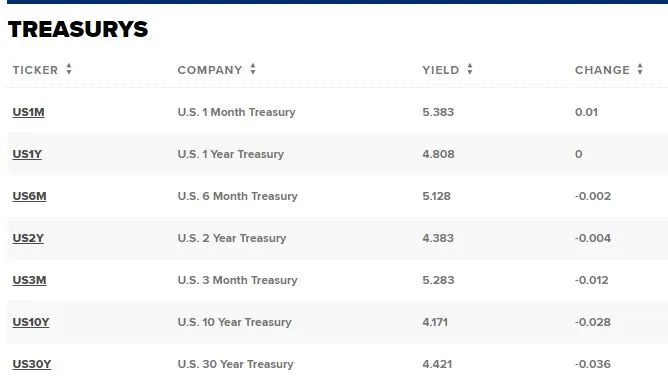

Treasury yields have recently fallen as investors grapple with anxiety over upcoming key economic data. This decline in Treasury yields comes at a critical juncture, with the Federal Reserve meeting on the horizon. Investors are keenly awaiting the Fed’s interest rate announcement and are closely monitoring labor market data for clues about the future of monetary policy. The outcome of these events will undoubtedly have significant implications for Treasury yields and broader market sentiment.

Source: CNBC

The Impact of the Federal Reserve Meeting

The Federal Reserve meeting is one of the most anticipated events for investors. Scheduled to start on Tuesday and conclude on Wednesday, this meeting will culminate in an interest rate announcement and the release of new monetary policy guidance. Many expect the Fed to maintain current rates, but investors are eager for hints about when rate cuts might begin. The statements made during this meeting could profoundly influence Treasury yields.

In recent months, Fed officials have emphasized the need for more evidence of sustainable inflation returning to the 2% target before considering rate cuts. Consequently, the market is on edge, awaiting any signs that the Fed might alter its stance. A shift in policy guidance could either stabilize or further unsettle Treasury yields, depending on the direction of the change.

Economic Data and Its Influence on Treasury Yields

Economic data plays a crucial role in shaping investor sentiment and Treasury yields. This week, several key data releases are expected to provide insights into the health of the economy. On Friday, the personal consumption expenditures (PCE) price index, the Fed’s preferred inflation measure, was released. The PCE rose by 0.1% in June from the previous month and 2.5% from a year earlier. This data aligns with expectations and underscores the ongoing battle against inflation.

Investors will also be closely watching the JOLTs job opening figures due on Tuesday, followed by ADP’s private payrolls report on Wednesday. The highlight of the week will be the July jobs report, including nonfarm payrolls and unemployment data, scheduled for release on Friday. These labor market data points are critical as they could influence the Fed’s future policy decisions and, consequently, Treasury yields.

Interest Rate Announcement: What to Expect

The interest rate announcement following the Federal Reserve meeting is eagerly anticipated. Although the market widely expects rates to remain unchanged, the focus will be on the accompanying policy guidance. Investors are looking for any indications of when rate cuts might commence and how many cuts could occur this year. The Fed’s communication strategy during the post-meeting press conference with Chairman Jerome Powell will be scrutinized for these clues.

Interest rate announcements have a direct impact on Treasury yields. A dovish stance, indicating potential rate cuts, could lead to lower Treasury yields as bond prices rise. Conversely, a hawkish tone, suggesting higher rates for longer, might result in higher Treasury yields. Therefore, the market reaction to the interest rate announcement will be a critical factor in determining the direction of Treasury yields in the near term.

Labor Market Data: A Key Indicator

Labor market data is a vital indicator for the Federal Reserve as it assesses the health of the economy. This week’s labor market data releases will provide essential insights into employment trends. The JOLTs job opening figures, ADP’s private payrolls report, and the July jobs report, including nonfarm payrolls and unemployment data, will be closely analyzed.

The labor market’s performance is crucial for the Fed’s policy decisions. Strong job growth and low unemployment could support a case for maintaining or even raising rates, which might increase Treasury yields. On the other hand, signs of labor market weakness could prompt the Fed to consider rate cuts, potentially leading to lower Treasury yields. Therefore, the labor market data released this week will significantly influence investor sentiment and Treasury yields.

Investor Sentiment and Market Reaction

Investor sentiment is currently shaped by a mix of anxiety and cautious optimism. The recent fall in Treasury yields reflects the market’s uncertainty about upcoming economic data and the Federal Reserve meeting. Investors are navigating a complex landscape, balancing concerns about inflation, economic growth, and the potential for monetary policy shifts.

As investors digest this week’s economic data and the Fed’s interest rate announcement, market reactions could be swift and significant. Treasury yields are likely to remain volatile as new information emerges. Investors will need to stay vigilant and adapt their strategies based on the evolving economic landscape and policy signals from the Fed.

The Broader Economic Context

The broader economic context is also essential in understanding the movements in Treasury yields. Inflation remains a persistent challenge, despite recent data showing some moderation. The Fed’s commitment to bringing inflation back to the 2% target means that monetary policy will continue to play a pivotal role in shaping economic outcomes.

Moreover, global economic conditions, including geopolitical tensions and supply chain disruptions, add to the complexity of the economic environment. These factors can influence investor sentiment and, by extension, Treasury yields. As such, the interplay between domestic economic data, Fed policy, and global events will continue to drive market dynamics.

Conclusion

In conclusion, Treasury yields have fallen amid growing investor anxiety over key economic data and the upcoming Federal Reserve meeting. The market’s focus is on the Fed’s interest rate announcement and the critical labor market data due this week. These events will provide crucial insights into the future direction of monetary policy and its impact on these yields.

Investors will closely monitor the Fed’s communications for clues about potential rate cuts and the overall economic outlook. As the week unfolds, the interplay between economic data, Fed policy signals, and investor sentiment will determine the trajectory of these yields. Navigating this complex landscape requires vigilance and adaptability as new information and insights emerge.

By understanding the significance of these events and their potential implications, investors can better position themselves to respond to the evolving economic environment and make informed decisions regarding Treasury yields.

Click here to read our latest article China Economic Slowdown Sparks Commodity Fears

This post is originally published on EDGE-FOREX.