Tesla Inc. is one of the largest U.S. corporations and a global leader in electric vehicle design and electricity generation and storage, thanks to its resilient business strategies and innovation.

The value of TSLA shares has increased by more than 93% over the past six months since April 2024. From October 14 to October 18 2024 alone, the company’s shares rose by over 10% on the back of a positive financial report highlighting a net profit increase of $2.1 billion in Q3 2024.

Can Tesla Inc. shares maintain their upward momentum, and what could this mean for their future value? Discover more in our latest review.

The article covers the following subjects:

Major Takeaways

- As for today, 13.11.2024, the price of Tesla shares is $328.48.

- Tesla reached its all-time high of $ on . The all-time low was $ on .

- Most experts provide positive forecasts for Tesla Inc.’s share price for 2024-2025. The stock value may increase to $271.00-$431.00 by the end of 2025. However, some analysts expect the rate to decline to $230.49-$207.83 in 2025.

- In 2026, the asset quotes will continue to grow. According to major analytical agencies, the value of TSLA may reach $305.36-$471.00. Nevertheless, some experts expect the asset price to decline to $197.82-$198.67.

- Experts express differing opinions regarding the dynamics of the TSLA rate from 2027 to 2030. Optimistic forecasts predict an increase in the asset value up to $637.00-$1,176.25. On the other hand, some analysts expect the price to fall to $110.28.

- Long-term estimates for 2030-2040 are mostly positive. However, they may not come true as many fundamental factors may come into play in the long term. By 2035-2040, TSLA shares are expected to grow to $682.56-$842.00

TSLA Market Status in Real-Time

The current TSLA price as of 13.11.2024 is $328.48.

To determine the current state of Tesla Inc. shares, remember to track the company’s financial indicators:

- Market cap: $924.82 billion (TSLA net market value).

- Shares outstanding: 3.21 billion (the total number of shares held by shareholders).

- Earnings per share (EPS): $3.65 (the part of the company’s profit allocated to each outstanding share).

- Price-to-earnings ratio (P/E): 73.80 (this value shows how expensive a share is relative to earnings).

- Annual dividend/payout ratio: the company does not pay dividends.

- Held by institutions: 45.77% (this metric shows the percentage of outstanding shares owned by institutional investors, such as stock companies, pension funds, etc).

- Short interest percentage: 2.47% (this metric shows the percentage of outstanding shares sold short).

- Monthly volatility: 6.52% (this metric reflects the 30-day price movement of the asset).

- Market Sentiment: Bullish (this metric reflects current market sentiment based on technical indicators).

- Fear and Greed Index: 39 – Fear (index scale: 0-24 extreme fear, 25-49 fear, 50 neutral, 51-75 greed, 76-100 extreme greed).

- Average trading volume (20-day): $84.08 million (this metric shows the average daily volume over the last 20 trading sessions).

The analysis of the above figures is a significant factor when making trading decisions for TSLA stocks, as they reflect the company’s current condition, viability, and market resilience.

TSLA Stock Price Prediction for 2024-2025 Based on Technical Analysis

To more accurately forecast the TSLA stock price, we will conduct a technical analysis of the daily and weekly price chart.

The recommended analysis tools are MACD, RSI, MFI, VWAP and SMA, and tick volumes combined with chart patterns.

These tools help identify overbought and oversold areas, trend strength, and price reversal levels that represent more favorable trade entry points.

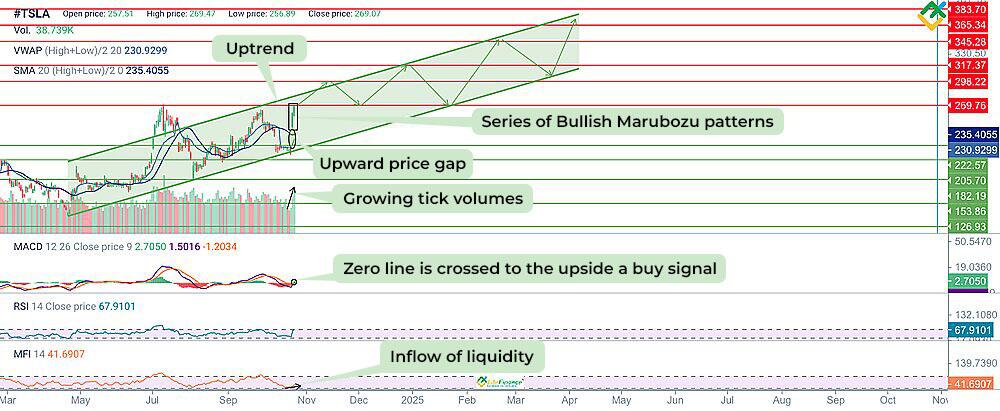

The TSLA stock daily chart shows that the company’s shares are trending up. Quotes are currently at around $269.07, and “Bullish Marubozu” trend continuation patterns have formed. Also, note an upward price gap, which also signals strong buying pressure.

Additionally, tick volumes are rising, indicating that market participants are interested in buying the asset. The MFI indicator also shows an inflow of funds into the asset.

The RSI values are located near the overbought zone at 67, with a slight potential for further growth. The MACD indicator values have crossed the zero line upwards and are rapidly increasing in the positive zone, giving a buy signal.

The market price is above the weighted average price according to VWAP and the SMA20, confirming the advantage of the bulls in the market.

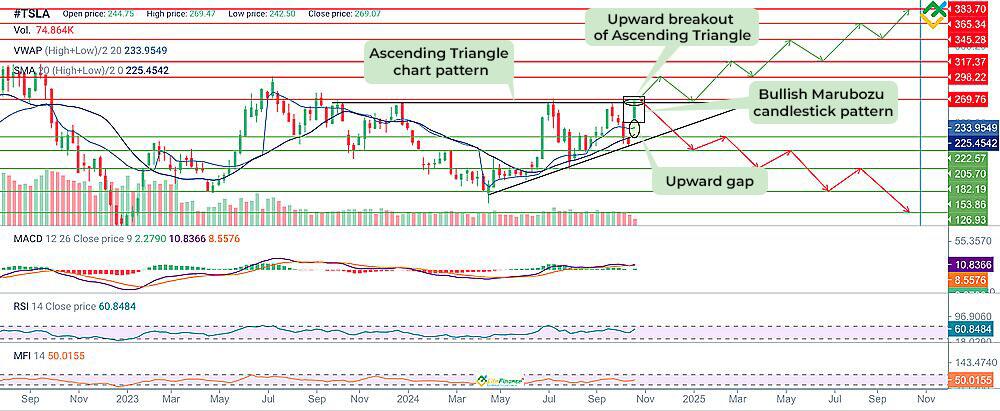

A large ascending triangle is being built on the weekly chart of TSLA shares. The price has broken it from below at around $266.98. According to the pattern rules, the potential target is located at $383.70.

