The Bank of Canada has been one of the first to start cutting rates, but EURCAD bears have at least two trump cards: lower vulnerability to tariffs and economic growth. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Canada is less vulnerable to U.S. protectionism than the Eurozone.

- Fiscal stimulus will boost Canadian GDP.

- BoC will slow the pace of monetary expansion in December.

- EUR/CAD will continue to fall to 1.45 and 1.43.

Monthly Fundamental Forecast for the Canadian Dollar

We knew it! Donald Trump’s victory in the U.S. presidential election has sent EUR/CAD down 3.4%. Canada has time to prepare for trade tariffs, as the agreement between North American countries can only be revised in 2026. The Eurozone does not have this opportunity, so the loonie has outdone the euro, unsurprisingly.

According to the Bank of Montreal, Canada will initially benefit from Donald Trump’s fiscal stimulus as it will boost the U.S. economy and increase domestic demand, including for Canadian imports. The United States is its largest trading partner: three-quarters of Canadian exports go to the world’s most robust economy.

U.S. and Canada Foreign Trade Trends

Source: Financial Times.

Unsurprisingly, Ottawa began to get nervous after the Republican victory in the U.S. elections. The new president has promised to impose a 10–20% tariff on imports from other countries. Considering the USMCA – an agreement supported by Donald Trump himself – and the high dependence of U.S. manufacturing on Canadian oil supplies, one may seem to afford a sigh of relief. However, the Republican’s unpredictability is so extreme that no one knows what to expect. Could the U.S. withdraw from the North American agreement? Increase oil production and subsequently halt imports from Canada?

Ottawa prefers caution. The Canadian government asserts that its policies are more synchronized with Washington than anywhere else, while Mexico acts differently, opening its doors to Chinese investments. In any case, the loonie appears less vulnerable to trade tariffs than the euro, and this supports the EUR/CAD decline. Moreover, unlike Europe, which is moving toward fiscal consolidation, the land of the maple leaf is not reluctant to stimulate GDP growth through incentives.

Justin Trudeau’s government announced a C$6.3 billion support package, including a temporary federal sales tax exemption and a one-time C$250 rebate to more than 18 million Canadians. This supports the IMF’s forecast that by 2025, Canada may become the fastest-growing economy in the G7.

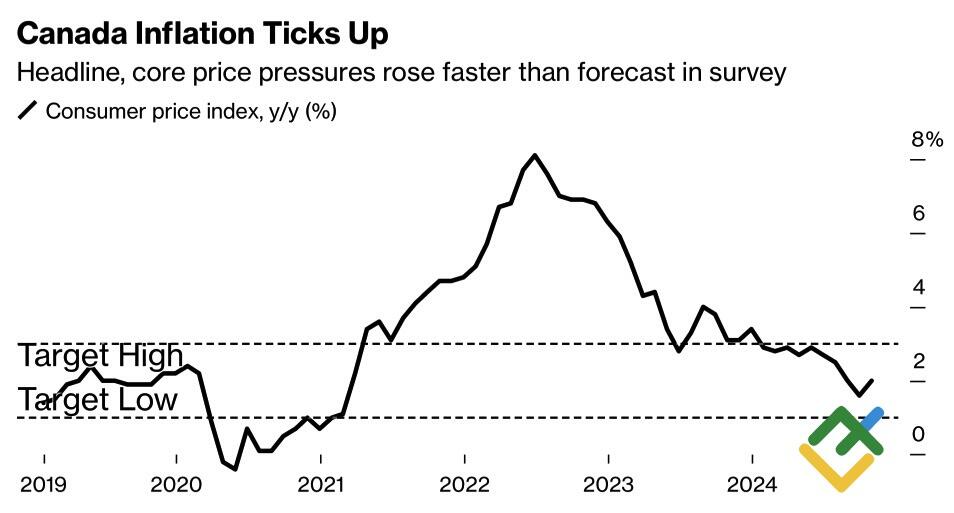

Inflation Trends in Canada

Source: Bloomberg.

The EURCAD bears were pressured by expectations of a 50 bp overnight rate cut in December following a similar move by the BoC in October. However, the central bank minutes showed officials’ concerns that a broad move could frighten the markets. With inflation accelerating to 2%, such rhetoric reduced the chances of cutting borrowing costs from 3.75% to 3.25% in December from 50% to 33% and supported the loonie.

Monthly Trading Plan for EUR/CAD

The divergence in economic growth and Canada’s lower vulnerability to tariffs will continue to push EUR/CAD quotes down. While the short targets at 1.5 and 1.485 were easily reached, it’s time to lower them to 1.45 and 1.435 and use the pullbacks to sell.

Price chart of EURCAD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.