For a long time now, the EURUSD has not reacted to the monetary policies of the Fed and the ECB but to the stock markets. The massive US tariffs have locked the euro in the 1.09–1.105 range. Will a 90-day reprieve make a difference? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The White House granted a 90-day pause on tariffs.

- The US raises duties against China to 125%.

- The S&P 500 rally prevented the euro from rising.

- Trades on the EURUSD pair can be opened in the 1.09-1.105 range.

Weekly US Dollar Fundamental Forecast

How do you make someone happy? Firstly, take something important away from them, and then give it back. Markets were taken aback by the magnitude of the White House tariffs, fearing a recession, which sent the S&P 500 below the bear market threshold. However, following the announcement by Donald Trump of a 90-day suspension on tariffs exceeding 10%, with the exception of those imposed on China, the broad stock index surged by 9.5%, thereby impeding the EURUSD pair from regaining its uptrend.

“This is a great time to buy,” the US president posted on his social media platform, triggering the strongest one-day rally in the S&P 500 since 2008. Markets roared to life as they realized that Donald Trump still cares about US equities. He releases bullish news at the commencement of the trading session and bearish news after it has closed.

The S&P 500 rally has had a significant impact on the EURUSD pair. The euro has been performing well recently, falling against the US dollar amid the decline of European stock indices and strengthening due to the collapse of the US ones. The EuroStoxx 50 has risen for two consecutive days, indicating a bullish outlook. If US stocks had fallen, it is likely that the major currency pair would have been able to restore the uptrend. However, this was not the case.

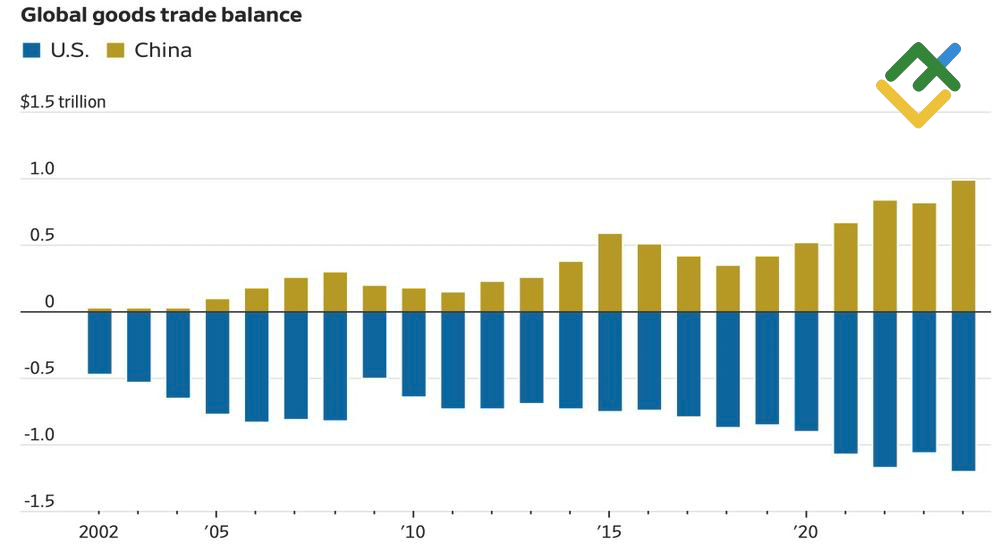

US and China Goods Trade Balance

Source: Wall Street Journal.

Donald Trump’s decision to raise import duties on Chinese goods to 125% has escalated the trade war. At the same time, he has provided other countries with an opportunity to reach an agreement with the US. This strategic measure will isolate Beijing. Moreover, US Treasury Secretary Scott Bessent warned the EU against closer alignment with China on trade.

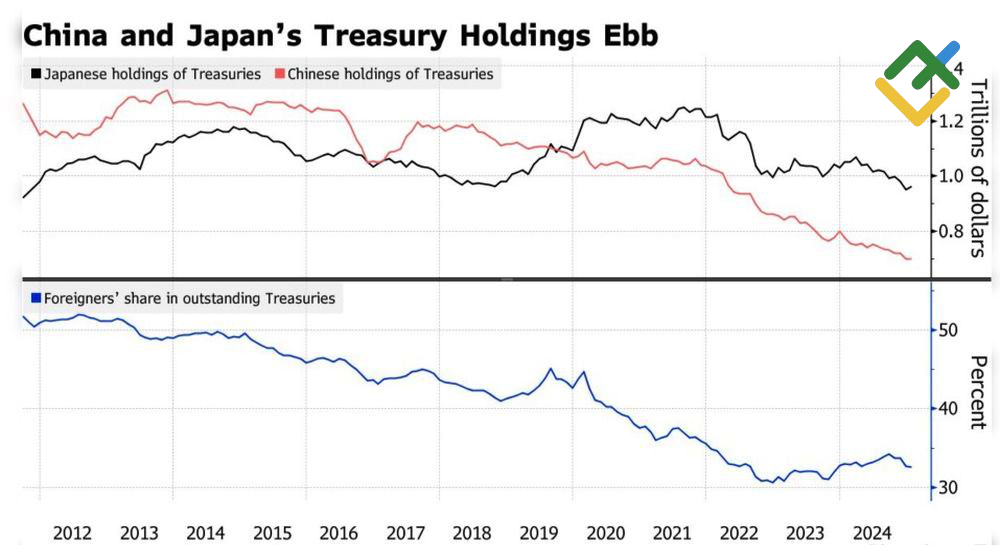

The US Treasury Secretary has issued a warning to China, urging it to refrain from devaluing the yuan or divesting from US bonds. The situation is likely to deteriorate further. Speculation that China was divesting its holdings of US Treasuries spurred their yields.

Japanese and Chinese Holdings of Treasuries

Source: Bloomberg.

The universal 10% tariff remains in place, and Donald Trump is determined to impose duties on pharmaceutical imports. It is likely that the S&P 500 has reached a level that is too high, driven by euphoria and the fear of missing out on gains.

The EURUSD pair continues to be influenced by the equity markets. Were it otherwise, the US dollar would have strengthened following the release of the FOMC meeting minutes, which indicated that the Fed was comfortable keeping interest rates at an elevated level. In contrast, the euro would have weakened after Bank of France President François Villeroy de Galhau stated that the deposit rate should be reduced due to the US tariffs.

Weekly EURUSD Trading Plan

Against this backdrop, the primary strategy for the EURUSD pair suggests opening long and short trades on a decline to 1.09 and an increase to 1.105, respectively. The euro is bought or sold depending on the EuroStoxx 50 index’s performance. This approach has a proven track record of success.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.