Note an upward price gap, followed by the formation of a Bullish Marubozu pattern. Tick volumes show neutral dynamics, while the MFI indicator shows a cash inflow. The RSI values are also rising and holding around 60, indicating potential for further growth.

After a continued decline, the MACD values have resumed growth in the positive zone. This indicates more active buying of the trading instrument and an increase in upward momentum.

The VWAP indicator’s weighted average price and the SMA20 line are below the market price, confirming the positive dynamics of TSLA shares.

The price will most likely continue to grow over the next 12 months. Breaking the key resistance of $269.76 may drive the opening of long positions with targets at around $298.22-$383.70.

In an alternative scenario, the price breaks out the lower boundary of the uptrend at $222.57. In this case, the downward movement may accelerate, and the price will fall to $205.70-$126.93.

|

Month |

Tesla (#TSLA) projected values |

|

|

Minimum |

Maximum |

|

|

November 2024 |

266.98 |

293.09 |

|

December 2024 |

271.23 |

300.37 |

|

January 2025 |

268.19 |

294.30 |

|

February 2025 |

293.09 |

315.55 |

|

March 2025 |

299.16 |

319.80 |

|

April 2025 |

296.12 |

323.45 |

|

May 2025 |

322.84 |

344.09 |

|

June 2025 |

316.77 |

344.70 |

|

July 2025 |

314.95 |

351.38 |

|

August 2025 |

345.31 |

366.56 |

|

September 2025 |

343.38 |

365.95 |

|

October 2025 |

362.91 |

382.95 |

TSLA Long-Term Trading Plan

TSLA shares remain likely to grow over the next 12 months. The conducted technical analysis has allowed us to identify key support and resistance levels that can be used in a long-term trading strategy.

Trading Plan for the Next Three Months

- A large ascending triangle is currently forming, and it was broken out at $266.98. A potential buy target is located at $383.70.

- The candlestick pattern Bullish Marubozu signals increasing demand for the asset. Technical indicators provide signals on the daily and weekly charts to open long positions once the price consolidates above the key resistance level of $269.76, with targets ranging from approximately $298.22 to $383.70.

- Alternative scenario: If the price declines to the key support of $222.57 and consolidates below, a further fall to $205.70-$126.93 can be expected.

- The support levels in the next 12 months are $222.57, $205.70, $182.19, $153.86, and $126.93.

- The key resistance levels are $269.76, $298.22, $317.37, $345.28, $365.34, and $383.70.

TSLA Price Expert Analysis for 2024-2025

Major analytical agencies disagree on the trajectory of TSLA shares in 2024-2025. However, many experts expect the rate to grow to $271.00-$431.00.

Panda Forecast

Price range for 2024-2025: $247.80 – $332.58 (estimated as of 05.11.2024).

Analysts at Panda Forecast expect quotes to close 2024 at $294.26.

For 2025, experts predict mixed dynamics and project the price to range from $247.80 to $332.58. The average price may hit $289.53 by mid-2025 and $313.93 by the end of 2025.

|

Month |

Average price, $ |

Low |

High |

|

2024 |

|||

|

November |

285.77 |

270.06 |

304.95 |

|

December |

294.26 |

270.31 |

306.88 |

|

2025 |

|||

|

January |

286.82 |

270.09 |

305.75 |

|

February |

270.41 |

247.80 |

282.90 |

|

March |

282.90 |

259.87 |

299.40 |

|

April |

295.04 |

273.94 |

315.48 |

|

May |

282.38 |

274.31 |

303.19 |

|

June |

289.53 |

269.46 |

313.09 |

|

July |

274.24 |

253.42 |

298.07 |

|

August |

272.73 |

262.53 |

289.53 |

|

September |

283.83 |

274.46 |

300.69 |

|

October |

285.39 |

263.42 |

304.23 |

|

November |

285.08 |

261.56 |

304.83 |

|

December |

313.93 |

294.94 |

332.58 |

Longforecast

Price range for 2024-2025: $229.00 – $657.00 (estimated as of 05.11.2024).

According to Longforecast, the share price will climb to $350.00 by the end of 2024.

The rate may reach $456.00 within the first six months of 2025 and climb to $608.00 by year-end.

|

Month |

Opening price,$ |

Low/ High, $ |

Closing price,$ |

|

2024 |

|||

|

November |

286.00 |

229.00-328.00 |

304.00 |

|

December |

304.00 |

304.00-378.00 |

350.00 |

|

2025 |

|||

|

January |

350.00 |

319.00-375.00 |

347.00 |

|

February |

347.00 |

347.00-431.00 |

399.00 |

|

March |

399.00 |

368.00-432.00 |

400.00 |

|

April |

400.00 |

378.00-444.00 |

411.00 |

|

May |

411.00 |

391.00-459.00 |

425.00 |

|

June |

425.00 |

420.00-492.00 |

456.00 |

|

July |

456.00 |

435.00-511.00 |

473.00 |

|

August |

473.00 |

453.00-531.00 |

492.00 |

|

September |

492.00 |

492.00-611.00 |

566.00 |

|

October |

566.00 |

540.00-634.00 |

587.00 |

|

November |

587.00 |

551.00-647.00 |

599.00 |

|

December |

599.00 |

559.00-657.00 |

608.00 |

Walletinvestor

Price range for 2024-2025: $224.75 – $280.42 (estimated as of 05.11.2024).

Experts at Walletinvestor forecast a sustained decline in #TSLA value in the next 12 months. By the end of 2024, the price may drop to $261.58.

