The Trump trade has offset the differing pace of monetary expansion between the Fed and the ECB as the U.S. presidential election approaches. However, this factor remains in play, pushing the EURUSD to the bottom. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Donald Trump’s new presidency will ruin Europe.

- Speculators return to the U.S. dollar.

- Fed’s caution helps the U.S. currency.

- EURUSD risks falling to 1.071 and 1.06.

Weekly fundamental forecast for dollar

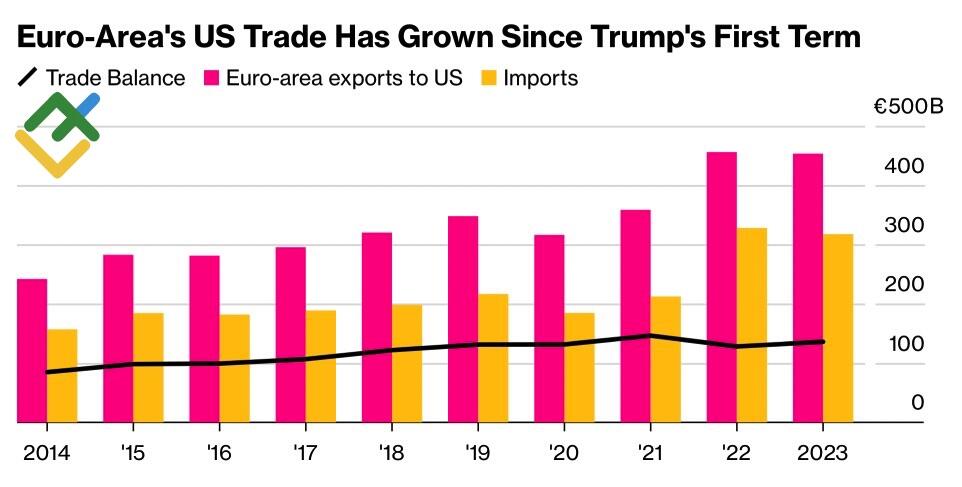

Europe’s biggest nightmare is Donald Trump’s return to the White House. The EURUSD bulls’ biggest nightmare is the pair sliding towards parity. There is a close connection between the two, as the Republican promises to impose a 10% tariff on imports. According to ABN Amro, if this happens, Europe’s €460 billion exports to the U.S. will fall by almost a third, and industrial output will drop by 1.5 percentage points. The struggling eurozone risks plunging into a severe recession, which could push the euro to the verge of collapse.

European imports from and exports to the United States

Source: Bloomberg.

Europe already has experience of dealing with Donald Trump during his first presidency. The Republican’s appetite for trade tariffs is stronger now, and the currency bloc is weaker, undermined by the COVID-19 pandemic, the military conflict in Ukraine, and the energy crisis. The current focus is on American protectionism and the continued slowdown of China’s GDP and the global economy overall. For an export-oriented region like the eurozone, this is like death.

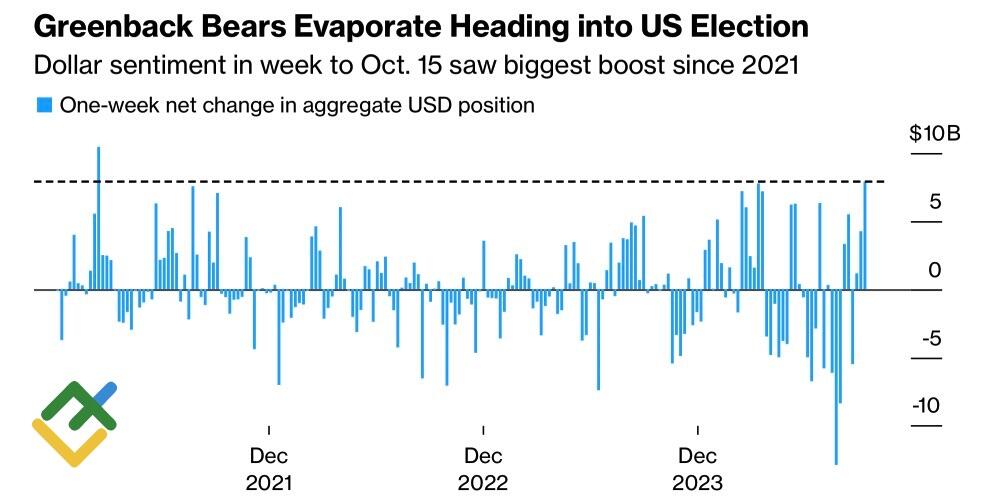

Unsurprisingly, investors who have been hesitating between the U.S. dollar and the euro throughout the year have shown a clear preference for the greenback in the past three weeks. Opening October with $13 billion in bearish bets on the American currency, speculators have reached a neutral level. According to JP Morgan, demand for hedging U.S. presidential results will continue to grow shortly, alongside the USD index.

Speculative trades in USD

Source: Bloomberg.

EURUSD‘s dive is based not only on concerns about the European and global economies as Donald Trump is potentially poised for a return to the White House, but also on investors’ reassessment of the Fed’s monetary expansion speed. Starting briskly in September, the Fed raised the bar for the expected scale of policy easing. Currently, it is gradually declining after a series of strong data from the U.S.

The Atlanta Fed’s leading indicator signals a 3.4% expansion in US GDP in the third quarter, and employment and retail sales statistics have shown good performance, suggesting caution in cutting the federal funds rate. Minneapolis Fed President Neel Kashkari and Kansas City Fed President Jeffrey Schmid are advocating a slower pace of monetary expansion. Their San Francisco counterpart, Mary Daly, calls current rates too high and intends to cut them further.

Weekly trading plan for EURUSD

The divergence in U.S. and eurozone growth that could widen further if trade wars resume, the Trump trade, and the Fed and ECB’s different approaches to monetary easing suggest that EURUSD must be sold with targets at 1.071 and 1.06. Hold shorts opened on a pullback from 1.0865.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.