While deregulation and tax cuts are good for markets, anti-immigration policies and tariffs will likely slow down the US economy. How will the EURUSD pair behave in such troubled waters? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Trump’s second tenure will be different from the first one.

- Markets may be overly optimistic.

- American exceptionalism supports the US dollar.

- The EURUSD pair will continue to fall toward 1.05.

Weekly US Dollar Fundamental Forecast

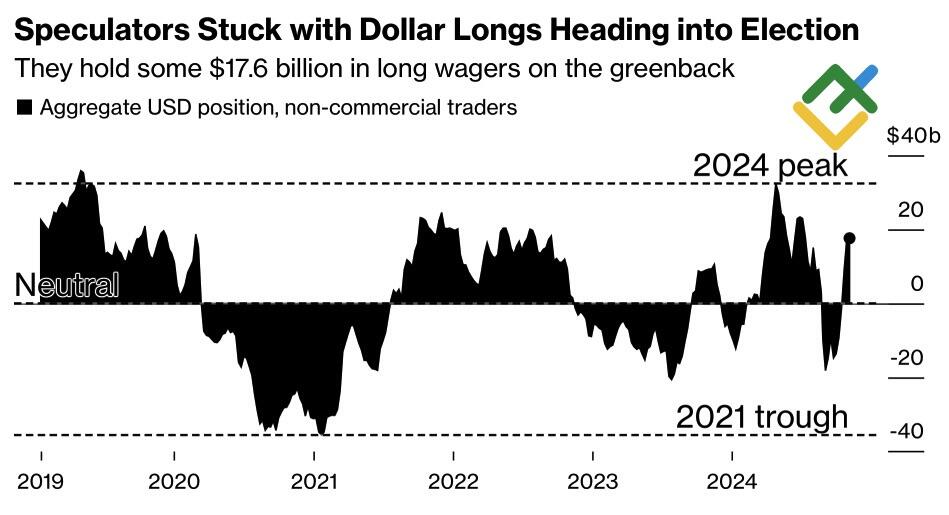

History is repeating itself. Like in 2016, after Donald Trump’s victory, stocks rallied, and bonds saw a sell-off, pushing their yields higher. However, economic conditions have changed significantly since then. While eight years ago, investors were betting on a so-called reflation trade as consumer prices accelerated, the prices are already elevated now. The outcome of the Republican presidency will be very different, but for now, speculators continue to buy the US dollar while EURUSD bulls flee the battlefield in panic.

Speculative Positions on US Dollar

Source: Bloomberg.

Donald Trump’s policies include four cornerstones, two of which are good for markets, and the remaining two could create serious headwinds. Lower corporate taxes and less regulation will accelerate GDP and fuel a rally in US equity indices. A crackdown on immigration and higher tariffs will cool the economy.

What matters is what Donald Trump plans to do, in what order, and what is just campaign rhetoric. The markets take seriously what they like and classify what they do not like as populism. That seems to be an over-optimistic view.

As a rule, politics affects the economy, although with a time lag. Jerome Powell said that the new US administration would not affect the Fed’s decisions because the central bank needed to see economic changes. Indeed, to implement the promises of tax cuts, the project must first pass through Congress. The effects will be felt several months later.

However, Donald Trump can implement anti-immigration policies and impose new tariffs without the approval of lawmakers. Protectionism may slow the US economy, but it will do even more damage to the rest of the world.

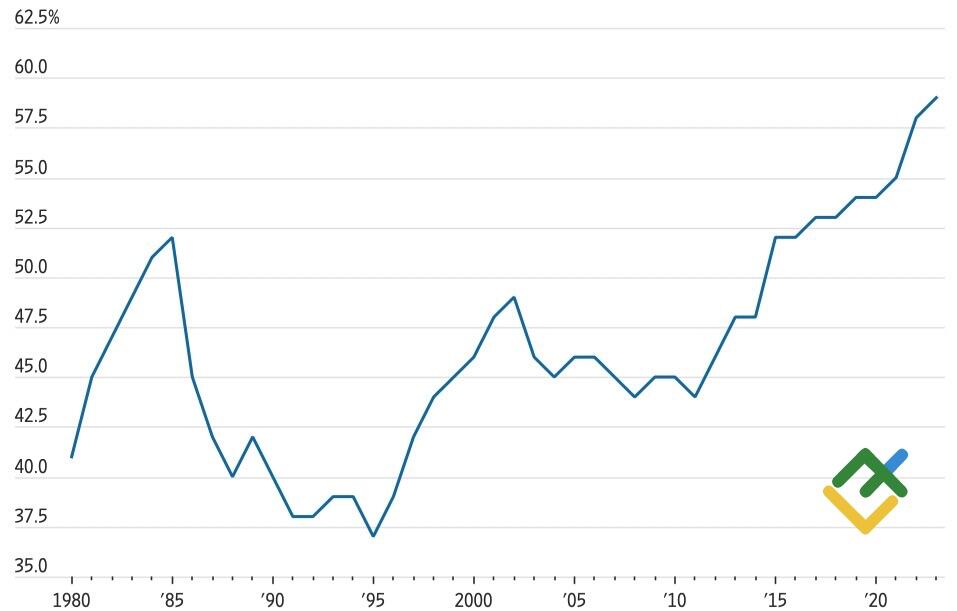

The massive fiscal and monetary stimulus from the pandemic, amid productivity growth, has pushed the US share of G7 GDP to its highest level since at least the 1980s. American exceptionalism has become a solid foundation for the US dollar’s appreciation.

US share in GDP of G7 countries

Source: Wall Street Journal.

The German Institute for Economic Research estimates that if Washington imposes tariffs of 60% on imports from China and 10-20% on imports from other countries, Germany’s GDP would decline by 1.2-1.4% by 2028. In contrast, the US economy may overheat under Donald Trump, according to Pimco. The divergence in economic growth is a good opportunity to sell the EURUSD.

Weekly EURUSD Trading Plan

In the near term, the major currency pair may continue declining as US inflation may accelerate without economic stimulus and new tariffs. The CPI is expected to accelerate to 2.6% from 2.4% in October, which sets the stage for selling the EURUSD pair with the target of 1.05.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.