A stable uptrend is expected to develop up to $230.49 throughout 2025.

|

Date |

Opening price,$ |

Closing price,$ |

Min. price, $ |

Max. price, $ |

Change |

|

2024 |

|||||

|

November |

252.88 |

258.18 |

224.75 |

280.42 |

2.09 % ▲ |

|

December |

266.20 |

261.58 |

259.19 |

266.20 |

-1.77 %▼ |

|

2025 |

|||||

|

January |

262.18 |

255.65 |

255.65 |

263.38 |

-2.55 %▼ |

|

February |

257.33 |

248.13 |

248.13 |

259.10 |

-3.71 %▼ |

|

March |

246.57 |

248.87 |

242.14 |

248.87 |

0.93 % ▲ |

|

April |

248.39 |

239.47 |

239.47 |

248.65 |

-3.73 %▼ |

|

May |

238.52 |

231.13 |

229.39 |

238.52 |

-3.2 %▼ |

|

June |

233.19 |

240.44 |

233.01 |

240.44 |

3.02 % ▲ |

|

July |

240.48 |

242.43 |

240.48 |

246.14 |

0.8 % ▲ |

|

August |

241.78 |

241.34 |

241.10 |

242.42 |

-0.18 %▼ |

|

September |

242.79 |

241.18 |

241.18 |

245.87 |

-0.67 %▼ |

|

October |

240.90 |

234.18 |

234.18 |

240.90 |

-2.87 %▼ |

|

November |

234.72 |

233.95 |

232.05 |

234.72 |

-0.33 %▼ |

|

December |

235.02 |

230.49 |

228.06 |

235.02 |

-1.97 %▼ |

Gov Capital

Price range for 2024-2025: $185.18 – $276.05 (estimated as of 05.11.2024).

Experts at Gov Capital project the price to decline to $237.46 by the end of 2024. The asset’s price may reach $226.18 by mid-2025 and $250.95 by year-end.

|

Date |

Average price, $ |

Lowest possible price, $ |

Highest possible price, $ |

|

30.11.2024 |

235.30 |

211.77 |

258.83 |

|

31.12.2024 |

237.46 |

213.71 |

261.20 |

|

31.01.2025 |

216.47 |

194.83 |

238.12 |

|

28.02.2025 |

220.92 |

198.83 |

243.02 |

|

31.03.2025 |

232.23 |

209.01 |

255.45 |

|

30.04.2025 |

224.49 |

202.04 |

246.94 |

|

31.05.2025 |

205.75 |

185.18 |

226.33 |

|

30.06.2025 |

226.18 |

203.56 |

248.80 |

|

31.07.2025 |

233.73 |

210.36 |

257.11 |

|

31.08.2025 |

240.54 |

216.49 |

264.59 |

|

30.09.2025 |

251.46 |

226.32 |

276.61 |

|

31.10.2025 |

230.16 |

207.14 |

253.17 |

|

30.11.2025 |

241.83 |

217.64 |

266.01 |

|

31.12.2025 |

250.95 |

225.86 |

276.05 |

TradersUnion

Price range for 2024-2025: $214.73 – $356.85 (estimated as of 05.11.2024).

According to TradersUnion, the asset’s average price will reach $263.63 by the end of 2024.

In the first half of 2025, the TSLA price is expected to range from $214.73 to $342.42 and reach $240.88 by the end of June. The average price will be $324.41 per share at the end of October.

|

Month |

Min. price, $ |

Max. price, $ |

Average price, $ |

|

November 2024 |

237.27 |

289.99 |

263.63 |

|

December 2024 |

272.51 |

333.07 |

302.79 |

|

January 2025 |

280.16 |

342.42 |

311.29 |

|

February 2025 |

225.02 |

275.02 |

250.02 |

|

March 2025 |

238.09 |

291.01 |

264.55 |

|

April 2025 |

214.73 |

262.45 |

238.59 |

|

May 2025 |

221.56 |

270.80 |

246.18 |

|

June 2025 |

216.79 |

264.97 |

240.88 |

|

July 2025 |

234.72 |

286.88 |

260.80 |

|

August 2025 |

265.41 |

324.39 |

294.90 |

|

September 2025 |

249.21 |

304.59 |

276.90 |

|

October 2025 |

291.97 |

356.85 |

324.41 |

According to expert forecasts, despite their high volatility, TSLA shares remain an attractive investment option in 2024-2025. The asset value is expected to reach $332.58-$657.00 in the next 12 months.

Analysts’ TSLA Price Projections for 2026

Most experts give a positive outlook for the dynamics of the TSLA rate in 2026, with a target range of $305.36-$471.00.

Panda Forecast

Price range for 2026: $280.52 – $354.77 (estimated as of 05.11.2024).

According to Panda Forecast, the TSLA stock value may rise to $319.80 by early 2026. They expect mixed dynamics, with the price ranging from $280.52 to $354.77 and an average price hitting $321.47 in December.

|

Month |

Average price, $ |

Minimum |

Maximum |

|

January |

319.80 |

305.38 |

334.22 |

|

February |

341.26 |

326.99 |

354.77 |

|

March |

326.62 |

312.60 |

342.78 |

|

April |

311.89 |

304.68 |

320.12 |

|

May |

318.06 |

291.12 |

340.80 |

|

June |

321.91 |

301.73 |

335.37 |

|

July |

294.64 |

285.57 |

306.31 |

|

August |

290.76 |

280.52 |

313.14 |

|

September |

296.83 |

281.81 |

316.42 |

|

October |

323.61 |

295.48 |

344.96 |

|

November |

322.18 |

298.44 |

329.27 |

|

December |

321.47 |

297.43 |

340.92 |

Longforecast

Price range for 2026: $493.00 – $970.00 (estimated as of 05.11.2024).

Experts at Longforecast project positive momentum for the asset. In the first half of the year, the price of TSLA will vary from $559.00 to $868.00 and equal $781.00 at the end of June.

