The decision to maintain the federal funds rate at 4.5% was anticipated. Hawkish signals from the FOMC might have supported EURUSD bears, but Jerome Powell’s comments led them to reconsider their stance. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The Fed has kept interest rates unchanged.

- Markets expect the Fed to pause in March and May.

- Trump’s protectionism puts pressure on the US economy.

- One can open long trades if the EURUSD pair rises above 1.0445.

Weekly US Dollar Fundamental Forecast

The Fed’s decision to keep interest rates unchanged was met with immediate criticism from the White House, reminiscent of a previous scenario during the initial presidential term of Donald Trump when Jerome Powell was viewed as a significant hurdle for the US economy. However, Trump’s efforts to shield the nation from Jerome Powell ultimately proved unsuccessful. The EURUSD exchange rate’s reaction to the outcomes of the January FOMC meeting indicates a shift in market sentiment.

The Fed’s attempts to adopt a more hawkish stance were met with skepticism. The derivatives market expectations of a rate cut were revised down from 28% to 20% in March and further from 47% to 41% in May, following the omission of the statement regarding the central bank’s progress toward its 2% inflation target. US Treasury yields and the US dollar reacted to Powell’s remarks, emphasizing that the statement should not be interpreted as a solid signal.

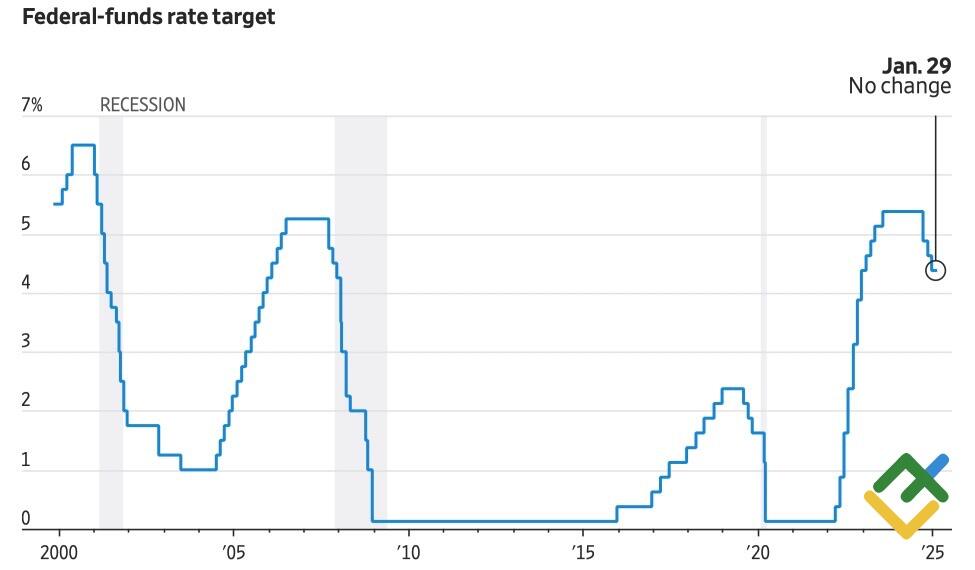

Fed Funds Rate Change

Source: Wall Street Journal.

The Fed has put its monetary cycle on pause due to a robust labor market and inflation that remains far from its target level. Interest rates have proven less detrimental to GDP growth than they were in September, when they began to decline. The Fed has also acknowledged the unpredictability of Donald Trump’s policies. According to Jerome Powell, the FOMC is awaiting the decisions that will be made. This approach is essential for providing a reliable assessment of the potential economic implications.

The consequences of these decisions are already becoming evident. In anticipation of tariffs, US companies have accelerated their imports. According to preliminary data, the foreign trade deficit surged by 18% in December, reaching a record $122 billion. This has prompted the Federal Reserve Bank of Atlanta to lower its estimate of GDP growth in the fourth quarter by 1% to 2.3%. In comparison, the consensus forecast of Bloomberg experts is 2.7%.

US Trade Balance

Source: Bloomberg.

It appears that President Trump’s unconventional policies are already exerting pressure on the US economy. This is likely to continue, as the Fed is expected to cut interest rates in response to tariffs, a move that contrasts with the prevailing market sentiment of maintaining current rates.

Currently, the prevailing narrative is that the US regulator will adopt a wait-and-see approach and that the European Central Bank will implement a policy of monetary loosening at four upcoming meetings, including the one on January 30. Against this backdrop, the EURUSD pair will likely continue its downtrend, making investors perceive its upswings as corrections. Meanwhile, the introduction of tariffs against the EU is required to make Forex speculate about parity again.

Weekly EURUSD Trading Plan

However, while investors remain uncertain regarding 25% import duties on Mexico and Canada that may take effect on February 1, decreasing net long positions on the US dollar continue to boost the EURUSD pair. If the pair breaks through the resistance level of 1.0445, one can open short-term long trades.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.