The retreat of the Trump trade allowed EURUSD bulls to recover. The Republican has not yet taken office as US President. Furthermore, there is often a discrepancy between words and actions. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Investors doubt Trump will fulfill his promises.

- The Fed leaves the door open for a rate cut in December.

- Markets are challenging the central bank.

- The EURUSD pair may drop to 1.05.

Monthly US Dollar Fundamental Forecast

Donald Trump does not like to remain silent. During his first tenure as President of the United States, he was called the king of social media. However, the Republican has not yet taken office, and the words may turn out to be nothing more than populism. These developments forced some investors to lock in profits on trades related to the Trump factor and triggered a pullback in the EURUSD pair.

Over the next few months, markets are trying to find out whether Trump’s policies will match his loud words. Will he impose new tariffs, or will he prefer to negotiate with other countries? Will he cut taxes? Investors have their minds on the fulfillment of his campaign promises. Are the bets on the Trump trade exaggerated?

The Fed added fuel to the EURUSD pullback by stating that the Republican’s second term will have no impact on the central bank’s decisions in the near term. Jerome Powell noted that the Fed was not trying to guess, speculate, or assume what would be the impact of the new administration on the economy. The regulator needs facts and data to make decisions.

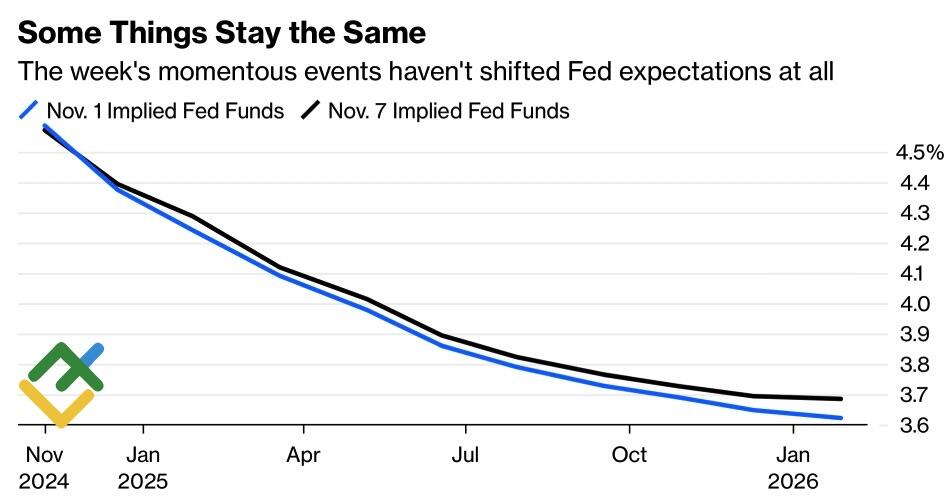

Market Expectations on Fed Funds Rate

Source: Bloomberg.

The Fed has cut the federal funds rate by 25 bps to 4.75%, noting that it has yet to make any decisions for December. The US regulator will depend on the labor market’s health. The central bank cannot leave the door to loosening monetary policy wide open, but it does not intend to close it either. In September, 10 FOMC members voted in favor of two acts of monetary expansion in November and December, while nine members voted for one.

After Jerome Powell’s press conference, the derivatives market reduced the odds of borrowing costs falling to 3.75% by the end of the cycle to 18% from 34%. Prior to the presidential election, the odds were 55%. Citi predicts the final rate will fall to 3.6%, not 2.8% as previously expected. Nomura believes that the Fed will take only one step down the road of monetary expansion in 2025 instead of four.

Therefore, markets are once again challenging the Fed, which claims that the policies of the new US administration will not affect the central bank’s judgments. Investors believe that Donald Trump’s tariffs, fiscal stimulus, and anti-immigration policies will spur inflation, forcing the Fed to pause and strengthen the US dollar.

US Dollar Index Performance and Donald Trump’s Rating

Source: Financial Times.

The other point is that it will take some time between the presidential election and the Republican’s fulfillment of his campaign pledges as Trump will move to the White House in a few weeks. In addition, there may be a difference between word and deed. This leads to the Trump trade retreat and a pullback in the EURUSD pair.

Monthly EURUSD Trading Plan

Donald Trump’s first term proved that he can be trusted. Therefore, an upward pullback in the EURUSD pair is a great opportunity to open short trades with targets at 1.06 and 1.05.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.