In the second half of the year, the bullish trend will reverse, and the asset value may fall to $576.00 by the end of the year.

|

Month |

Opening price,$ |

Low/ High, $ |

Closing price,$ |

|

January |

608.00 |

559.00-657.00 |

608.00 |

|

February |

608.00 |

608.00-755.00 |

699.00 |

|

March |

699.00 |

699.00-868.00 |

804.00 |

|

April |

804.00 |

628.00-804.00 |

683.00 |

|

May |

683.00 |

643.00-755.00 |

699.00 |

|

June |

699.00 |

699.00-843.00 |

781.00 |

|

July |

781.00 |

781.00-970.00 |

898.00 |

|

August |

898.00 |

702.00-898.00 |

763.00 |

|

September |

763.00 |

600.00-763.00 |

652.00 |

|

October |

652.00 |

515.00-652.00 |

560.00 |

|

November |

560.00 |

493.00-579.00 |

536.00 |

|

December |

536.00 |

530.00-622.00 |

576.00 |

Walletinvestor

Price range for 2026: $493.00 – $970.00 (estimated as of 05.11.2024).

Experts at Walletinvestor project a bearish trend for TSLA shares in 2026, in contrast to most analytical agencies. The share price will vary in a narrow range of $196.67-$231.92 and reach $198.67 by the end of December.

|

Date |

Opening price,$ |

Closing price,$ |

Min. price, $ |

Max. price, $ |

|

January |

230.37 |

224.22 |

224.22 |

231.92 |

|

February |

225.72 |

218.01 |

218.01 |

227.69 |

|

March |

216.30 |

217.05 |

210.63 |

217.46 |

|

April |

217.38 |

207.86 |

207.86 |

217.38 |

|

May |

206.87 |

199.41 |

197.98 |

206.87 |

|

June |

201.47 |

208.50 |

201.30 |

208.50 |

|

July |

209.33 |

210.71 |

209.33 |

214.70 |

|

August |

211.26 |

211.29 |

209.80 |

211.29 |

|

September |

210.94 |

210.31 |

210.31 |

214.44 |

|

October |

209.30 |

203.04 |

203.04 |

209.30 |

|

November |

203.65 |

203.76 |

200.76 |

203.76 |

|

December |

203.23 |

198.67 |

196.67 |

203.45 |

Gov Capital

Price range for 2026: $211.89 – $298.90 (estimated as of 05.11.2024).

Analysts at Gov Capital predict that the asset’s value will vary from $211.89 to $287.98 in the first six months, with an average price hovering at $246.27. By the end of 2026, the asset’s value may increase to $270.16.

|

Date |

Average price, $ |

Lowest possible price, $ |

Highest possible price, $ |

|

31.01.2026 |

244.36 |

219.92 |

268.80 |

|

28.02.2026 |

239.28 |

215.36 |

263.21 |

|

31.03.2026 |

254.18 |

228.76 |

279.60 |

|

30.04.2026 |

252.86 |

227.57 |

278.14 |

|

31.05.2026 |

235.43 |

211.89 |

258.97 |

|

30.06.2026 |

246.27 |

221.65 |

270.90 |

|

31.07.2026 |

252.90 |

227.61 |

278.19 |

|

31.08.2026 |

262.34 |

236.11 |

288.58 |

|

30.09.2026 |

271.72 |

244.55 |

298.90 |

|

31.10.2026 |

260.31 |

234.28 |

286.34 |

|

30.11.2026 |

269.51 |

242.56 |

296.46 |

|

31.12.2026 |

270.16 |

243.14 |

297.17 |

According to analysts’ forecasts, TSLA shares will still be attractive in 2026. The asset’s value may rise to $314.34-$576.00.

Analysts’ TSLA Price Projections for 2027

Most analysts anticipate a sustained bullish trend for TSLA shares in 2027.

Longforecast

Price range for 2027: $443.00 – $660.00 (estimated as of 05.11.2024).

Based on Longforecast‘s estimates, TSLA stock will continue growing in price, reaching $458.00 in early 2027. By mid-year, the rate may hit $528.00-$611.00, recording a high of $660.00 in May.

Mixed dynamics are expected in the year’s second half, with TSLA price reaching $500.00 in December.

|

Month |

Opening price,$ |

Low/ High, $ |

Closing price,$ |

|

January |

458.00 |

458.00-569.00 |

527.00 |

|

February |

527.00 |

481.00-565.00 |

523.00 |

|

March |

523.00 |

523.00-649.00 |

601.00 |

|

April |

601.00 |

547.00-643.00 |

595.00 |

|

May |

595.00 |

562.00-660.00 |

611.00 |

|

June |

611.00 |

486.00-611.00 |

528.00 |

|

July |

528.00 |

522.00-612.00 |

567.00 |

|

August |

567.00 |

443.00-567.00 |

482.00 |

|

September |

482.00 |

461.00-541.00 |

501.00 |

|

October |

501.00 |

501.00-622.00 |

576.00 |

|

November |

576.00 |

451.00-576.00 |

490.00 |

|

December |

490.00 |

460.00-540.00 |

500.00 |

Walletinvestor

Price range for 2027: $165.20 – $200.51 (estimated as of 05.11.2024).

According to Walletinvestor, TSLA shares will decline in price in 2027, ranging from $165.20 to $200.51. The asset’s value is expected to fall to $166.82 by the end of December.

|

Date |

Opening price,$ |

Closing price,$ |

Min. price, $ |

Max. price, $ |

|

January |

198.52 |

192.89 |

192.89 |

200.51 |

|

February |

194.17 |

187.91 |

187.91 |

196.38 |

|

March |

186.11 |

186.02 |

179.26 |

186.11 |

|

April |

185.64 |

176.21 |

176.21 |

185.89 |

|

May |

175.67 |

169.74 |

166.65 |

175.67 |

|

June |

169.58 |

177.35 |

169.58 |

177.35 |

|

July |

177.46 |

179.67 |

177.46 |

183.43 |

|

August |

180.14 |

179.45 |

178.47 |

180.14 |

|

September |

179.89 |

178.71 |

178.71 |

183.23 |

|

October |

177.67 |

171.86 |

171.86 |

177.67 |

|

November |

172.55 |

171.95 |

169.53 |

172.55 |

|

December |

172.23 |

166.82 |

165.20 |

172.23 |

Gov Capital

Price range for 2027: $235.97 – $327.39 (estimated as of 05.11.2024).

Analysts at Gov Capital project TSLA quotes to grow in 2027. In the year’s first half, the asset value will range from $235.97 to $316.48, with an average price estimated at $287.70 per share in June.

