As investors shift their focus from central banks to Trump’s tariff decisions, the RBA’s monetary expansion cycle fades into the background. What’s more noteworthy is the White House’s delay in addressing the situation with China. Let’s discuss it and make a trading plan for AUD/USD.

The article covers the following subjects:

Major Takeaways

- The RBA is poised for a key rate cut for the first time in 4 years.

- The Aussie started strong but is losing ground.

- Trump’s delay in imposing tariffs on China is benefiting the Australian dollar.

- Consider selling the AUD/USD with a target of 0.6.

Monthly Fundamental Forecast for the Australian Dollar

Everyone starts somewhere. The Reserve Bank of Australia is on the verge of starting a cycle of monetary policy easing. Most of its counterparts from other developed countries began cutting rates in mid-2024, putting pressure on their own currencies. Now, the RBA will have to do the same, but the speed of monetary expansion will be crucial for the AUDUSD pair.

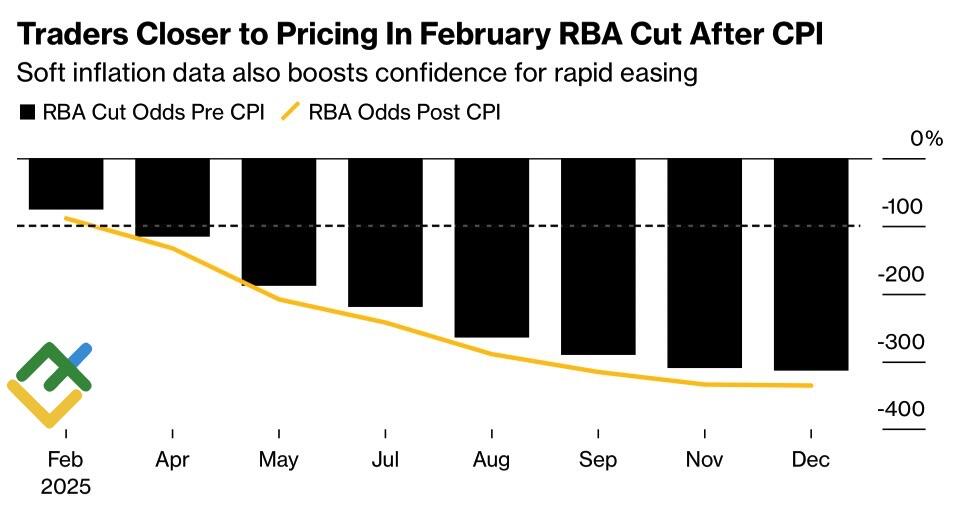

Twenty out of twenty-three Bloomberg experts predict that in February, Canberra will cut the key interest rate from 4.35% to 4.1% for the first time in four years. The futures market shows a 90% probability of this outcome due to the slowdown in core inflation in Q4 to 3.2%. This figure is now close to the upper limit of the RBA’s target range of 2-3%.

Market Expectations for RBA Rates

Source: Bloomberg.

Delaying this decision would be dangerous, as keeping the cash rate high since November 2023 has seriously cooled the Australian economy. Household consumption has significantly decreased, and weak demand in the private sector is causing sluggish GDP growth.

On the other hand, the labor market remains strong. In December, the unemployment rate remained at 4%, and employment grew by 53.6 thousand. This increases the risk that high wage growth will start accelerating inflation. The Reserve Bank must act cautiously to avoid this. Michele Bullock and her team’s main job is to prevent the market from thinking that the first rate cut will lead to a quick series of further cuts. This would be a serious problem for AUDUSD.

The pair plummeted to its lowest since the 2008 global financial crisis after the U.S. employment statistics for December confirmed the Federal Reserve’s intention to pause its monetary expansion cycle. However, since then, it has recovered significantly due to slowing inflation in the U.S. and Donald Trump’s hesitation in implementing tariffs. The global appetite for risk, driven by the S&P 500 rally, has further fueled the AUDUSD rebound.

AUDUSD and Central Bank Rates

Source: Bloomberg.

The Australian dollar is also supported by Trump’s reluctance to start protectionist policies against China. The Republican uses the slogan “hit your own so others will fear” and threatens tariffs on his close neighbors — Canada and Mexico. His directive for the administration to investigate unfair trade practices and report by April 1 suggests that China has a reprieve.

Monthly Trading Plan for AUD/USD

History is repeating itself. Like in 2017, AUDUSD bulls started the year strong but then lost their gains. Reaching the target of 0.615 for shorts was followed by a pullback, which could be used for selling the pair with a target of 0.6. The selling strategy remains valid.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.