The ECB must prevent the eurozone from sliding into the deflation it had been fighting for a decade before the pandemic. Anything goes. Why not use a sharp rate cut? Let’s discuss it and make a trading plan for EURUSD.

The article covers the following subjects:

Highlights and Key Points

- The ECB may cut the deposit rate by 50 bp.

- The European Central Bank must prevent deflation.

- Under certain conditions, the Fed will pause the monetary expansion cycle.

- Ramp up shorts on EURUSD formed from 1.12 and below.

Weekly fundamental forecast for euro

After the Fed has stunned financial markets by cutting the federal funds rate by 50 bps, why shouldn’t the ECB do the same? Few expected such a drastic start ahead of the September FOMC meeting. A cut in the deposit rate from 3.5% to 3.25% is widely anticipated ahead of the Governing Council meeting. However, rumors that the European Central Bank may go further have pushed EURUSD below 1.09.

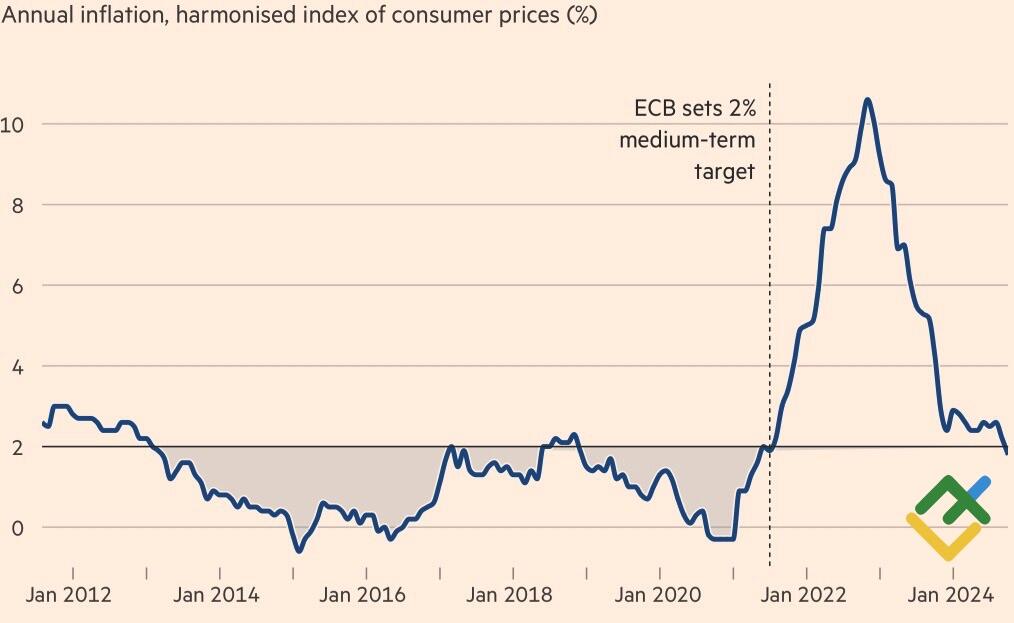

The ECB made tremendous efforts to combat deflation during the decade before the pandemic, often called the lost decade for Europe. For 93 out of 120 months until July 2021, consumer prices were below the 2% target. The central bank was forced to take unconventional measures, implementing large-scale quantitative easing programs and introducing negative interest rates.

European inflation trends

Source: Financial Times.

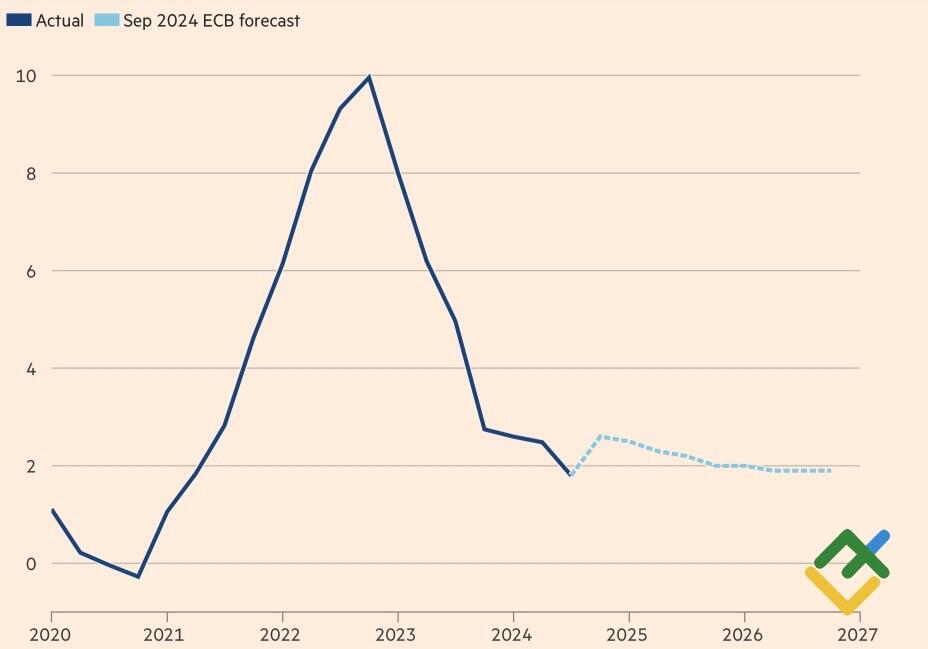

COVID-19 became a lifeline for Frankfurt. Supply chain disruptions pushed inflation above 10%, and the ECB had a chance to quickly raise borrowing costs to 4%. In 2024, the central bank has already cut borrowing costs twice, but the rapid return of the CPI to deflation suggests this is not enough.

The weakness of the eurozone economy is obvious, and the situation could be even worse if Donald Trump comes to power. Trade wars will heavily impact the export-oriented currency bloc, while Trump’s intention to end the war in Ukraine could halt aid to Kyiv, leaving the EU to bear the financial burden alone.

Nobody wants a return to deflation, and the ECB must prevent it. There is only one way—to accelerate policy easing, including through cutting deposit rates by 50 bp on October 17.

European CPI trends and forecasts

Source: Financial Times.

Conversely, the Fed is set to slow down. Christopher Waller says the central bank needs to tread more cautiously after taking a bold step in September. Monetary expansion could be accelerated if inflation falls below the 2% target and the labor market weakens significantly. In contrast, stronger consumer demand or a supply shock would compel the Fed to pause monetary easing, according to a senior FOMC official.

Speculation that the federal funds rate could plateau has unsettled investors, as have discussions about the ECB potentially cutting borrowing costs by half a point in October. EURUSD has continued to drop, and the bulls have almost no chance of a counterattack. The euro will likely remain under pressure until the ECB announces its decision – and possibly beyond.

Weekly trading plan for EURUSD

Shorts on EURUSD opened above 1.12 and from 1.1045 should be held and built up on retracements.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.