The upward trend will continue in the second half of the year, and by the end of the year, the value of TSLA shares will be fixed at $289.43, with a high of $337.21 anticipated in early December.

|

Date |

Average price, $ |

Lowest possible price, $ |

Highest possible price, $ |

|

31.01.2027 |

270.55 |

243.49 |

297.60 |

|

28.02.2027 |

265.31 |

238.78 |

291.84 |

|

31.03.2027 |

284.46 |

256.01 |

312.90 |

|

30.04.2027 |

271.49 |

244.34 |

298.63 |

|

31.05.2027 |

262.19 |

235.97 |

288.41 |

|

30.06.2027 |

287.70 |

258.93 |

316.48 |

|

31.07.2027 |

280.29 |

252.26 |

308.32 |

|

31.08.2027 |

291.91 |

262.71 |

321.10 |

|

30.09.2027 |

296.85 |

267.16 |

326.53 |

|

31.10.2027 |

291.39 |

262.25 |

320.53 |

|

30.11.2027 |

297.63 |

267.86 |

327.39 |

|

31.12.2027 |

289.43 |

260.49 |

318.38 |

TradersUnion

Price range for 2027: $325.83 – $337.73 (estimated as of 05.11.2024).

Experts at TradersUnion forecast the price to rise to $325.83 by mid-2027. The rate is expected to continue rising to $337.73 by the end of the year.

|

Year |

Mid-Year, $ |

Year-end, $ |

|

2027 |

325.83 |

337.73 |

Most experts anticipate a continued bullish rally for TSLA stock in 2027, to $337.21-$660.00. A negative outlook suggests the price may decline to $166.82.

Analysts’ TSLA Price Projections for 2028

Most stock market analysts project that Tesla shares will continue trending up.

Longforecast

Price range for 2028: $397.00 – $746.00 (estimated as of 05.11.2024).

According to Longforecast‘s experts, TSLA shares will trade from $397.00 to $746.00 per share in 2028. By mid-year, the price will reach $538.00, with a high expected in April at $669.00.

In the second half of 2028, the upward trend will continue. The rate will vary in a wide range of $397.00-$746.00 but fall to $431.00 by the end of December.

|

Month |

Opening price,$ |

Low/ High, $ |

Closing price,$ |

|

January |

500.00 |

431.00-507.00 |

469.00 |

|

February |

469.00 |

431.00-505.00 |

468.00 |

|

March |

468.00 |

468.00-581.00 |

538.00 |

|

April |

538.00 |

538.00-669.00 |

619.00 |

|

May |

619.00 |

484.00-619.00 |

526.00 |

|

June |

526.00 |

495.00-581.00 |

538.00 |

|

July |

538.00 |

538.00-649.00 |

601.00 |

|

August |

601.00 |

601.00-746.00 |

691.00 |

|

September |

691.00 |

540.00-691.00 |

587.00 |

|

October |

587.00 |

462.00-587.00 |

502.00 |

|

November |

502.00 |

397.00-502.00 |

431.00 |

Walletinvestor

Price range for 2028: $133.83 – $169.34 (estimated as of 05.11.2024).

Experts at Walletinvestor project the TSLA price to continue declining in 2028, varying from $133.83 to $169.34.

By the end of the year, analysts expect the price to fall to $135.12.

|

Date |

Opening price,$ |

Closing price,$ |

Min. price, $ |

Max. price, $ |

|

January |

168.77 |

162.70 |

161.66 |

169.34 |

|

February |

162.32 |

154.54 |

154.54 |

165.26 |

|

March |

153.92 |

153.86 |

148.03 |

154.58 |

|

April |

154.77 |

145.50 |

145.50 |

154.77 |

|

May |

145.05 |

138.48 |

135.42 |

145.05 |

|

June |

138.38 |

145.55 |

138.24 |

145.55 |

|

July |

148.25 |

149.05 |

148.25 |

152.24 |

|

August |

148.37 |

148.11 |

147.14 |

148.51 |

|

September |

147.80 |

147.07 |

147.07 |

152.03 |

|

October |

146.41 |

140.78 |

140.61 |

146.41 |

|

November |

140.92 |

140.50 |

138.30 |

141.02 |

|

December |

139.98 |

135.12 |

133.83 |

140.56 |

Coincodex

Price range for 2028: $275.85 – $859.04 (estimated as of 05.11.2024).

Coincodex anticipates growth to $275.85-$859.04. By mid-year, the average price will hit $367.72; by December, it will reach $796.99.

|

Month |

Min. price, $ |

Average price, $ |

Max. price, $ |

|

January 2028 |

364.57 |

426.59 |

486.02 |

|

February 2028 |

355.97 |

382.18 |

401.34 |

|

March 2028 |

317.48 |

342.18 |

377.47 |

|

April 2028 |

275.85 |

325.27 |

377.70 |

|

May 2028 |

334.43 |

348.24 |

364.92 |

|

June 2028 |

334.44 |

367.72 |

462.76 |

|

July 2028 |

433.03 |

487.55 |

531.75 |

|

August 2028 |

390.45 |

415.49 |

445.64 |

|

September 2028 |

429.77 |

475.76 |

525.80 |

|

October 2028 |

431.35 |

490.08 |

627.09 |

|

November 2028 |

619.43 |

675.51 |

752.38 |

|

December 2028 |

755.74 |

796.99 |

859.04 |

Gov Capital

Price range for 2028: $260.32 – $361.16 (estimated as of 05.11.2024).

The Gov Capital analytical portal provides a moderately positive outlook. The TSLA price will reach $301.79 through the first six months. The uptrend will continue in the second half of the year, with quotes reaching $318.19.

|

Date |

Average price, $ |

Lowest possible price, $ |

Highest possible price, $ |

|

31.01.2028 |

289.24 |

260.32 |

318.17 |

|

29.02.2028 |

292.73 |

263.46 |

322.00 |

|

31.03.2028 |

298.24 |

268.42 |

328.06 |

|

30.04.2028 |

298.55 |

268.69 |

328.40 |

|

31.05.2028 |

292.00 |

262.80 |

321.20 |

|

30.06.2028 |

301.79 |

271.61 |

331.97 |

|

31.07.2028 |

297.45 |

267.71 |

327.20 |

|

31.08.2028 |

321.95 |

289.75 |

354.14 |

|

30.09.2028 |

314.88 |

283.40 |

346.37 |

|

31.10.2028 |

310.34 |

279.30 |

341.37 |

|

30.11.2028 |

328.33 |

295.49 |

361.16 |

|

31.12.2028 |

318.19 |

286.37 |

350.01 |

In a positive scenario for 2028, TSLA shares are expected to climb to $362.87-$859.04. However, some experts argue that the price may decline to $135.12 by year-end.

