The robust US economy and elevated interest rates have prompted a surge in capital inflows, exerting downward pressure on the EURUSD exchange rate. Import tariffs and fiscal stimulus measures are poised to accelerate this trend. In this context, should the weak US dollar remain only on paper? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The weak-dollar policy is Donald Trump’s populism.

- The US economy is still strong.

- Trade wars will weaken US competitors.

- The 1.083 level is the line in the sand for the EURUSD pair.

Weekly US dollar fundamental forecast

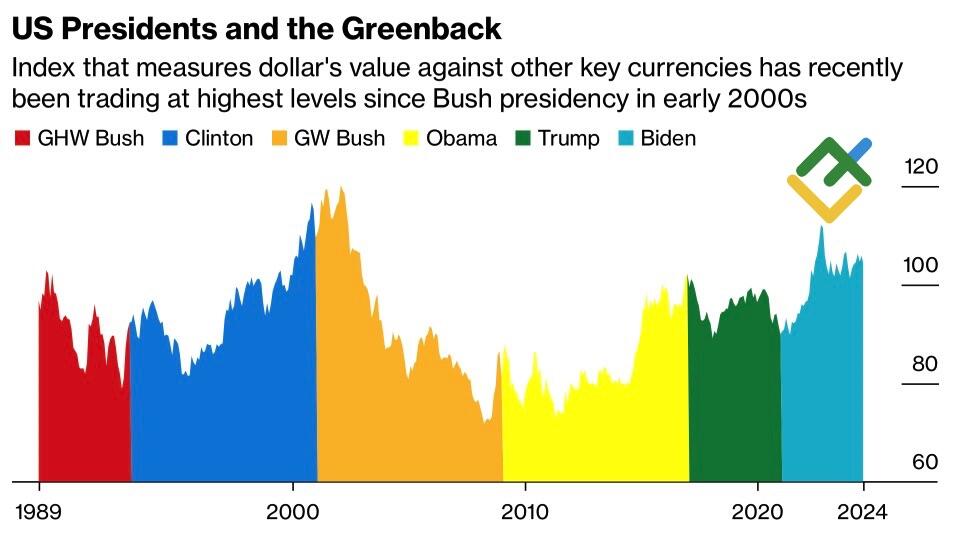

While Donald Trump wants to adopt a weak-dollar policy, a fundamental analysis suggests that the greenback is not currently overvalued. As stated by Treasury Secretary Janet Yellen, the United States has pursued a tight monetary policy with higher rates than other countries over the past few years. This has stimulated capital inflows, strengthening the US dollar. This is precisely how the system functions. Against this backdrop, the USD index has gained 15% since Joe Biden took office as US President.

US dollar performance over the course of US presidencies

Source: Bloomberg.

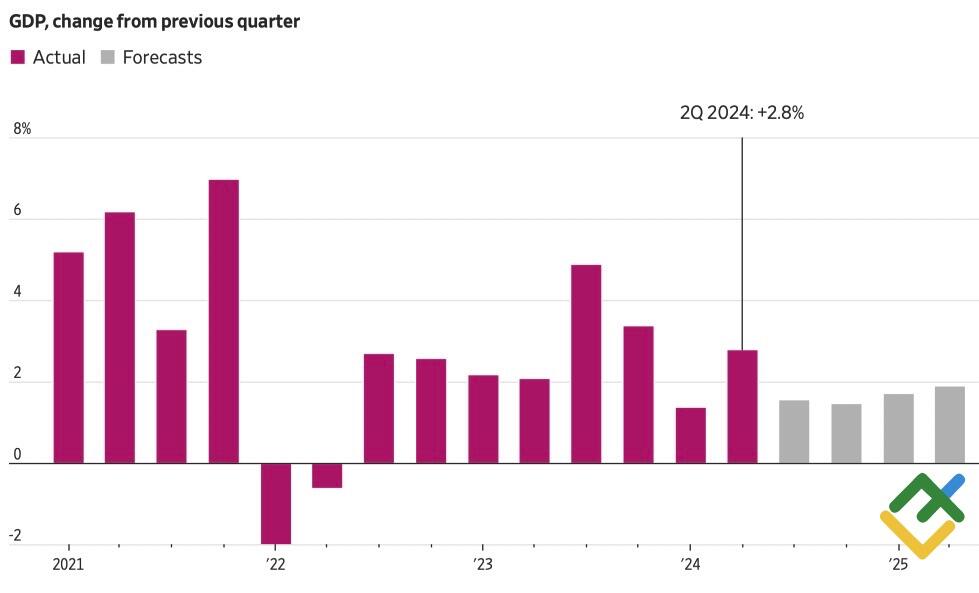

Regardless of the outcome in November, whether Republican or Democrat, the economy will remain robust. Second-quarter GDP growth accelerated unexpectedly, rising to 2.8% from 1.4%, exceeding the Bloomberg experts’ forecast of 2%. Notably, the personal consumption expenditures index also gained traction, surging to 2.9% from 2.7%. The data suggests that either the June PCE will be significantly higher than forecasts or the data for April-May will be revised upward. This is a positive sign for EURUSD bears.

The US economy is robust and poised for further growth. Meanwhile, Donald Trump aims to provide additional stimulus. The introduction of new tariffs on imports is likely to result in a deceleration of GDP growth overseas while also reigniting the debate around American exceptionalism, which has historically been a driver of the US dollar in global markets.

US GDP change q/q

Source: Wall Street Journal.

A robust economy is inherently inflation-resistant. However, renewed trade wars will disrupt supply chains, spurring producer and consumer prices. This was starkly evident during the pandemic. The Federal Reserve will be compelled to maintain the federal funds rate at its current level or resume the monetary tightening cycle. The US dollar will strengthen as a result of the inherent dynamics of the system.

During his previous presidency, Donald Trump attempted to influence the situation by calling Jerome Powell “America’s public enemy number one.” He also made verbal interventions in favor of a weaker currency. However, these efforts had no effect. A person sensitive to approval from the markets should be aware that political pressure on the Fed and interventions in the foreign exchange market will cause turbulence, forcing investors to flee to safe-haven assets. First and foremost, to the US dollar.

Weekly EURUSD trading plan

Therefore, those seeking a weak dollar should refrain from restarting trade wars or adding fiscal stimulus. If current conditions remain unchanged, the US economy will continue to cool down, prompting the Fed to loosen monetary policy, which will cause EURUSD quotes to rise. However, it remains uncertain whether Donald Trump will accept this scenario. Long trades remain relevant as long as the pair is trading above 1.083. On the contrary, if the price drops below this level, there will be an opportunity to sell the euro.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.