Will the new US president have trouble delivering on his campaign pledges? If not, the EURUSD pair will fall below parity. If he does implement his policies, the outcomes have already been priced in the pair’s quotes. Meanwhile, a pullback is inevitable. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

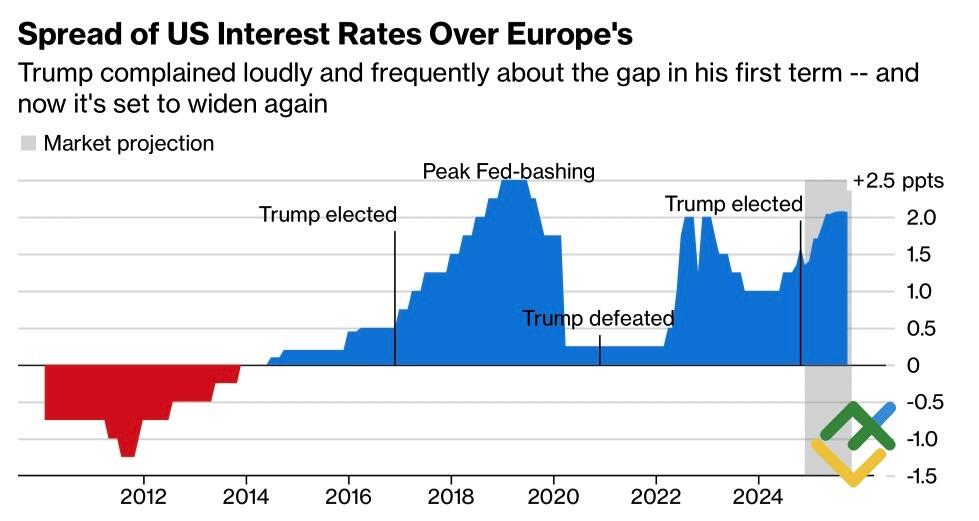

- The Fed-ECB rate gap was as high as 250 bps during Trump’s first term.

- The differential is 150 bps and is likely to continue to expand.

- Difficulties with the implementation of the US President’s plans will undermine investor confidence in the US dollar.

- The EURUSD pair may collapse to 0.95 or return to 1.072.

Quarterly US Dollar Fundamental Forecast

It is essential to understand past market movements to project future trends. Since the September peak, the EURUSD pair has depreciated by 7.3%. This decline is attributed to the perception that Donald Trump’s policies will exacerbate the divergence in US and eurozone economic growth, potentially slowing down the Fed’s monetary policy easing. As Trump’s approval ratings increased and he secured the election victory, investors’ confidence in this scenario strengthened. This confidence was further bolstered by the precedent set during his previous tenure in the White House.

Fed-ECB Interest Rates Spread

Source: Bloomberg.

In 2019, the gap between the Fed and ECB interest rates reached 250 basis points, strengthening the US dollar against the euro until the Fed adopted a proactive stance on monetary policy easing in response to the pandemic in 2020. The current gap stands at 150 bps, and based on derivatives market indicators, it is expected to widen further into 2025.

The derivatives market indicates a potential reduction in the federal funds rate of 35 to 55 basis points and a decrease in the deposit rate of 100 to 130 basis points. This could potentially widen the differential to 250 basis points, similar to the 2019 level, pushing the EURUSD pair to parity.

Estimated Final Central Bank Rates

Source: Nordea.

Despite the recent red wave, the Republican party does not have complete control over Congress. For example, some Republicans have expressed reluctance to support Donald Trump’s proposal to raise the national debt ceiling and extend it to 2027. This could lead to a renewed debate over the impact of the shakedown in March 2025, potentially testing the new administration’s ability to manage the economy and the US dollar.

Notably, not all of the president’s campaign promises will translate into actual reforms, and many are already reflected in the EURUSD exchange rate. As investors gauge the president’s ability to implement his agenda, they may opt to close their short positions, leading to a pullback in the pair.

On paper, fiscal stimulus could boost GDP and inflation in the US, potentially slowing the Fed’s rate cuts. Tariffs on European exports to the US could restrict the eurozone’s ability to rely on domestic demand. The combination of its inherent weakness and the influx of Chinese goods could revive deflationary concerns, potentially prompting the European Central Bank to adopt a more accommodating monetary policy.

However, if fiscal stimulus is postponed and tariffs remain a mere negotiating tactic, the actual outcomes may differ. In such a scenario, the Fed is likely to continue reducing interest rates, while the ECB will likely decelerate its cycle. As a result, the EURUSD’s pullback could be substantial.

Quarterly EURUSD Trading Plan

If Donald Trump’s plans are enacted, the major currency pair may decline not only to parity but also to 0.95. Conversely, challenges in implementing his election promises could lead to a correction to 1.072. According to the prevailing market narrative, a more favorable strategy suggests opening short trades on the EURUSD pair on upward pullbacks.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.