Expert TSLA Price Projections for 2029

Analysts are divided on where TSLA stock will go in 2029, with some expecting moderate gains and others predicting a bearish trend.

Walletinvestor

Price range for 2029: $104.28 – $138.14 (estimated as of 05.11.2024).

According to Walletinvestor, the TSLA value will decline, opening the year at around $137.11. A bearish trend will drive the rate to $110.28 by the end of October.

|

Date |

Opening price,$ |

Closing price,$ |

Min. price, $ |

Max. price, $ |

|

January |

137.11 |

131.28 |

130.54 |

138.14 |

|

February |

131.00 |

123.76 |

123.76 |

134.00 |

|

March |

122.40 |

122.46 |

116.96 |

123.04 |

|

April |

123.58 |

114.40 |

114.40 |

123.58 |

|

May |

113.38 |

106.66 |

104.28 |

113.38 |

|

June |

106.52 |

113.58 |

106.52 |

113.58 |

|

July |

116.26 |

117.29 |

116.26 |

120.97 |

|

August |

117.40 |

116.30 |

115.82 |

117.40 |

|

September |

117.89 |

116.45 |

116.45 |

120.74 |

|

October |

115.82 |

110.28 |

109.27 |

115.82 |

CoinPriceForecast

Price range for 2029: $517.00 – $583.00 (estimated as of 05.11.2024).

Based on CoinPriceForecast‘s expectations, the asset’s price will hit $517.00 and may rise to $564.00 by year-end. December’s values may reach $583.00.

|

Year |

Mid-Year, $ |

Year-end, $ |

|

2029 |

564.00 |

583.00 |

Coincodex

Price range for 2029: $737.21 – $1,227.61 (estimated as of 05.11.2024).

Analysts at Coincodex provide an utterly positive outlook: TSLA may reach a high of $1,227.61 in 2029. At the beginning of the year, the average price is expected to be around $943.33, and then it may decrease. In June, the share price will be $790.95.

From July until the end of the year, the price will resume growth and reach $1,069.32 in December.

|

Month |

Min. price, $ |

Average price, $ |

Max. price, $ |

|

January 2029 |

891.53 |

943.33 |

970.36 |

|

February 2029 |

750.97 |

868.86 |

955.51 |

|

March 2029 |

751.15 |

805.64 |

832.89 |

|

April 2029 |

816.88 |

843.15 |

875.33 |

|

May 2029 |

737.21 |

766.82 |

813.75 |

|

June 2029 |

760.75 |

790.95 |

825.07 |

|

July 2029 |

788.88 |

809.98 |

848.07 |

|

August 2029 |

816.43 |

842.05 |

862.42 |

|

September 2029 |

859.49 |

878.98 |

901.90 |

|

October 2029 |

896.95 |

999.65 |

1,193.04 |

|

November 2029 |

1,066.50 |

1,141.67 |

1,227.61 |

|

December 2029 |

993.44 |

1,069.32 |

1,148.01 |

Gov Capital

Price range for 2029: $259.16 – $370.44 (estimated as of 05.11.2024).

Analysts at Gov Capital remain cautious yet optimistic. TSLA prices will fluctuate within a wide trading range of $259.16-$370.44 throughout the year, with the average price potentially reaching $329.04 by the end of December.

|

Date |

Average price, $ |

Lowest possible price, $ |

Highest possible price, $ |

|

31.01.2029 |

296.88 |

267.19 |

326.56 |

|

28.02.2029 |

300.96 |

270.87 |

331.06 |

|

31.03.2029 |

326.63 |

293.96 |

359.29 |

|

30.04.2029 |

304.22 |

273.79 |

334.64 |

|

31.05.2029 |

287.96 |

259.16 |

316.75 |

|

30.06.2029 |

322.62 |

290.36 |

354.89 |

|

31.07.2029 |

310.76 |

279.68 |

341.83 |

|

31.08.2029 |

330.76 |

297.69 |

363.84 |

|

30.09.2029 |

336.76 |

303.08 |

370.44 |

|

31.10.2029 |

304.83 |

274.35 |

335.32 |

|

30.11.2029 |

336.48 |

302.83 |

370.13 |

|

31.12.2029 |

329.04 |

296.13 |

361.94 |

Many analysts and experts are confident that TSLA will continue to grow in 2029. According to bullish forecasts, the price may reach $370.44-$583.00. Some experts expect rapid growth towards $1,227.61.

Analysts’ TSLA Price Projections for 2030

Long-term estimates for TSLA stock price performance in 2030 vary. Below are expert forecasts.

CoinPriceForecast

Price range for 2030: $583 – 637 (estimated as of 05.11.2024).

Experts at CoinPriceForecast anticipate continued upward momentum, with the price reaching $627.00 by mid-year and hitting $637.00 by December.

|

Year |

Mid-Year, $ |

Year-end, $ |

|

2030 |

627.00 |

637.00 |

Coincodex

Price range for 2030: $568.99 – 1,176.25 (estimated as of 05.11.2024).

Coincodex expects Tesla quotes to hover at $1,052.55 in early 2030. Then, a decline will follow, with the rate falling to $653.31 by December.

|

Month |

Min. price, $ |

Average price, $ |

Max. price, $ |

|

January 2030 |

940.42 |

1,052.55 |

1,176.25 |

|

February 2030 |

888.87 |

963.59 |

1,009.09 |

|

March 2030 |

893.72 |

1,005.55 |

1,130.74 |

|

April 2030 |

963.70 |

1,050.58 |

1,147.08 |

|

May 2030 |

791.44 |

875.16 |

996.87 |

|

June 2030 |

801.47 |

834.63 |

864.17 |

|

July 2030 |

826.70 |

894.87 |

998.78 |

|

August 2030 |

921.40 |

969.87 |

1,004.07 |

|

September 2030 |

878.17 |

958.02 |

1,004.22 |

|

October 2030 |

778.87 |

813.55 |

871.49 |

|

November 2030 |

693.03 |

739.66 |

807.49 |

|

December 2030 |

568.99 |

653.31 |

748.48 |

Gov Capital

Price range for 2030: $276.96 – $397.58 (estimated as of 05.11.2024).

