when the volatility reduces.

Black dots indicate a slight compression, meaning that the price is not yet squeezed. Nevertheless, volatility is already falling, and you should monitor the market situation.

If you trade with LiteFinance, you can find this indicator in MetaTrader 5. In case it is not available on your trading platform, you can access it for free on TradingView. Analyze the charts there and then open trades on your trading platform.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.