The import duties announced by Donald Trump were larger than anticipated. In response, many countries have pledged to respond, but retaliation may only add to the pain. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- The US will impose universal tariffs of 10%.

- Duties against Europe, China, and Japan have been much higher.

- The White House warns those who want to retaliate.

- Long trades on the EURUSD pair can be opened with targets at 1.105 and 1.117.

Weekly US Dollar Fundamental Forecast

The tariffs imposed by Donald Trump, which he himself called “Discounted Reciprocal Tariff,” have caused significant turbulence in financial markets. The 10% tariff on all US imports, the 20% tariff on European goods, the 24% tariff on Japanese goods, and the 34% tariff on Chinese goods have led to significant concern among investors. However, Treasury Secretary Scott Bessent advised against the implementation of retaliatory measures against the affected states. The current rates have likely hit the ceiling for some time. However, an escalation is looming.

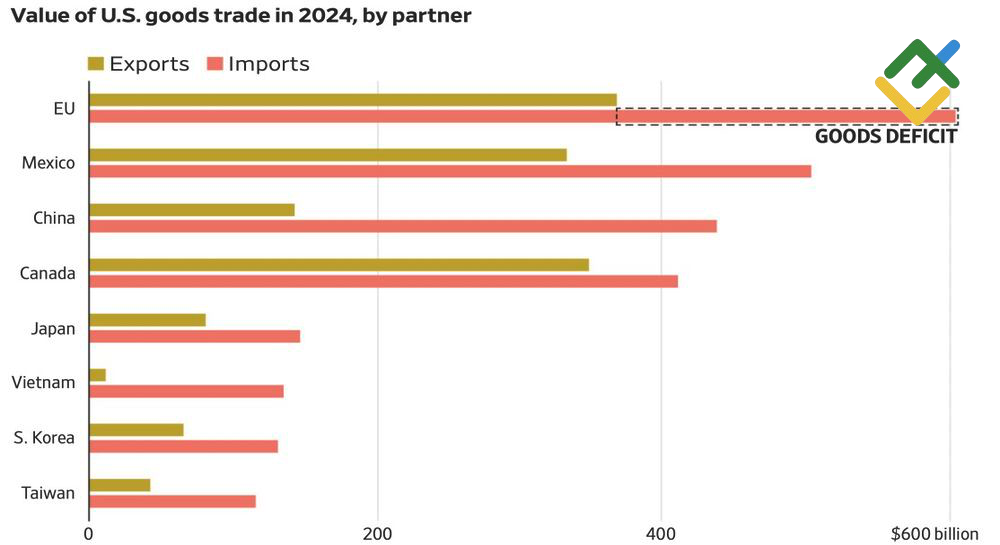

US Exports and Imports

Source: Bloomberg.

According to Donald Trump, other countries have been benefiting financially at America’s expense for years. Now, it is America’s turn to prosper. The tariff strategy is intended to bolster the revenue side of the US budget and to encourage the repatriation of factories and production facilities to the US. However, the process of repatriating these factories and facilities is expected to be protracted and costly. Estimates from the US administration and research companies diverge significantly in terms of the total levies.

The Trump administration aims to generate $2.5 trillion in revenue through tariffs, with the goal of addressing the budget deficit. However, the projected revenues from extending tax cuts and reducing government spending by $2.5 trillion are expected to fall short. According to Capital Economics, the US can potentially generate up to $835 billion in duties on imports. However, this estimate will be reduced to $700 billion because many countries will curtail their shipments to the US. The firm anticipates that a 25% increase in the effective tariff rate, the highest in over a century, would lead to an inflation surge of 2.5% to 4%, necessitating the Fed to keep the rate unchanged, letting the economy slip into a recession.

Meanwhile, investment bank Piper Sandler projects a 1% contraction in GDP over the next three months and a 2.6% surge in consumer prices.

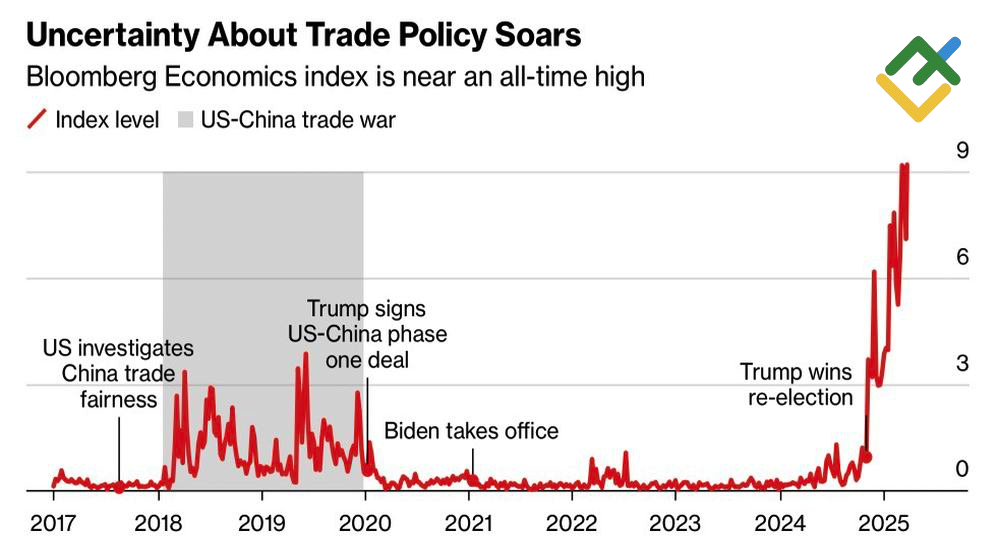

US Trade Policy Uncertainty Index

Source: Bloomberg.

It is evident that the considerable uncertainty surrounding Donald Trump’s policies, coupled with the potential for retaliation from other nations, will serve as key factors restraining investment and dampening domestic demand. This, in turn, will lead to a marked slowdown in the global economy.

Notably, China is poised to take retaliatory action, while the EU will only do so if negotiations are hindered. Japan is demanding the removal of tariffs, and Israel has been hit with a 17% levy despite canceling its tariffs against the US.

It is likely that further developments will ensue. The outlook for global trade is bleak, with the potential for US stock indices to decline, accelerated capital flight from the US to other regions, and a weakening of the US dollar. These developments are likely to exacerbate recessionary fears, exerting pressure on Treasury yields and boosting EURUSD quotes.

Weekly EURUSD Trading Plan

Long trades opened on the EURUSD pair in the area of 1.0735–1.0755 and at 1.0845 can be kept open. The targets are located at 1.105 and 1.117.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.