Gov Capital projects the stock price to range from $276.96 to $397.58 throughout 2030. Mixed dynamics are expected, with December’s average price hitting $349.71.

|

Date |

Average price, $ |

Lowest possible price, $ |

Highest possible price, $ |

|

31.01.2030 |

316.08 |

284.47 |

347.69 |

|

28.02.2030 |

320.08 |

288.07 |

352.09 |

|

31.03.2030 |

332.12 |

298.91 |

365.33 |

|

30.04.2030 |

326.99 |

294.29 |

359.69 |

|

31.05.2030 |

307.74 |

276.96 |

338.51 |

|

30.06.2030 |

327.30 |

294.57 |

360.03 |

|

31.07.2030 |

326.36 |

293.73 |

359.00 |

|

31.08.2030 |

344.28 |

309.85 |

378.71 |

|

30.09.2030 |

349.81 |

314.83 |

384.79 |

|

31.10.2030 |

324.28 |

291.85 |

356.71 |

|

30.11.2030 |

352.29 |

317.06 |

387.52 |

|

31.12.2030 |

349.71 |

314.74 |

384.68 |

TradersUnion

Price range for 2030: $404.13 – $418.89 (estimated as of 05.11.2024).

Analysts at TradersUnion predict TSLA shares to rise to $404.13 by mid-2030. In December, the rate will grow to $418.89.

|

Year |

Mid-Year, $ |

Year-end, $ |

|

2030 |

404.13 |

418.89 |

Many experts anticipate a long-term uptrend, with the asset’s price rising to $637.00-$1,176.25 per share. These forecasts may come true if Tesla continues new technology development.

Analysts’ TSLA Price Projections up to 2050

Making long-term forecasts involves certain risks, as many fundamental factors influence the price. All these forecasts are approximate, but they can be considered when developing long-term investment strategies.

CoinPriceForecast

Based on CoinPriceForecast‘s long-term forecasts, the TSLA value will grow from 2,031 to 2,036. By the end of 2033 and 2036, the price will reach $725.00 and $842.00, respectively.

Gov Capital

Analysts at Gov Capital provide a positive outlook for the TSLA rate in 2031. Quotes may reach $367.84 per share by the end of October. A peak of $407.53 is expected in September.

TradersUnion

Analysts at TradersUnion also believe that the asset’s price will rise from 2031 to 2040. By the end of 2035, TSLA shares will break above $500.00. By the end of 2040, quotes may reach $682.56.

|

Year |

Coin price forecast, $ |

Gov Capital, $ |

TradersUnion, $ |

|

2031 |

664.00 |

367.84 |

398.31 |

|

2035 |

799.00 |

506.03 |

|

|

2040 |

682.56 |

According to long-term expert forecasts, the value of TSLA is expected to continue rising beyond 2030. Some estimates suggest that the price could reach $799.00, while more conservative projections expect it to hit $682.56 only by the end of 2040.

TSLA (Tesla) Market Sentiment on Social Media

Monitoring market sentiment on social media in the 21st century has become an important analysis element before making trading decisions, specifically before buying TSLA stock.

The Fear and Greed index suggests that the market state is neutral at 45.

The number of searches for Tesla in GoogleTrends is rising in the “YouTube search” of the “Web search” menu (ranking 54 out of 100), indicating growing interest in the asset.

Examples of social media sentiment following Tesla’s Q3 financial report

According to @latestly, billionaire Elon Musk expects higher sales if Donald Trump wins the U.S. presidential election.

@thepakistan2021 notes Tesla’s promising outlook due to the favorable earnings report and Cybertruck profitability.

@ProfitTradingUS also considers buying TSLA shares amid the company’s revenue growth.

These posts on platform X reflect bullish sentiment among retail investors and traders, with particular attention to the political factor that will shape Tesla’s future trajectory.

TSLA Price History

The highest price of Tesla (TSLA) was recorded on and reached USD. The lowest price of Tesla (TSLA) was recorded on and was USD.

To make our forecasts as accurate as possible, it’s important to assess historical data. Below is the #TSLA chart for the past ten years.

Tesla went public through an IPO in 2010; since then, its stock has surged over 1575%.

This impressive success stems from Tesla’s innovative business model. Elon Musk has revolutionized the auto industry, making Tesla the world’s most valuable automaker with a market cap of over $840 billion.

TSLA saw significant price growth at the end of 2019 due to strong Q3 and Q4 earnings, reporting over $6 billion in revenue and an EPS of $1.86. This was also when Tesla’s Shanghai factory, a $2 billion project, began producing the Model Y, attracting new investors.

Despite the COVID-19 pandemic in 2020, Tesla boosted production by 71%, and critics were proven wrong as the company approached an annual output of 500,000 vehicles.

Tesla’s stock rose dramatically from $16.45 in 2019 to $414.33 by 2021.

In early 2022, TSLA’s bull trend reversed due to rising global inflation, the Fed’s tighter monetary policy, and geopolitical tensions in Eastern Europe. Elon Musk’s $44 billion acquisition of Twitter, funded by selling a portion of his Tesla shares, also drove a sharp drop in Tesla’s stock price.

However, by 2023, Tesla’s shares rebounded, reaching $299.27 amid a positive annual report showing $12.5 billion in net income, up from $5.5 billion in 2021.

In July 2023, the stock’s trend turned bearish again after Musk announced reduced production due to factory upgrades. Additionally, vague plans for an autonomous vehicle ecosystem disappointed investors and Musk’s plans to invest $1 billion in the Dojo supercomputer for AI also raised doubts. The absence of clear timelines for the Cybertruck release further unsettled investors.

By March 2024, TSLA fell to $153.75, but it rebounded in April after reaching an agreement with Baidu to bring semi-autonomous driving to China.

Following a strong quarterly report, the stock surged to $273.49 in October 2024, with record profits of $2.2 billion.

Tesla plans to mass-produce the Cybercab robotaxi by 2026, targeting annual production of 2–4 million units.

TSLA Stock Fundamental Analysis

Like other financial instruments, TSLA stock prices are influenced by numerous macroeconomic and geopolitical factors.

