The attempted assassination of the 45th President of the United States has brought back his former audacity. Donald Trump is beginning to threaten the Fed, even though he has not yet become head of state. However, the markets believe that the central bank will not go along. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Highlights and key points

- Republicans are demanding that the Fed not cut rates until after the election.

- Bank of America believes that the Fed will cut three times in 2024.

- The EURUSD reaction to US retail sales suggests the weakness of sellers.

- Markets believe the Fed, which can push the euro above $1.1.

Weekly US dollar fundamental forecast

No sooner has Donald Trump come to power than he is putting pressure on the Fed. The Republican has threatened to fire Jerome Powell if he does start cutting interest rates before the presidential election. The former president would like to see the central bank as his own puppet. However, investors disagree and continue to buy the EURUSD pair in anticipation of an imminent start to monetary expansion in the US.

After Goldman Sachs, which claims that the conditions are already in place for monetary easing in July, Bank of America was noted for its dovish rhetoric. It predicts a cut in the federal funds rate in September, November, and December, which will threaten the US dollar. Therefore, investors are trying to get rid of the greenback as soon as possible.

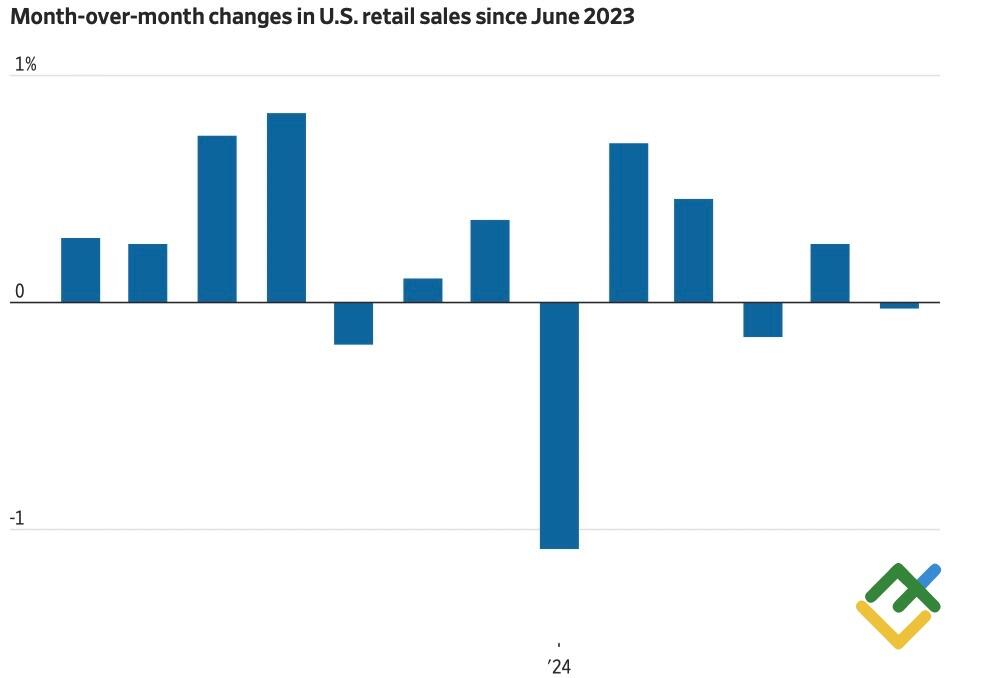

The EURUSD’s reaction to the retail sales data is telling. The figure showed zero growth instead of the predicted 0.4% contraction in June, and the previous figures were revised upward. On paper, this means that consumer demand and the US economy are resilient, which initially caused the major currency pair to fall.

US retail sales

Source: Wall Street Journal.

However, when it is necessary to get rid of the greenback, the principle of “sell when everyone is buying” goes well. The EURUSD did not even manage to reach the support at 1.086 before bulls pushed the price higher. The neutral rhetoric of FOMC member Adriana Kugler did not help either. She believes that if the labor market remains stable, the slowdown in inflation will allow the Fed to cut rates by the end of the year. Has Donald Trump found the person he wants to replace Jerome Powell?

The 45th US president has previously called the Fed chairman America’s public enemy No.1. History risks repeating itself. According to the IMF, imposing additional import tariffs will unleash inflation and force central banks to keep rates higher longer than expected. Donald Trump, who expects to raise duties on all Chinese imports to 60%, will surely demand monetary expansion from Jerome Powell.

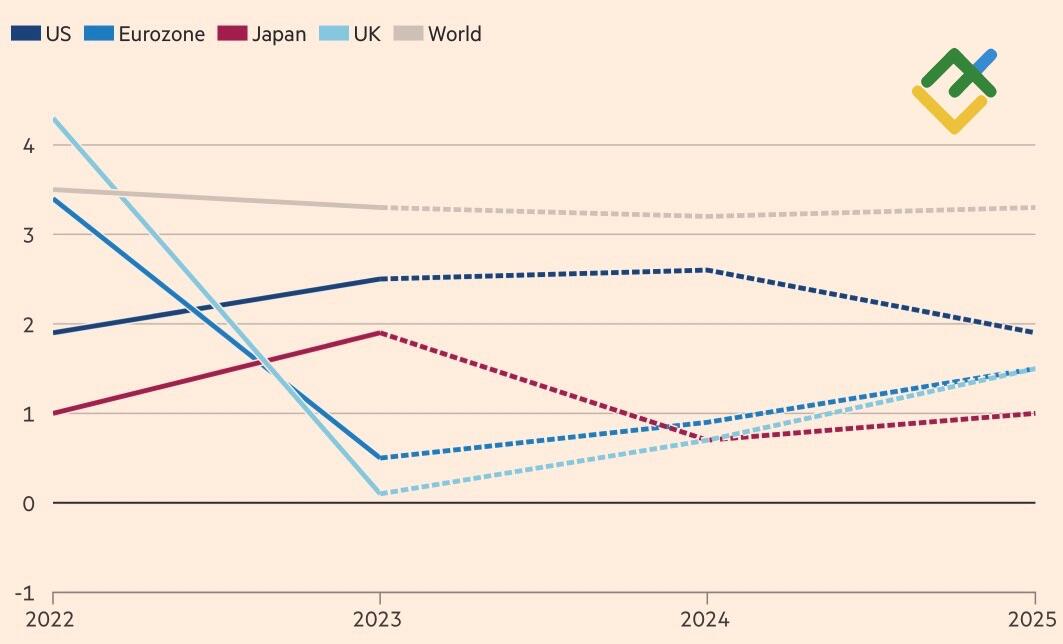

The IMF modestly raised its forecast for eurozone GDP in 2024 to 0.9% from 0.8%, lowering it for US GDP to 2.6% from 2.7%. In 2025, the divergence will narrow further. The currency bloc’s economy will expand by 1.5%, and its US counterpart will add 1.9%. Against this backdrop, the EURUSD pair will likely continue its rally unless the eccentric Republican does not put a spoke in its wheels.

Performance of world’s leading economies

Source: Financial Times.

Weekly EURUSD trading plan

The failure of the main currency pair’s bears to counterattack shows their weakness and allows the EURUSD pair to recover towards 1.1-1.11. Long trades on the pair are still relevant.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.