- Financial performance. Strong earnings reports boost confidence among major market players in Tesla Inc.’s long-term growth. Consistently rising profits suggest high demand for the company’s products, attracting new investors.

- High competition in the electric car industry. Chinese automakers’ rapid growth is putting pressure on Tesla in the global market, as prices for cars from China are nearly half of Tesla’s.

- Innovative technologies. On the one hand, large investments in technologies, including AI, make investors wary, but on the other hand, they highlight the company’s large-scale development prospects.

- Geopolitical factors. Various armed conflicts force investors to hedge their risks with precious metals and other safe-haven assets. This reduces the popularity of stocks, including TSLA, and concerningly, the asset’s value may decline.

- Macroeconomic factors. The trade war between the US and China significantly impacts the stock market. Sanctions and higher trade tariffs to protect domestic markets directly affect electric vehicle production and Tesla’s stock price.

- Elon Musk’s statements. TSLA’s high volatility is partly due to the activity of Tesla Inc.’s founder on various social media platforms, particularly X. The entrepreneur’s high-profile statements have repeatedly caused major fluctuations in TSLA’s price.

More About TSLA

Tesla Inc. was founded in 2003 and is headquartered in Austin, Texas.

In addition to producing, repairing, and servicing vehicles, the company designs and installs solar energy generation and storage devices.

Tesla Inc. gained popularity thanks to its innovative approach to automotive engineering. Autonomous driving, robotaxis, and other AI-based technologies are how the company imagines the industry’s future.

However, due to the high cost of these innovations, the company’s stock remains quite volatile, attracting numerous traders. TSLA shares offer opportunities for profit in both the short and long term.

Year over year, the company’s revenues and capitalization continue to grow. Tesla remains dynamic, developing in a highly competitive environment, making it popular among market participants.

Pros and Cons of Investing in TSLA

This section covers the pros and cons of investing in TSLA shares.

Pros

- Attractive purchase price. The asset’s current price is significantly lower than the peak values of 2021 when the price reached 414.33. Certainly, there are no guarantees that the stock price will exceed those peak levels. However, expert forecasts, supported by technical analysis, inspire optimism. Large players buy and build up assets during temporary drawdowns to profit from future growth.

- Historical dynamics of TSLA stock prices. Positive financial earnings reports indicate growing demand for the company’s products and its steady development. The company’s market capitalization is also growing, showing Tesla’s substantial potential.

- The company’s investments in innovative technology development. Tesla was the first to make a breakthrough in the automotive industry by creating an electric vehicle. Now, the company plans to produce autonomous vehicles and robotaxis. Additionally, the global shift to green energy will support TSLA’s growth

Cons

- High production costs for electric vehicles greatly increase Tesla’s vehicle prices. Tax benefits for electric cars don’t help much, so consumers still face high costs. This, in turn, may negatively impact the company’s revenue, profit, and stock value.

- The company’s costly innovations may also harm Tesla’s stock. More and more Chinese companies are entering the market with cheaper electric cars, already challenging the position of Tesla. Large expenditures on innovation may not pay off, potentially leading to worsening financial results for Tesla and, consequently, affecting the company’s stock price.

- High volatility allows traders and investors to achieve quick profits, but the risks of losing investments are also high. Therefore, before making trading decisions on TSLA stock, it’s essential to conduct a thorough fundamental and technical analysis.

How We Make Forecasts

The key components in forecasting various trading instruments, including TSLA stock, are:

1. Fundamental analysis:

- Evaluating forecasts from leading analytical agencies;

- Assessing the company’s financial condition (market capitalization, income/expenses, earnings per share, business profitability, return on investment, and much more);

- Analyzing the news environment around the company;

- Examining geopolitical and macroeconomic factors that may affect the company’s stock price.

2. Technical Analysis. Generally, asset quotes are cyclical, and many factors are already priced in.

A price chart is not just statistical data; it also reflects market psychology. There are numerous tools and methods available for technical analysis. A more successful conservative research model combines candlestick, chart, and indicator analysis.

Signals from various technical tools help identify the most advantageous entry points and determine optimal profit targets.

Conclusion: Is TSLA a Good Investment?

Tesla has shown mixed dynamics in 2024. The company’s financial results and plans for electric vehicle production and global deliveries are worth special attention.

Elon Musk has clarified that Tesla plans to actively develop autonomous driving, robotaxis, and the integration of AI-based products. So, we can expect new partnerships and entry into new markets.

Most analysts provide positive forecasts for TSLA, predicting a range of $271.00-$1,176.25 over the next five years.

However, production delays and rising competition from other automakers may challenge Tesla’s position and negatively impact its stock price.

Tesla shares could be an excellent asset for a long-term investment portfolio, but such investments require a flexible, well-informed strategy considering fundamental factors, risks, and market volatility.

TSLA Stock Price Prediction FAQ

The current #TSLA price is around $328.48 per share as of today, 13.11.2024.

Forecasts for Tesla’s stock price are divided. Some experts predict the continuation of the bullish rally that began in October 2024, while others are more skeptical, forecasting a price decline.

Yes, Tesla stocks are an attractive investment, but they require a well-thought-out strategy due to the influence of various fundamental factors and high market volatility. The average target price range is $271.00 to $431.00 per share, though some experts predict a drop to $230.49-$207.83.

The 52-week high and low for Tesla stocks are $273.54 and $138.80, respectively. The 50/200-day moving averages are at $232.23 and $201.95. These figures may change due to increased market volatility.

Most analysts forecast Tesla’s stock price to rise to $305.36-$471.00 by 2026, while more conservative experts predict a drop to $197.82-$198.67.

Experts predict that Tesla’s stock price will range between $637.00 and $1,176.25 in 5 years, though some analysts expect a drop to $110.28.

Some estimates suggest Tesla’s stock could reach $637.00 to $1,176.25 by 2030. Negative forecasts suggest a potential decline to $110.28.

In the near term, Tesla’s stock price may rise to $271.00-$431.00 following a positive quarterly report and the company’s development plans.

Currently, the consensus recommendation is “Hold,” meaning experts expect Tesla’s stock dynamics to be consistent with the overall market. However, based on analysts’ forecasts and technical analysis, adding Tesla stock to your investment portfolio could be a good idea, provided you carefully assess all potential risks.

Price chart of TSLA in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.